|

De Beers set to go private

|

|

February 15, 2001: 8:35 a.m. ET

South African diamond miner lands $17.6bn bid from major shareholders

|

LONDON (CNN) - De Beers' major shareholders launched a $17.6 billion takeover bid for the company on Thursday, aiming to take the diamond miner private.

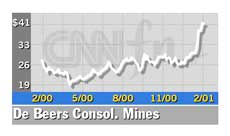

A consortium involving miner Anglo American, the Oppenheimer family and the Botswana government offered $43.14 per share for the former diamond monopoly, De Beers and Anglo American said.

That represents a 31-percent premium on De Beers shares from late January, when the shareholder group first expressed interest in a deal.

De Beers has been looking for a way to dismantle the cross-shareholdings with Anglo American that have been faulted for putting a damper on the stocks. It owns 35 percent of Anglo-American while Anglo-American has 32 percent of De Beers. De Beers has been looking for a way to dismantle the cross-shareholdings with Anglo American that have been faulted for putting a damper on the stocks. It owns 35 percent of Anglo-American while Anglo-American has 32 percent of De Beers.

If the deal closes, Anglo and the Oppenheimer family will each own 45 percent of De Beers, with the Botswana government holding 10 percent. De Beers will be managed by the Oppenheimer family's Central Holdings Ltd.

Independent De Beers directors said the offer was "fair and reasonable."

De Beers managing director Gary Ralfe told reporters on a conference call from Johannesburg that the firm would recommend shareholders accept the offer.

The offer values the company's diamond business at $8.3 billion and its cross-shareholding in Anglo at $9.3 billion, and it amounts to a 69-percent premium to the average price of De Beers shares in 2000.

"The price offered pretty fairly reflects where De Beers is today...De Beers has changed dramatically over the past two to three years into a much more investor friendly company," Charles Kernot, analyst with BNP Paribas, told CNN.

De Beers produces some 43 percent of the global market for newly mined, rough-cut diamonds, but through alliances in places like Russia and Canada it controls two-thirds of the global marketing of newly mined production.

Although its control of the diamond market has dwindled in the last few years, De Beers still faces the stigma of being a monopolist in the eyes of the U.S. government. And for that reason, De Beers is prevented from operating in the United States – even though the country accounts for half of the world's $56-billion retail diamond market.

Shares of Anglo American (AAL), which said the buyout would enhance shareholder value, were up 1.5 percent at 4,495 pence in London midday trade.

Deal to lift cloud over Anglo

Anglo Chief Executive Tony Trahar told reporters the deal would eliminate the cross shareholdings that have been a hurdle to its share price.

Trahar said the deal, which would be earnings neutral, but cash positive, would increase the free float of Anglo shares to around 90 percent.

"What (Anglo gets) is a much more direct stake in a wide range of commodities. Anglo American is clearly a very widely diversified metals and mining group and diamonds would perhaps account for about 15 percent of that rather than the give or take 50 percent that they are within De Beers," Kernot said.

De Beers said the South African Reserve Bank had approved the deal, but it still needed approval by shareholders and other government regulators.

De Beers' (DBRSY: Research, Estimates) American depository receipts closed unchanged at $40.50 in New York trade on Wednesday. De Beers' (DBRSY: Research, Estimates) American depository receipts closed unchanged at $40.50 in New York trade on Wednesday.

The consortium offered 0.43 of an Anglo share, $14 in cash and a $1 dividend for each share in De Beers.

The offer was higher than had been anticipated; the consortium had previously indicated its offer could value De Beers at $40 per share, for a total of $16 billion.

Rough diamond sales to fall 10 percent

De Beers also said that following a great 2000, rough diamond sales would likely fall in 2001, bringing earnings below last year's headline earnings of $1.7 billion.

"I can't take issue with any of you investment analysts who have been predicting that the Diamond Trading Company sales this year will be falling by 10 percent, or more than 10 percent," De Beer's Ralfe said.

"That, I think, is inevitable given the softening of demand in the U.S.,' he said.

"There is no way we can possibly hope to repeat those results for the year 2000 in the coming year," Ralfe said.

De Beers unveiled plans last month to form a new retail venture with French luxury goods maker LVMH Louis Vuitton Moet Hennessy to market De Beers-branded diamonds.

"Looking long term and assuming the LVMH joint venture comes to fruition and actually starts to generate value, then I would perhaps have put a long term valuation on De Beers of $60 a share," Kernot said.

The new retailing company could allow De Beers to have better access to the U.S. market.

De Beers chairman Nicky Oppenheimer, whose grandfather Ernest Oppenheimer founded Anglo, will remain executive chairman of the diamond firm, but will step down as deputy chairman of Anglo once the deal has completed.

|

|

|

|

|

|

|