|

Pummeling on Wall St.

|

|

February 16, 2001: 5:21 p.m. ET

Investors run for the exits after Dell, Nortel and Hewlett-Packard disappoint

By Staff Writer Jake Ulick

|

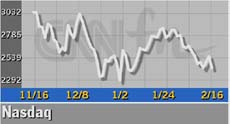

NEW YORK (CNNfn) - A rash of profit and sales warnings from some of the biggest names in technology hit Wall Street Friday, sparking a sell-off that wiped out all the year's gains for the Nasdaq composite index and Standard & Poor's 500.

Nortel Networks, Dell Computer and Hewlett-Packard all readied investors for financial shortfalls, casting more doubt on the economy's health. Troubling inflation news didn't help. Prices at the wholesale level showed surprising gains last month.

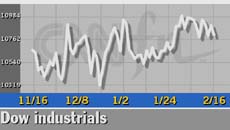

What a difference a day makes. On Thursday, a two-session tech rally led some investors to bet the market's worst days were over. Now, after tumbling last year, the Nasdaq and S&P 500 are lower for 2001 while the Dow Jones industrial average is barely higher.

"I think the market doesn't know where to go," Tom Gallagher, head of trading at CIBC Oppenheimer, told CNNfn's market coverage. "I think the market doesn't know where to go," Tom Gallagher, head of trading at CIBC Oppenheimer, told CNNfn's market coverage.

Nortel Networks lost nearly a third of its market value after the communications equipment maker said it would lose money this quarter, instead of the profit Wall Street expected. Dell Computer and Hewlett-Packard once again lowered their financial targets.

But technology firms weren't the only ones with troubles. Drugmaker Schering-Plough said first-quarter earnings could miss forecasts by as much as 25 percent.

CIBC's Gallagher sees more problems ahead for the market, particularly the high-priced technology stocks. He expects financial stocks eventually to lead other sectors higher.

The Nasdaq composite index tumbled 127.53 points, or 5 percent, to 2,425.385. The losses put the index 1.8 percent lower on the week and year. The Dow Jones industrial average lost 91.20, or almost 1 percent, to 10,799.82. Still, the Dow gained 0.1 percent on the week and is up about the same amount on the year.

The S&P 500 declined 25.07, or 1.9 percent, to 1,301.54, bringing its losses to 1 percent over the last five sessions and 1.4 percent for 2001.

Stocks tumbled to their lowest levels of the day after just after 2 p.m. ET, when the U.S. military said it launched air strikes on Iraq to enforce the no-fly zone. But the market recovered from its worst losses by the close.

Click here for more of CNNfn.com's special market coverage

Investors had more than just bad news from Corporate America to digest Friday when somewhat contradictory data on the economy crossed the wires. Inflation at the wholesale level rose, even as the industrial sector showed more weakness. Consumer confidence tumbled amid a housing market that displayed surprising strength.

But the direction of most stocks was clear. Declining issues on the New York Stock Exchange outpaced advancing ones 1,917 to 1,136 as 1.2 billion shares traded. Nasdaq losers beat winners 2,670 to 1,039 as 1.8 billion shares changed hands. But the direction of most stocks was clear. Declining issues on the New York Stock Exchange outpaced advancing ones 1,917 to 1,136 as 1.2 billion shares traded. Nasdaq losers beat winners 2,670 to 1,039 as 1.8 billion shares changed hands.

In other markets, Treasury securities rose. The dollar fell against the euro but rose versus the yen.

Tech wreck

Nortel (NT: Research, Estimates) stock tumbled $9.75 to $20, after the company said late Thursday it expects to lose 4 cents a diluted share in the first quarter, well below the 16 cents a share in profit analysts expected.

Nortel's troubles spread to Corning (GLW: Research, Estimates), which declined $9.01 to $33. The company, which sells to Nortel, said it expects 2001 sales growth in its photonics business of 50 percent, down from the 75 percent-to-90 percent previously forecast.

Computer maker Dell Computer (DELL: Research, Estimates), whose profit in the last quarter missed forecasts by a penny a share, warned that it expects to earn 17 cents a share in its fiscal first quarter. That's below the 19 cents per share Wall Street expected. Dell stock fell $1.50 to $23.50.

Another PC maker, Hewlett-Packard (HWP: Research, Estimates), slid $3.22 to $33.13 after missing its revenue forecasts in the fiscal first quarter and saying it's no longer comfortable with earnings and revenue forecasts for the fiscal year that ends in October.

"I think what this is telling us is there's a tremendous amount of uncertainty that's out there these days," Walt Czaicki, senior portfolio manager at Banc of America Capital Management, told CNNfn's market coverage. "I think what this is telling us is there's a tremendous amount of uncertainty that's out there these days," Walt Czaicki, senior portfolio manager at Banc of America Capital Management, told CNNfn's market coverage.

Czaicki forecasts companies having more problems with falling corporate profits over the next several months.

Few technology companies escaped Friday's rout; the top 19 most actively traded Nasdaq stocks fell.

Among them, JDS Uniphase (JDSU: Research, Estimates), which makes fiber optics components, declined $9.31 to $35.69. Sun Microsystems (SUNW: Research, Estimates), a maker of computer network systems and servers, lost $4 to $23.19. Juniper Networks (JNPR: Research, Estimates), another maker of communications equipment, declined $12.19 to $82.80

"It's pretty grim," Larry Wachtel, market analyst at Prudential Securities, told CNNfn's Market Call.

Still, Wachtel advises that investors take a long-term outlook on technology. "Not the next day, not the next hour," he said.

A turnaround

Just Thursday, an upbeat forecast from optical networking equipment maker Ciena sparked a rally, as some investors bet that the worst for the hard-hit sector was over. Ciena (CIEN: Research, Estimates) did hold up better than its competitors Friday, losing $6.38 to $82.63, after surging 17 percent in the previous session.

Not all the losses were in technology. Schering-Plough (SGP: Research, Estimates) skidded $7.07 to $41.25. The maker of the allergy drug Claritin said manufacturing problems would result in weaker-than-expected first-quarter and full 2001 earnings.

Still, investors found some places to hide. Exxon Mobil (XOM: Research, Estimates) rose $1.52 to $84.02, Procter & Gamble (PG: Research, Estimates) gained 98 cents to $74.84, and Philip Morris (MO: Research, Estimates) advanced 54 cents to $46.53.

PPI surges

Topping the blitz of economic data released Friday, prices at the wholesale level surged 1.1 percent last month, the Labor Department said, well above the 0.2 percent gain expected.

While the big jump in the Producer Price Index could make it harder for the Federal Reserve to make the kind of aggressive interest rate cuts that stock investors want, economists were quick to note the report's quirks.

Ian Shepherdson, chief U.S. economist at High Frequency Economics, said the gains were driven by three areas: car prices, tobacco and paper.

"Clearly, this report looks awful, but it does not presage any change in the underlying inflation environment," Shepherdson said. "PPI is not driving Fed policy."

The "core" PPI, which excludes the volatile food and energy sectors, rose 0.7 percent in January, the biggest increase since a 1 percent gain in December 1998.

"The index was well behaved last year," said Mike Moran, economist at Daiwa Securities. "And one monthly jump does not necessarily signal a shift in trend."

The latest read on industrial activity was more in line with recent trends.

U.S. industrial production declined 0.3 percent in January, the Federal Reserve said, adding to a 0.5 percent drop in the previous month.

But separately, the Commerce Department said housing starts jumped a whopping 5.3 percent in January to a 1.7 million annual rate, compared with an unrevised 0.3 percent gain in December. The housing market is the one area of the economy that has held up amid the slowdown.

Not so with consumer confidence. The closely watched University of Michigan survey sentiment index on consumer attitudes tumbled in February to a preliminary 87.8 from 94.7 in January.

Even amid a falling stock market and growing corporate layoffs, the size sentiment drop took analysts by surprise.

"Given (Federal Reserve Chairman Alan Greenspan's) concerns regarding consumer attitudes this development has to be seen as worrisome," said Steven Wood, economist at FinancialOxygen.

After cutting interest rates by a full percentage point in January, the Federal Reserve is expected to continue to lower the cost of borrowing. But the next move may not come until late March at the next meeting of policy makers.

Brian Wesbury, chief economist at Griffin Kubik Stephens & Thompson, told CNN's Street Sweep that he expects the Fed to cut rates by a quarter percentage point in March.

Financial markets are closed Monday for Presidents Day.

|

|

|

|

|

|

|