|

Lucent mulls unit sale

|

|

March 14, 2001: 1:49 p.m. ET

Sale of Optical Fiber unit mulled by Lucent, could fetch up to $10 billion

|

NEW YORK (CNNfn) - Lucent Technologies confirmed Wednesday that it is looking at some options for its Optical Fiber Solutions business and is considering selling it or forming a joint venture.

Murray Hill, N.J.-based Lucent (LU: Research, Estimates) said the decision is part of the company's strategy to focus on systems, software and services. The company will decide which course to take over the next few months, the company said in a statement.

Sale of the Atlanta-based Optical Fiber has long been rumored, and the business could fetch between $8 billion and $10 billion, press reports said. Bill O'Shea, Lucent executive vice president, corporate strategy and development, described the unit's performance as stellar and said it is grew by more than 60 percent in 2000.

The Optical Fiber unit employs about 6,300 people, and makes and designs optical fiber, fiber cable and specialty fiber components for the telecommunications industry.

A source familiar with the situation told CNNfn.com that Lucent is currently in discussions with prospects. Corning Inc. (GLW: Research, Estimates), Alcatel SA (ALA: Research, Estimates) of France, JDS Uniphase Corp. (JDSU: Research, Estimates) and Pirelli SpA of Italy have all expressed interest in the unit, the interactive version of the Wall Street Journal reported.

A Lucent spokeswoman declined to comment.

Falling behind

Lucent will probably get somewhere in the mid-range of estimates, around $4 billion-to-$7 billion, for the unit, analysts said. The Optical Fiber unit had $1.8 billion revenue in fiscal 2000 and is growing by 60 percent while the slightly bigger Corning is only growing at 20 percent, said analyst Steve Levy, of Lehman Brothers.

"I can't imagine that Lucent is going to grow faster than Corning," he said. "I doubt they'd get more than $4 billion."

Lucent's fiber manufacturing facility in Norcross, Ga., could fetch about $6 billion separately, said analyst Jim Jungjohann, of CIBC World Markets. The company's specialty fiber business, which would be included in the sale, is much smaller with about $100 million sales and could go for about $500 million-to-$600 million.

Together, the two businesses could fetch about $6 billion-to-$7 billion, Jungjohann said. "The would be three times sales for the fiber business," he said. Together, the two businesses could fetch about $6 billion-to-$7 billion, Jungjohann said. "The would be three times sales for the fiber business," he said.

Lucent will more likely opt for a sale of the Optical Fiber unit than a joint venture, analysts said. Lucent has fallen behind rivals in the key optical networking market, struggling with manufacturing constraints and declining demand for its core telephone equipment products. The company trimmed its growth outlook several times last year and in January announced plans to cut 8 percent of its work force as well as take a charge of up to $1.6 billion.

In February, Lucent successfully secured $6.5 billion in new financing, but the company still has much debt to contend with, and analysts vary on the amount.

Lucent has about $6.5 billion debt currently, CIBC's Jungjohann said, while Lehman's Levy said the company had $8.1 billion debt and $3.8 billion cash at the end of December.

Lucent is expected to lose another $1.5 billion in the March quarter that "will stress the balance sheet," Levy said.

Lucent will make somewhere between $2.5 billion and $5 billion once it spins off Agere Systems Inc., its microelectronics unit.

Agere Systems plans to offer 500 million shares at $12-to-$14 each via lead underwriter Morgan Stanley Dean Witter. The company plans to trade under the New York Stock Exchange symbol "AGR.A."

However, a struggling Nasdaq makes it questionable whether the IPO will get off. The new issue is still expected to begin trading next week, underwriters on the deal said.

However, another Lucent-backed IPO, Wavesplitter Technologies Inc., formally withdrew its planned offering on Monday due to poor market conditions.

"March is going to be an interesting quarter," Levy said.

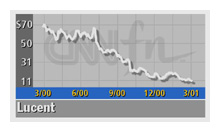

Shares for Lucent fell by 25 cents in afternoon trading to $11.00 Wednesday.

|

|

|

|

|

|

|