|

Hughes repels News Corp.

|

|

March 9, 2001: 10:06 a.m. ET

DirecTV firm said to court other investors to block News Corp. takeover

|

NEW YORK (CNNfn) - Hughes Electronics Corp. Chairman Michael Smith has begun approaching potential investors about taking a large stake in the satellite broadcaster and then spinning it off in hopes of blocking an acquisition bid from News Corp., according to a published report Friday.

The talks are the clearest sign yet that News Corp.'s initial proposal won't fly, partly due to strong opposition from Smith, other Hughes (GMH: Research, Estimates) executives and many of the General Motors Corp (GM: Research, Estimates) subsidiary's shareholders, the Wall Street Journal reported.

Smith apparently hopes to work up an alternative deal that would allow him to remain in control while giving GM the cash it needs for selling its stake. Smith apparently hopes to work up an alternative deal that would allow him to remain in control while giving GM the cash it needs for selling its stake.

Possible investors mentioned include General Electric's (GE: Research, Estimates) NBC television network, SBC Communications (SBC: Research, Estimates) and Microsoft Corp. (MSFT: Research, Estimates), people familiar with the matter told the Journal.

Hughes has opinions from three investment banks that such a buyout is possible, according to one person familiar with the plan, and hopes to come up with a deal that would give General Motors at least $5 billion in cash over a year or more. The initial News Corp. (NWS: Research, Estimates) proposal had up to $8 billion going to GM, which controls 30 percent of Hughes.

Click here to view other media stocks

Smith's plan has infuriated News Corp., which is threatening to abandon its takeover effort and has entered talks with EchoStar Communications Corp. (DISH: Research, Estimates), the nation's second-largest satellite TV broadcaster behind Hughes, the Journal said.

Hughes and News Corp. declined to comment. GM spokeswoman Toni Simonetti said, "We've always said we have a number of strategic alternatives that we're looking at...We continue to do that."

Word of News Corp.'s bid for the DirecTV unit of Hughes Electronics leaked out last month. Terms of the possible deal would leave News Corp. with a 35 percent stake in the newly combined operation with Hughes shareholders owning the rest.

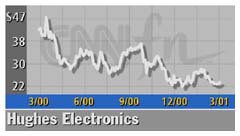

Shares of Hughes, which trades as a GM tracking stock, lost 34 cents to $23.04 early Friday, while parent company GM's shares advanced 42 cents to $58.87. News Corp. American depositary receipts slipped 64 cents to $35.26.

|

|

|

|

|

|

|