|

Yahoo!: Help wanted

|

|

March 7, 2001: 6:38 p.m. ET

Internet media company will miss 1Q target; seeks new CEO

|

NEW YORK (CNNfn) - Yahoo! said Wednesday its first-quarter financial results will fall short of previous expectations and that it has begun a search for a new chief executive to replace Tim Koogle, who will remain the Internet media company's chairman.

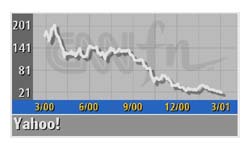

The news came after hours of speculation on Wall Street that began when the company's shares were halted in the first hour of trade pending a company announcement. After being halted at $20.94, they fell to $18.56 in after-hours trade.

Pinning the blame on the slowing U.S. economy and uncertainty about its strength moving ahead, Yahoo! executives said they now expect to post first-quarter sales in a range between $170 million and $180 million. Analysts polled by earnings tracker First Call most recently had been expecting to see $232.6 million on Yahoo!'s top line for the quarter.

Yahoo! also said it expects to break even in the quarter, compared with recent expectations for a profit of 5 cents per share.

"It is becoming very apparent that external conditions have weakened," Susan Decker, Yahoo!'s chief financial officer, told analysts during a teleconference.

She said most businesses have frozen their commitments to short-term discretionary spending, such as advertising and marketing. Yahoo! relies on advertising for the bulk of its revenue.

"In addition, this development has further tightened funding and return assumptions by investors in newly formed companies, which is having the effect of accelerating the transition away from the dot.com group," Decker added. "Both of these factors are having a significant impact on our business, and unfortunately, neither of them are factors we can control in terms of their impact on the top line."

Because of the lack of visibility looking beyond the first quarter, Decker said the company could not provide estimates for the remainder of the year. She said the company will provide further guidance when it reports the first-quarter results on April 11.

As for the new CEO, Yahoo! said it has hired Spencer Stuart & Associates, a senior executive search firm, to lead the recruiting effort.

"I will remain chairman and CEO until the search is completed, and then will continue as an active and dedicated chairman," Koogle, 49, said.

"This position is an extension of a drive we have had under way to add great senior level talent to increase our bench strength and position us for the next phase of growth in our company." "This position is an extension of a drive we have had under way to add great senior level talent to increase our bench strength and position us for the next phase of growth in our company."

Koogle's decision to relinquish the CEO title comes after several of the company's top executives have resigned in recent months, which has prompted speculation that some members of the senior management team were at odds about how to cope with the dramatic slowdown in Internet advertising.

The announcement of Koogle's departure as CEO also sheds some light on Yahoo!'s recent decision to adopt a shareholders' rights plan, or a so-called "poison pill," which makes its stock less attractive in the event of a hostile takeover attempt.

Since its shares have fallen more than 91 percent from a high of $237.50 reached in January 2000, the company has become much more vulnerable to a hostile takeover.

Under the terms of its poison pill provision, Yahoo shareholders have the right to buy one unit of a share of preferred stock for $250 if a person or group acquires at least 15 percent of the company's stock. The rights apply to shareholders of record as of March 20 and will expire March 1, 2011.

| |

THE YAHOO! TEAM THE YAHOO! TEAM

|

|

| |

|

Who will replace Tim Koogle as CEO? Here's a look at Yahoo!'s current management team.

Chief Yahoos

|

|

|

Some of Yahoo!'s largest shareholders, including Jerry Yang, one of its founders, reportedly were concerned about a potential takeover attempt in the midst of the top-level management shift.

Also on Wednesday, Yahoo! announced a stock-repurchase program under which it may acquire up to $500 million of its outstanding shares in the open market over the next two years.

As of March 1, 2001, Yahoo! had approximately 565 million shares of common stock outstanding.

|

|

|

|

|

|

|