|

HP meets 1Q, warns on '01

|

|

February 15, 2001: 6:32 p.m. ET

Company hits lowered profit mark, misses revenue target; lowers guidance

|

NEW YORK (CNNfn) - Hewlett-Packard Co., met lowered earnings forecasts for its fiscal first quarter Thursday on weaker than expected revenue, but company officials warned that troubles are far from over.

Company officials told analysts and investors that the slowdown in the worldwide economy and pricing pressure in some segments, as well as some internal execution problems, means it is no longer comfortable with earnings and revenue forecasts for the current fiscal year, which runs through the end of October. But the officials did not give specific earnings per share, or range or revenue forecasts, for the coming period.

"Certainly we are not comfortable with the guidance out there at this point," said Robert Wayman, the company's chief financial officer. "There's an expectation that there will be some model adjustment on the downside."

Analysts surveyed by earnings tracker First Call were looking for full-fiscal year earnings per share of $1.70, down from $1.73 for fiscal year 2000. Revenue forecasts now stand at $52.6 billion for the current fiscal year, up 8 percent from $48.8 billion in the previous fiscal year. But Wayman said that he believes many analysts' models probably overestimate second-half revenue. Analysts surveyed by earnings tracker First Call were looking for full-fiscal year earnings per share of $1.70, down from $1.73 for fiscal year 2000. Revenue forecasts now stand at $52.6 billion for the current fiscal year, up 8 percent from $48.8 billion in the previous fiscal year. But Wayman said that he believes many analysts' models probably overestimate second-half revenue.

For the fiscal first quarter that ended Jan. 31, the company earned $727 million, or 37 cents, excluding special items. That was in line with lowered forecasts of analysts surveyed by First Call. Those estimates came down from 42 cents after a warning from the company Jan. 11. Earnings also fell from $825 million, or 40 cents a share, excluding special items, in the year earlier quarter.

Special items included a $365 million charge, or 15 cents a share, stemming from impairment of investments in emerging market companies, and a $102 million charge, or 3 cents a share, associated with the previously announced elimination of approximately 1,700 marketing positions. Including those and other items net income came in at $328 million, or 17 cents a share, down from $794, or 38 cents a share a year earlier.

Revenue came in at $11.9 billion, which missed analysts' forecasts of $12.4 billion in the period. The company said that sales of the closely watched Superdome, the company's high-end UNIX system, were taking longer than expected to build.

Carly Fiorina, the company's CEO, attributed the slower-than hoped start of sales partly to corporate caution on IT spending. But she said the company believes the outlook and market acceptance of the product has been good.

Economic slowdown, pricing pressures cited

HP is the world's third-leading supplier of personal computers, but it also sells other products including handheld computers, printers, scanners and digital cameras as well as network servers and technology services.

In December it told investors that product diversity insulated it from weakness in any one particular segment. But in January it was forced to follow competitors in issuing a warning, blaming weaker economic conditions and a slowdown in corporate and consumer technology spending.

The company said it is not counting an a turnaround in the market anytime soon.

Click here for a look at a look at computer stocks

"We are maintaining our revenue guidance for the second fiscal quarter in the low-to-mid single digits," said the company's earnings statement. "We could see revenue growth improvement in the second half if the U.S. economy improves as some economists expect and current foreign exchange rates hold. However, visibility remains extremely limited and we are not counting on a return to double-digit revenue growth this year."

Fiorina said the company is now looking for only marginal growth in worldwide personal computer sales this year and no growth in the U.S. market, although the company is still optimistic about gaining market share. And while she said the company will try to hold profit margins on PC sales, she said the sector has seen growing pricing pressure from competitors.

Fiorina said part of the problem was that the company pulled money out of channel sales, which reflects sales through distributors and other partners, just as some competitors were putting more money into that area. She said the company has refocused efforts, working closer with its sales partners on delineating which customers are ones to which HP should sell direct and which are ones that will be sold through channels.

Fiorina said HP is particularly worried about the recent slow-down in the U.S. economy spreading to its customers elsewhere in the world. Fiorina said HP is particularly worried about the recent slow-down in the U.S. economy spreading to its customers elsewhere in the world.

"We're being cautious, particularly in economies that are dependent on exports to the U.S.," she said. She cited Mexico, Korea, Taiwan and China as areas of concern.

Fiorina also said that while she's convinced use of the Internet by consumers and businesses will continue to grow, HP's server business was hurt by the financial woes of many dot.com companies.

"I think it's also fair to say that in the dot.com space, which was a significant contributor to our growth in '00, we are seeing that space dry up and disappear," she said. "We're confident in mid- to long-term growth of the IT (information technology) sector. But I think there was a large portion of the market that does not exist anymore, and that has an impact certainly."

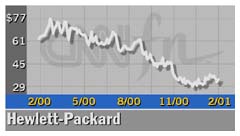

Shares of Hewlett-Packard (HWP: Research, Estimates), a component of the Dow Jones industrial average, lost $1.94 to $34.51 in after-hours trading after gaining $1.96 to close regular trading at $36.35, ahead of the earnings announcement.

|

|

|

|

|

|

|