|

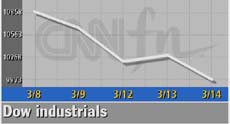

Dow falls below 10,000

|

|

March 14, 2001: 5:13 p.m. ET

Nearly two years after rising above five figures, Dow returns to four digits

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Dow Jones industrial average tumbled below 10,000 for the first time in nearly five months Wednesday in a broad U.S. stock selloff that came on growing fears that a weakening global economy will take a big bite out of corporate profits.

From financials to retailers to drug shares, all 30 Dow stocks fell, taking the blue chip index to its lowest levels in almost two years.

"The confidence in the earnings outlook is disintegrating daily," Joe McAlinden, chief investment officer at Morgan Stanley Dean Witter Asset Management, told CNNfn's The Money Gang. "The confidence in the earnings outlook is disintegrating daily," Joe McAlinden, chief investment officer at Morgan Stanley Dean Witter Asset Management, told CNNfn's The Money Gang.

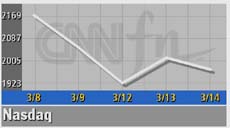

But for a change, the selling did not focus exclusively on technology shares. The Nasdaq composite index fell but ended above its 27-month low reached Monday.

The Dow Jones industrial average dropped 317.34 points, or 3 percent, to 9,973.46, its first close below 10,000 since Oct. 18.

Nearly two years ago today, euphoria gripped the market when the Dow first closed above 10,000. But Wednesday's selloff forced the New York Stock Exchange to set circuit breakers to limit the damage two days after another big decline.

The Nasdaq fell 42.70, or 2.1 percent, to 1,972.08 and the S&P 500 lost 30.95, or 2.6 percent, to 1,166.71, sending it further into the bear market territory it entered Monday.

Losses that began in Europe deepened after McDonald's, the world's biggest fast-food restaurant chain, warned its profit for both this quarter  and this year will fall short. News that Fitch, the credit rating agency, might lower its rating on 19 Japanese banks added to the nervousness. and this year will fall short. News that Fitch, the credit rating agency, might lower its rating on 19 Japanese banks added to the nervousness.

Still, Morgan Stanley's McAlinden sees the markets rising in the months ahead once the period for companies warning about first-quarter results ends and the Federal Reserve again cuts interest rates.

"I believe at this point next month we will be at higher levels despite all the doom and gloom," he said.

More stocks fell than rose. Declining issues on the New York Stock Exchange beat advancing ones 2,379 to 716 as 1.2 billion shares changed hands. Nasdaq losers beat winners 2,723 to 1,081 on volume of 2.1 billion shares.

Treasury securities rose as investors seeking safety snapped up fixed-income securities. The dollar gained against the yen and euro.

More selling

Wednesday's broad market losses recall those of Monday, when the Dow tumbled more than 400 points and the Nasdaq sank below 2,000 for the first time in more than two year's.

The Dow's financial stocks, whose profits are considered closely tied to the economy, led the way down, with Citigroup (C: Research, Estimates) losing $3.49 to $44.90 and J.P. Morgan Chase (JPM: Research, Estimates) declining $3.65 to $43.75.

Retailers, sensitive to the fast-weakening consumer spending, fell. Wal-Mart (WMT: Research, Estimates) gave back $1.60 to $47.20 and Home Depot (HD: Research, Estimates) lost $1.08 to $41.62.

The latest selling comes on a months-old concern: that the fast-slowing economy is sapping corporate profits. The latest selling comes on a months-old concern: that the fast-slowing economy is sapping corporate profits.

McDonald's (MCD: Research, Estimates) said it expects to miss earnings expectations in the current quarter and year because of consumer concerns about beef supplies in Europe. McDonald's fell 25 cents to $27.55.

Nextel Communications, the wireless provider, also issued an warning Wednesday, sliding $5.81 to $14.63. MetLife (MET: Research, Estimates) lost $2.93 to $28.75 after the insurer said its quarterly profits will fall below Wall Street's expectations.

Click here for a list of the latest corporate disappointments

NYSE trading collars, which put a limit on big program trades, kicked in when the Dow Jones industrial average moved down 210 points.

The latest losses mean that the Dow is essentially back where it was two years ago; the index first closed above four figures on March 29, 1999. At that time, many predicted the Dow's rally would continue. And it did for a time. The Dow rose above 11,700 by early last year. But it's been downhill ever since.

Analysts for months have tried to pick the bottom of the fast-falling market. But Linda Jay, trader at RPM Specialists, said she was encouraged by the heavy selling volume earlier Wednesday.

"This is the definition of capitulation," Jay told CNNfn's Market Call.

On the Nasdaq, Cisco Systems (CSCO: Research, Estimates) lost $1.13 to $20.25. At an analysts' conference Tuesday, Cisco CEO John Chambers gave a pessimistic outlook for his company's business, the world's biggest supplier of equipment for connecting computer networks.

Still, some tech stocks, whose losses over the last 12 months pushed the Nasdaq down 62 percent from its peak, drew buyers.

WorldCom (WCOM: Research, Estimates), whose shares are near their 52-week low of $13.50, gained $1.25 to $16.44. Dell Computer (DELL: Research, Estimates), off 60 percent from its 52-week high, rose 44 cents to $24.38.

Banking on the Fed, college hoops

The market faced overseas problems Wednesday. Fitch, the rating agency, said it is considering downgrading the credit quality of 19 banks in Japan, the world's second-biggest economy.

European markets tumbled to 16-month lows while Europe's currency, the euro, is trading about 22 percent below its high. Japan's Nikkei stock index touched a 16-year low Tuesday before recovering slightly Wednesday.

To date, many of the market's worries have focused on the domestic economy. The Japan concerns recall crises such as the Asian currency problems in 1997 and the Russian debt defaults that hit the markets in 1998.

But those problems were short-lived, in part because the Federal Reserve aggressively cut interest rates. Once again, investors are looking longingly to the Fed, which cut interest rates twice in January, and meets Tuesday to set rates.

Quoting a former Federal Reserve official, the Wall Street Journal Wednesday predicted an interest rate cut of no more than a half-percentage point March 20. But that forecast is largely in line with those of many Fed watchers. Quoting a former Federal Reserve official, the Wall Street Journal Wednesday predicted an interest rate cut of no more than a half-percentage point March 20. But that forecast is largely in line with those of many Fed watchers.

"I think that cut is priced into the markets," Morgan Stanley Dean Witter's McAlinden said.

Down the road, economists expect the central bank, which at this time last year was raising rates, to continue lowering borrowing costs.

The latest economic data may support the case for rate cuts. A government report showed stockpiles on company shelves rose 0.4 percent in January, faster than expected, as customers' demand for products cooled. On Tuesday, the government said retail sales fell 0.2 percent in February.

Unlike past sessions, when companies such as Intel, JDS Uniphase and Sun Microsystems readied investors for shortfalls, Wednesday's losses come amid a relative lack of corporate information.

"I think it's emotional, because all the news out today is already known," Barry Hyman, chief market strategist at Weatherly Securities, told CNNfn's Market Call.

The next key earnings report comes Thursday, when Oracle announces its fiscal third-quarter profit. Friday brings an important read on consumer confidence when the University of Michigan releases its survey on consumer attitudes.

But the market's most important break comes in the form of a distraction. The NCAA men's basketball tournament begins Thursday afternoon.

|

|

|

|

|

|

|