|

Beef scares bite McD's

|

|

March 14, 2001: 4:11 p.m. ET

Company warns about profitability as it struggles with cattle diseases

|

NEW YORK (CNNfn) - McDonald's Corp. warned Wednesday that earnings for the first quarter and year will miss Wall Street forecasts due to sluggish sales, hurt by consumer concerns about beef supplies in Europe arising from the spread of Mad Cow disease and foot-and-mouth disease.

The world's largest restaurant chain said its annual earnings could be 4-to-5 cents a share below current forecasts, and that it expects earnings per share of about 30 cents in the first quarter. Wall Street forecasts are for 32 cents a share for the first quarter and $1.46 a share for the year.

McDonald's sales in Europe have eroded since late last year, resulting in an uncharacteristic fourth-quarter profit decline. Industry analysts have been expecting a warning from the Oak Brook, Ill.-based company. McDonald's sales in Europe have eroded since late last year, resulting in an uncharacteristic fourth-quarter profit decline. Industry analysts have been expecting a warning from the Oak Brook, Ill.-based company.

"The effect of consumer concerns regarding the European beef supply has persisted longer than we expected," chairman and chief executive Jack Greenberg said in a statement.

'Dead money'

Greenberg also said difficult sales comparisons worldwide compared to the prior year, which had strong marketing programs, are pressuring results. The company is taking several measures to drive up sales, including hastening the development of more nonbeef menu offerings in Europe.

But those measures might not lift McDonald's share price right away.

"It is likely that the Street's confidence in McDonald's could be at an all-time low," Salomon Smith Barney restaurant analyst Mark Kalinowski wrote in research published Wednesday.

"The stock may be proverbial 'dead money' for a while, as investors may want to see hard evidence of a sustained turnaround before they warm to the shares," Kalinowski wrote. "This may not happen until the second half of 2001."

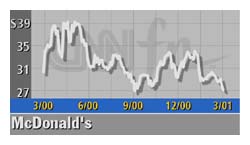

McDonald's stock near 52-week low

McDonald's (MCD: Research, Estimates) shares recovered from deep losses in early trading to close down 25 cents at $27.55, near its 52-week low of $26.37.

The stock is one of 30 in the Dow Jones industrial average, which fell sharply on investor worries that the slowing economy will hurt corporate earnings for much of the year.

In January, McDonald's reported a lower quarterly profit for the first time in 2-1/2 years, with earnings down 7 percent mainly because of the emerging concern about Mad Cow disease. The company also said then that the first-quarter is proving "very challenging" due to "continuing consumer confidence issues about European beef."

Mad Cow disease, a fatal brain-wasting disorder formally known as bovine spongiform encephalopathy, was detected in cattle herds in some of the company's key markets, including Germany and France. A related disease in humans is believed to be contracted through beef from affected animals.

Click here to view food and beverage stocks

The restaurant chain also is moving on its own to enforce often ignored rules aimed at keeping the nation's beef supply free of Mad Cow disease. It has given packers until April 1 to document that the cattle they buy have been fed in accordance with federal regulations.

Public concern over beef has heightened in Europe as foot-and-mouth disease, a highly contagious viral infection that affects cattle and other cloven-footed animals, had spread from the United Kingdom to the Continent. In most cases, that disease is not fatal to animals.

The U.S. Department of Agriculture banned imports of European beef Tuesday on concern foot-and-mouth disease could spread to the United States.

-- from staff and wire reports

|

|

|

|

|

|

|