|

BellSouth eyes Sprint

|

|

March 15, 2001: 2:10 p.m. ET

BellSouth pursuing No. 3 long-distance company, newspaper says

|

NEW YORK (CNNfn) - BellSouth Corp. is trying to buy Sprint Corp., the nation's No. 3 long-distance telephone company, but any deal is probably months away, press reports said Thursday.

Quoting sources familiar with the talks, the Washington Post also said that SBC Communications Inc., the biggest local phone company in the Midwest, Texas and California, is talking about acquiring WorldCom Inc., the No. 2 long-distance carrier. But the sources said there had been no talks between SBC and WorldCom in recent weeks, the newspaper said.

The report said BellSouth is discussing a complex deal to buy Sprint along with its national wireless business, then sell its 40 percent stake in Cingular Wireless back to its joint-venture partner, SBC. No proposed prices were mentioned in the report.

Sprint declined to comment on the BellSouth takeover report. SBC also declined to comment on rumors it is acquiring WorldCom. Neither BellSouth nor WorldCom could be reached for comment.

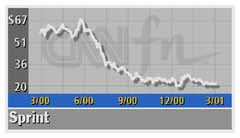

Sprint (FON: Research, Estimates) stock jumped $1.43 to $21.99 in afternoon trading, a gain of 6.96 percent, WorldCom (WCOM: Research, Estimates) rose $1.44, or 8.75 percent, to $17.87 while BellSouth (BLS: Research, Estimates) fell $1.15 to $39.50. SBC (SBC: Research, Estimates) dropped 3 cents to $42.08.

A telecom merger anywhere?

According to the newspaper's sources, SBC's conversations with WorldCom began earlier this year and have recently cooled, but both companies remain interested.

At a conference in New York Wednesday, WorldCom Chief Executive Bernie Ebbers was asked if WorldCom has held merger talks with SBC. He replied, "We haven't had any discussions." SBC said Tuesday it has no current plans for acquisitions.

The newspaper said falling stock prices have made some companies potentially more attractive, while the Bush administration is expected to be less likely than its predecessor to block mergers.

Analysts discounted reports that BellSouth was in talks to buy Sprint. Gary Jacobi, of Deutsche Banc Alex. Brown, said there is not any motivation for regional bell operating companies (RBOC), like Verizon, SBC or BellSouth, to buy a company like Sprint.

"We believe that RBOC's have a fundamental cost advantage going after consumer and enterprise customers [themselves] that will enable them to easily and successfully enter the long-distance business," he said. "We believe that RBOC's have a fundamental cost advantage going after consumer and enterprise customers [themselves] that will enable them to easily and successfully enter the long-distance business," he said.

Analyst Pat Comack, of Guzman & Co., said that BellSouth may have been interested in Sprint six months ago but the situation has changed.

"BellSouth now has a long-distance relationship with Qwest and a wireless relationship with SBC," Comack said. "My bet is [the BellSouth-Sprint] doesn't happen."

WorldCom's declining stock price makes it a good takeover candidate and shares are currently trading 64 percent below their 52-week high of $49.96. But a foreign company may be a more likely candidate to buy WorldCom or Sprint, Comack said, who declined to speculate on any likely buyers.

Firms like BellSouth and SBC are also more focused on growing internal operations, such as building out their wireless and DSL businesses, and may not be interested in a merger anytime soon.

"They've got a lot on their plate, a lot of issues, and to delve into an acquisition now would be more of a mess," Comack said.

|

|

|

|

|

|

|