|

Tyco buying CIT for $9.2B

|

|

March 13, 2001: 12:19 p.m. ET

Diversified manufacturer acquiring financial services firm for cash and stock

|

NEW YORK (CNNfn) - Tyco International Ltd. agreed Tuesday to acquire commercial finance firm CIT Group Inc. for $9.2 billion in cash and stock, giving the diversified manufacturer a financial services arm.

Tyco will exchange 0.6907 share for each share of CIT, valuing the transaction at $35.02 per CIT share based on Tyco's close of $50.70 Monday. The ratio represents a 54 percent premium to CIT's closing price Monday of $22.75.

The purchase includes the 27 percent CIT stake, or 71 million shares,� held by Japan's Dai-ichi Kangyo Bank, for which Tyco will pay $35.02 a share cash, or $2.5 billion. The purchase includes the 27 percent CIT stake, or 71 million shares,� held by Japan's Dai-ichi Kangyo Bank, for which Tyco will pay $35.02 a share cash, or $2.5 billion.

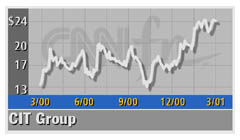

The news sent CIT shares soaring $7.55, or 33.19 percent, to $30.30 at midday Tuesday. Tyco fell $5.50, or 10.85 percent, to $45.20.

The transaction, which is expected to close in July, will immediately add to Tyco's earnings, the companies said. The purchase will add 2 cents a share to Tyco earnings in the current year and 10 cents in the next full fiscal year, a spokeswoman said.

The boards of both companies have approved the transaction, which still requires regulatory approval as well as shareholder endorsement.

Tyco already lends money to its clients, but the CIT purchase will let it finance customer purchases of its products and services, the spokeswoman said.

"After evaluating several paths to this goal, including developing a financing capability in-house, we concluded that acquiring CIT gives us a faster, more efficient and more robust solution at lower risk than anything we might have done internally or through joint-venture or other approaches," Tyco Chairman and CEO L. Dennis Kozlowski said.

Once the deal is consummated, CIT will sell up to $6 billion in non-core or underperforming assets, which may include trucking, overseas, recreational vehicles and manufactured housing, the spokeswoman said.

Albert Gamper Jr., who has served as CIT's Chairman and CEO since 1987, will remain CEO and President of CIT and will join Tyco's board.

Another GE?

Tyco is trying to become the next General Electric (GE: Research, Estimates), one analyst said. Stamford, Conn.-based GE Capital, the financial services arm of GE, accounts for about 40 percent of GE's revenue, offering personal and business financing globally.

New York-based CIT (CIT: Research, Estimates) is a diversified commercial lender with $50.4 billion in managed assets, mostly in the form of loans. In 1999, CIT bought Newcourt Credit Group, the biggest nonbank lender in Canada, for about $4.2 billion in stock.

Bermuda-based Tyco (TYC: Research, Estimates), which has operational headquarters in Exeter, N.H., makes electronics, fire and security systems, disposable medical supplies, and flow-control products such as valves.

The CIT purchase is the largest for Tyco since it agreed to buy AMP Inc. for $11.3 billion in November 1998. In December, Tyco agreed to acquire Simplex Time Recorder Co. for $1.15 billion cash in a move to expand its security product offerings. That followed the purchase in November of Lucent Power Systems, a unit of telecom equipment maker Lucent Technologies, for $2.5 billion.

"Tyco didn't have any financial services prior to this acquisition," analyst Walter Liptak of McDonald Investments Inc. said. "They are trying to diversify and get consistent earnings growth."

Tyco likely will purchases other financial services firms to boost its offerings, Liptak said.

|

|

|

|

|

|

|