|

BHP, Billiton merge

|

|

March 19, 2001: 12:24 p.m. ET

Australia's BHP, UK's Billiton agree to merge, creating No. 2 mining company

|

NEW YORK (CNN) - Australia's BHP Ltd. and Britain's Billiton PLC agreed Monday to merge, creating the world's second-largest mining concern by market value.

The combined company, called BHP-Billiton, will have a market capitalization of $28 billion and an estimated $20 billion in annual sales. It will be the world's second-biggest minerals and metals group, behind aluminum producer Alcoa (AA: Research, Estimates).

"This is a sensational fit," BHP Chief Executive Paul Anderson said in a statement. "The companies balance each other well, with an exceptional breadth of assets and capabilities which have taken many years to develop. "This is a sensational fit," BHP Chief Executive Paul Anderson said in a statement. "The companies balance each other well, with an exceptional breadth of assets and capabilities which have taken many years to develop.

Though the companies will effectively keep their separate identities and listings on the Australian and London stock exchanges, they will share management and be operated as one entity, with headquarters in Melbourne, Australia. BHP will own 58 percent of the new company, and Billiton will hold 42 percent.

BHP's Anderson will be chief executive officer of the combined company until the end of 2002, when Billiton chief Brian Gilbertson will take over.

A spate of mining mergers

The merger comes amid a spate of mergers and acquisitions in the mining industry as the sector moves to cut costs. Rivals Rio Tinto and Anglo American, for example, have spent billions on acquisitions.

"We have to decide whether we are going to participate in industry consolidation and lead it and define the industry, or whether we are going to watch the industry consolidating around us and be a victim of that consolidation," BHP's Anderson said.

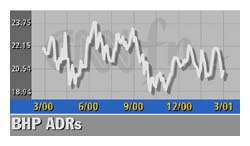

BHP's shares soared in Australia immediately after the deal was announced. In midday trading on the New York Stock Exchange, American depositary receipts (ADRs) of BHP (BHP: Research, Estimates) were up 65 cents to $21. Billiton does not issue ADRs.

In a vote of confidence for the deal, ratings agency Standard & Poor's placed BHP's credit ratings on a positive watch, saying upgrades will likely take place if the merger proceeds.

BHP's long-term debt is currently rated "A minus" by Standard and Poor's and the short-term debt ranks "A2."

Combining commodity businesses

BHP said the rationale of the merger was for each company to gain world-class positions in commodity businesses to which the other has no existing exposure.

BHP is the world's largest nongovernment producer of copper and one of the world's largest iron ore and coking coal miners. It also produces steel and diamonds and has an oil and gas division.

Billiton is the world's top producer of chrome and manganese ores and alloys. It is also among the world's largest aluminum and nickel producers.

The merger is subject to shareholder and regulatory approval and BHP shareholders will receive a bonus issue of 1.0651 BHP shares for each BHP share held. This will lift the total number of shares on issue in both companies following the merger to 6,024 million.

Also under the deal, BHP will spin off its steel assets to shareholders as a separate business. The spinoff is expected to be completed by the end of 2002.

-- from staff and wire reports

|

|

|

|

|

|

|