|

Intel warns, downsizes

|

|

March 8, 2001: 6:37 p.m. ET

Chip leader further lowers financial bar, eliminates 5,000 jobs

|

NEW YORK (CNNfn) - Intel Corp., the No. 1 supplier of computer chips, said late Thursday that its sales in the current quarter will be down about 25 percent from the previous quarter and it will eliminate 5,000 jobs as it moves to rein in costs.

Previously, Intel had told the Street to expect a sequential revenue decline of about 15 percent, a target that itself was below recent expectations.

In addition, Intel (INTC: Research, Estimates) said its gross margin in the current quarter will be about 51 percent, compared with its previous estimate for a gross margin of 58 percent.

At the same time, Intel said its expenses during the quarter are now expected to be down approximately 15 percent from the fourth quarter. This is an improvement over the previous expectation that first-quarter expenses would be approximately flat with fourth-quarter expenses of $2.4 billion, primarily due to lower revenue and profit-dependent expenses as well as cost-cutting measures.

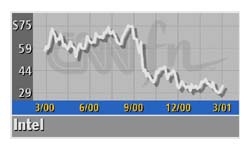

Shares of Intel rose 31 cents to $33.25 in Nasdaq trade ahead of the news, which was released after the closing bell. They tumbled $2.41 to trade 7.2 percent lower at $30.84 in after-hours trade.

The 5,000 job cuts, which represent about 5.9 percent of the company's total work force, are expected to take place over the next nine months and will be primarily through attrition, Intel said.

The job cuts, part of a range of cost-cutting measures executives unveiled last month, exclude any personnel additions from potential future acquisitions.

Faced with a sudden and substantial decrease in demand for its products, Intel late last month implemented a range of cost-cutting measures. In addition to the job reductions, Intel said it is deferring pay increases for employees and reducing discretionary spending.

But at the same time, the company announced plans to step up capital spending in 2001 to $7.5 billion from $6.5 billion in 2000. Meanwhile, research and development spending in 2001 will be roughly $4.3 billion, compared with $3.9 billion in 2000, Intel executives said.

|

|

|

|

|

|

|