|

Sorry, Charlie - Heinz warns

|

|

March 5, 2001: 4:54 p.m. ET

Company will miss 3Q, '01 targets due to weak tuna prices, overseas sales

|

NEW YORK (CNNfn) - Sorry, Charlie; H.J. Heinz, maker of StarKist Tuna and other well-known food products, warned investors Monday that weak prices for tuna, higher costs for energy and weaker overseas sales would make it miss third-quarter and full-fiscal year financial forecasts.

The company said its core earnings per share, excluding special items, would be 65 cents in the fiscal third quarter, which ended in January, missing the 70-cent forecast of analysts surveyed by earnings tracker First Call.

The nation's fifth-largest food company said its fiscal fourth quarter, which ends May 2, should see EPS of 52-to-54 cents a share, well below the 69 cent forecast. That should bring core full-year EPS to $2.54 to $2.56, missing the $2.75 First Call forecast. The nation's fifth-largest food company said its fiscal fourth quarter, which ends May 2, should see EPS of 52-to-54 cents a share, well below the 69 cent forecast. That should bring core full-year EPS to $2.54 to $2.56, missing the $2.75 First Call forecast.

The tuna prices will cost the company 3 cents a share in the second half of the year, and 7 cents for the full year. High energy prices, primarily natural gas, will cost 6 cents a share for the year, and competitive pressures and inventory cutbacks by European infant food customers will cost it 7 cents a share. Weaker-than-expected sales in Australia and New Zealand will cost it another 5 cents a share for the year.

Heinz' largest business is its ketchup products and food service segment. Besides Heinz ketchup and StarKist Tuna, its products include Skippy peanut butter, Ore-Ida potatoes and 9 Lives cat food.

"With the exception of weakness in tuna pricing, Heinz's underlying earnings are strong, fueled by rapid growth in our leading businesses, such as Heinz ketchup and food service," said a statement from William Johnson, the company's CEO.

The company's statement said the results were helped by an improvement in the currency exchange rates in recent months.

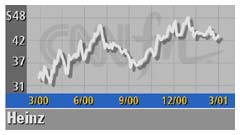

Shares of Heinz (HNZ: Research, Estimates) lost $2.39 to $40.70 in after-hours trading soon after the warning, after gaining 5 cents to close regular-hours trading at $43.09 ahead of the statement.

|

|

|

|

|

|

|