|

Pru to buy American Gen.

|

|

March 12, 2001: 2:29 p.m. ET

British insurer to acquire U.S. rival for $26.5 billion in stock; shares slide

|

LONDON (CNN) - British insurer Prudential on Monday agreed to buy American General for $26.5 billion, in one of the largest insurance industry deals of all time. But the news sent the British firm's shares down 13 percent.

The transaction, which is the biggest insurance industry deal of all time in the United States, according to Thomson Financial Data, allows Houston-based American General to expand overseas, and Prudential to further diversify itself outside of the United Kingdom.

London-based Prudential, which called the all-share deal the biggest transatlantic merger in the financial services sector, said it would enable the U.K. insurer to compete better with rival global insurance companies such as France's AXA.

Prudential, which is not related to Prudential Insurance Co. of America, is offering 3.66 of its shares for each American General share, implying a value of $49.52 per American General share. Prudential, which is not related to Prudential Insurance Co. of America, is offering 3.66 of its shares for each American General share, implying a value of $49.52 per American General share.

That represents a 28 percent premium over American General's closing stock price of $38.25 in New York on Friday. Prudential shareholders will own 50.5 percent of the new company.

But Prudential investors weren't buying. By mid-morning on Monday, Prudential (PRU) shares had tumbled 14 percent to 770 pence, their lowest level since April 1999, amid concerns that the company was paying too much.

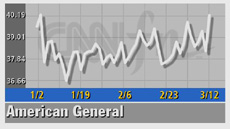

American General (AGC: Research, Estimates) shares gained 84 cents to $39.09 in Monday afternoon trading.

Paul Goulekas, an insurance industry analyst with Conning & Co., said the merger looks great on paper, but believes shareholders of both companies will nix the deal because it could dilute the value of their stock.

"Prudential shareholders seem very dissatisfied with the acquisition," Goulekas said. "We can't imagine that shareholders will go for that, but we'll be able to tell in the next two or three weeks after the road show."

Prudential expects cost savings of more than $130 million per year by the end of 2002.

An unnamed fund manager, quoted by Reuters, called the price "ludicrous for assets that are not yet clear."

"They are paying three times book value which, even for a 15-to-20 percent return on equity, is still pretty generous," the fund manager said.

The merger comes amid a spate of consolidation in the financial-services industry and is a major expansion for the Pru, making it one of the biggest insurance concerns with strong positions in the United States, the United Kingdom, and Asia.

The combined group will have a market capitalization of $45.3 billion, based on Friday's closing prices, making it the sixth-largest international insurance business. It will be the 11th largest company on the FTSE 100 index of leading U.K. stocks.

"Our position in Asia and the rest of the world and American General's strong position in the U.S. make us one of the top five or six players in the world," Jonathan Bloomer, chief executive of Prudential, told CNN. "Our position in Asia and the rest of the world and American General's strong position in the U.S. make us one of the top five or six players in the world," Jonathan Bloomer, chief executive of Prudential, told CNN.

Prudential plans to merge its Jackson National Life and PPM America subsidiary in the United States with American General's operation to boost its life-insurance and fixed and variable annuities businesses. American General is based in Houston.

American General Chairman and Chief Executive Robert Devlin will run the combined company's U.S. operations, and is expected to join the board as deputy chairman.

The merger is expected to be completed in the third quarter of 2001.

The 76-year-old American General sells retirement, life insurance and consumer finance products through its more than 1,350 U.S. offices and on the Internet.

|

|

|

|

|

|

|