|

Wall St. takes a beating

|

|

March 16, 2001: 4:28 p.m. ET

Daily warnings, Fed and rate concerns, options send major indexes reeling

By Staff Writer Catherine Tymkiw

|

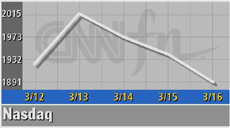

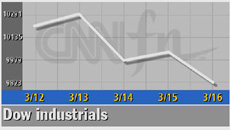

NEW YORK (CNNfn) - The Nasdaq composite index fell to its lowest level since November 1998 Friday, capping a seven-week losing streak, and the Dow Jones industrial average had its worst weekly point loss.

The losses came in a week full of investor uncertainty about the economy and growth in the technology sector.

"It's been brutal," said Mark Donahoe, institutional equity sales trader with U.S. Bancorp Piper Jaffray. "It's more of the same but tech is in its own world right now and it's a world of hurt. Cash is king right now."

U.S. stocks were under pressure all week as daily corporate warnings sent investors fleeing to the sidelines. Friday's action was driven by investor concern about how aggressive the Federal Reserve might be in cutting interest rates -- while warnings from several tech leaders and options expiration weighed heavily on the major indexes.

"It's been a disastrous week and we're just limping along here -- ultimately we're in a profit recession and the question is how long will that linger, which is frustrating the plight of equities," said Bryan Piskorowski, market analyst with Prudential Securities. "In the bigger picture you have a market that is clearly unhappy, and that stems from the lack of visibility," referring to the inability of companies to forecast even short-term results. "It's been a disastrous week and we're just limping along here -- ultimately we're in a profit recession and the question is how long will that linger, which is frustrating the plight of equities," said Bryan Piskorowski, market analyst with Prudential Securities. "In the bigger picture you have a market that is clearly unhappy, and that stems from the lack of visibility," referring to the inability of companies to forecast even short-term results.

The Nasdaq tumbled 49.80 points, or more than 2 percent, to 1,890.91; it modestly rebounded from as low as 1,877.69 -- the first time the indicator has been below 1,900 since Nov. 19, 1998. The tech-heavy index is down 7.89 percent for the week and it has fallen 62.5 percent from its March 10, 2000 high of 5,048.

The Dow industrials fell 207.87 to 9,823.41. The blue chip index shed a record 821 points this week, or 7.7 percent. The S&P 500 shed 23.03 to 1,150.53 and is 6.7 percent down for the week. The Dow industrials fell 207.87 to 9,823.41. The blue chip index shed a record 821 points this week, or 7.7 percent. The S&P 500 shed 23.03 to 1,150.53 and is 6.7 percent down for the week.

Warnings from several tech firms provided enough of a catalyst to spark a broad selloff in technology and beyond. But even consumer cyclical issues took a beating as economic concerns bubble to the surface ahead of Tuesday's Fed meeting.

Friday also was "triple witching" options expiration, which accounted for a good deal of the volume. Triple witching is the quarterly expiration of futures, index options and individual stock options that happens within the same day.

"The triple witch effect has increased volatility, with most of the programs in the sell column," said Peter Coolidge, senior trader with Brean Murray & Co.

Market breadth was negative. On the New York Stock Exchange, decliners outpaced advancers 2,058 to 992 as more than 1.54 billion shares were traded. Losers beat winners on the Nasdaq 2,586 to 1,044 as more than 2.06 billion shares changed hands.

In other markets, Treasury securities edged lower. The dollar rose against the yen and euro.

Investors find little comfort in data

Two major economic reports did little to give investors confidence that the Fed would be more aggressive than anticipated with cutting interest rates.

"There's still a lot of uncertainty out there, especially about how long and how deep the economic slowdown will be," said Coolidge. "It's a bad day in a bad week."

In economic news, the Producer Price Index -- a measure of prices at the wholesale level -- rose just 0.1 percent in the United States last month, in line with Wall Street forecasts. Excluding often volatile food and energy prices, the "core" PPI fell 0.3 percent, in contrast to the 0.1 percent increase predicted by economists.

"It's good news because it shows there's no creeping inflation," said Art Hogan, chief market strategist with Jefferies & Co. "And the Fed is not worried about inflation. What they (Fed governors) care about is the manufacturing side of things, retail sales and consumer spending."

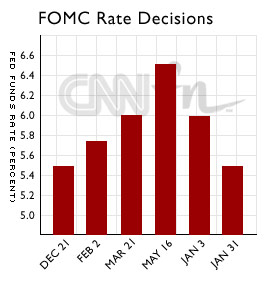

Most expectations are for the Federal Open Market Committee (FOMC), the Fed's policy-making body, to cut rates by at least a half-percentage point when it meets Tuesday. Most expectations are for the Federal Open Market Committee (FOMC), the Fed's policy-making body, to cut rates by at least a half-percentage point when it meets Tuesday.

"I think 50 basis points (one-half percentage point) is a credible consensus estimate for what the Fed does (at its March 20 meeting)," Hogan said. "Unfortunately, over the last five or six tumultuous trading days, we've talked ourselves into the fact that the Fed cares about equity valuations, but that's not the case."

But the University of Michigan's twice-monthly barometer of consumer confidence came in at 91.8 in March, slightly higher than expected and better than the 90.6 level reported in February.

"We just can't win with economic data," said Prudential's Piskorowski. "You see the slight uptick in consumer sentiment which bodes well for the economy but runs counter to the crew that was looking for a 75 basis point cut from the Fed, so there was some disappointment there."

Tech pain

Technology stocks were unable to find any significant support to draw in buyers after several firms issued warnings, led by the computer services sector.

"There is such apathy toward investing," Barry Hyman, chief market strategist with Weatherly Securities, told CNNfn's Market Call.

Computer Sciences (CSC: Research, Estimates) skidded $21.40 to $32.70, after the third-largest supplier of computer services warned its financial results would fall sharply below expectations and that it plans to cut 700 to 900 jobs. Computer Sciences (CSC: Research, Estimates) skidded $21.40 to $32.70, after the third-largest supplier of computer services warned its financial results would fall sharply below expectations and that it plans to cut 700 to 900 jobs.

IBM (IBM: Research, Estimates), which competes with Computer Sciences in services and outsourcing, fell $5.46 to $90.10.

Other computer services stocks followed suit. Cambridge Technology (CATP: Research, Estimates) fell 22 cents to $3.19 and Electronic Data Systems (EDS: Research, Estimates) shed $3.25 to $55.25.

Bad news hurt other tech leaders.

Oracle (ORCL: Research, Estimates), the business software maker, reduced its estimates for the current quarter and met lowered forecasts for the quarter ended last month. Oracle shares dropped 63 cents to $14.06.

Compaq Computer (CPQ: Research, Estimates) fell 50 cents to $18 after it joined other tech leaders by warning that its March quarter will be a disappointment. The PC maker said late Thursday that it expects to report earnings of 12-to-14 cents a share, compared with the consensus forecast of 18 cents. The company also said it will cut up to 5,000 jobs.

Good news lifted shares of Adobe Systems (ADBE: Research, Estimates) after the maker of desktop publishing software posted better fiscal first-quarter earnings than the company's lowered expectations. Adobe shares jumped $3.63 to $28.63.

It wasn't purely a tech selloff, however -- drug and industrial issues also fell. Merck (MRK: Research, Estimates) shed $2.60 to $71.45, United Technologies (UTX: Research, Estimates) slid $4.33 to $71.42, and Boeing (BA: Research, Estimates) fell $2.58 to $53.52.

|

|

|

|

|

|

|