|

Dell misses profit target

|

|

February 15, 2001: 7:33 p.m. ET

PC maker misses earnings, but beats fourth-quarter revenue estimates

|

NEW YORK (CNNfn) - Dell Computer reported a fiscal fourth-quarter operating profit Thursday that narrowly missed the Street's recently reduced forecasts on revenue that came in slightly above expectations.

And executives at the world's second-largest personal computer maker said they expect first-quarter results also will come in slightly below Wall Street's current expectations but declined to provide a growth forecast beyond that.

|

|

VIDEO

|

|

Dell Computer CEO Michael Dell chats with CNNfn's Bruce Francis about earnings and layoffs. Dell Computer CEO Michael Dell chats with CNNfn's Bruce Francis about earnings and layoffs. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

"We're going to speak to the first quarter," Michael Dell, the company's chairman and chief executive, told CNNfn's The N.E.W. Show Thursday.

"But to forecast beyond that ... we don't have a lot of confidence in our ability to do that, so we're not going to give any numbers beyond the first quarter," Dell added.

After the close of trading, Dell reported operating earnings of $508 million, or 18 cents per share, for the quarter ended Feb. 2. That's a penny less than the 19 cents per share analysts had expected the company to report, according to a survey conducted by earnings tracker First Call. In the same period a year earlier, Dell logged an operating profit of 15 cents per share.

At $8.7 billion, Dell's fourth-quarter revenue was up 28 percent from $6.8 billion in the year-ago quarter and was slightly better than the $8.45 billion in sales analysts had generally expected the company to report, according to the First Call survey.

Click here to check on computer stocks

In the fiscal first quarter, Dell said the company is aiming for a profit of 17 cents, while revenue will fall slightly to about $8 billion. He stressed, however, that he expects its growth will continue to outpace the rate of growth for the entire industry. (267K WAV) or (267K AIFF)

Analysts had generally expected Dell to log earnings of 19 cents per share on $8.45 billion in revenue in the first quarter.

In a conference call, executives said the company would continue its program of aggressive price cutting.

The company will also continue to concentrate on growing its notebook and services segments, moving away from desktops. Notebooks and services – Internet infrastructure, business services and storage – now account for more than half the company's revenues and two-thirds of profits.

Dell reported its latest results just hours after announcing it would lay off 1,700 full-time employees, roughly 4 percent of its total work force.

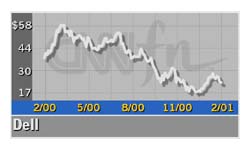

Shares of Dell (DELL: Research, Estimates) rose $2.06 to $25, a 9 percent gain on Nasdaq ahead of the earnings news, which was released after the close of trading. They fell 94 cents to $24.06 in after-hours trade.

Analysts had already reduced their fourth-quarter estimates for Dell after it warned late last month that the results would be below previous expectations, forecasting a profit of 18-to-19 cents per share, compared with Wall Street's prior expectations for 25 cents per share.

The Round Rock, Tex.-based company, which historically has posted annual revenue growth in the 40 percent-to-50 percent range, also has been steadily reining in its revenue growth forecasts, and analysts had been expecting the company to do so again Thursday. The Round Rock, Tex.-based company, which historically has posted annual revenue growth in the 40 percent-to-50 percent range, also has been steadily reining in its revenue growth forecasts, and analysts had been expecting the company to do so again Thursday.

For the fiscal year that just ended, Dell posted total revenue of $31.9 billion, a 26.2 percent increase from $25.3 billion in the previous year. Earlier this year, Dell executives had been targeting a 30 percent growth rate, but they took that down a few notches to 27 percent in October.

When they reported third-quarter results last November, Dell executives said they were now aiming for annual revenue growth of 20 percent in the current fiscal year.

Including a one-time pretax charge of $105 million related to job reductions and consolidation of facilities, Dell reported fourth-quarter net income of $434 million, or 16 cents per share. That's compared with $436 million, or 16 cents per share, during the same period a year earlier.

For the full year, Dell recorded net income of $2.18 billion, or 81 cents per share, up from $1.7 billion, or 61 cents per share during the previous year.

|

|

|

|

|

|

|