|

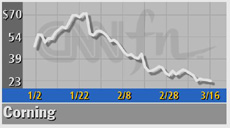

Corning warns on 2001

|

|

March 19, 2001: 3:14 p.m. ET

Maker of fiber-optic gear cites slower spending, economy for lower forecast

|

NEW YORK (CNNfn) - Corning Inc. warned Monday that earnings will miss Wall Street forecasts this year due to sluggish spending by telephone companies as the economy slows.

Corning said it is still steadily taking orders, but said it believes its telecommunications customers will ramp up spending more slowly than initially anticipated. As a result, the company is considering further staff reductions beyond the 825 it announced earlier this month as well as other cost-cutting measures.

The company, which makes fiber-optic cable and other components that telephone companies have been using to upgrade their networks, said it now expects to earn about $1.25 per share this year, little changed from last year's $1.23 a share, and below Wall Street forecasts of $1.36 a share.

Corning (GLW: Research, Estimates) said sales should be between $8.2 billion and $8.5 billion, up from $7.1 billion last year. It said it has not changed its forecast for first-quarter profit of 28 cents-to-31 cents a share versus last year's 23 cents a share. Wall Street had been expecting profit of 29 cents a share for the quarter, according to First Call, which tracks analysts' estimates. Corning (GLW: Research, Estimates) said sales should be between $8.2 billion and $8.5 billion, up from $7.1 billion last year. It said it has not changed its forecast for first-quarter profit of 28 cents-to-31 cents a share versus last year's 23 cents a share. Wall Street had been expecting profit of 29 cents a share for the quarter, according to First Call, which tracks analysts' estimates.

"Our new outlook is based on recent customer feedback, which indicates that a meaningful recovery of spending by our telecommunications customers will occur much more slowly than we had previously anticipated," Corning CEO John Loose said in a statement.

Corning said 2001 revenue from photonic technologies is now expected to grow 20 percent-to-25 percent, significantly lower than the company's previous expectations for 50 percent growth.

The advisory came shortly after Verizon Wireless said it had entered a three-year, $5 billion contract for third-generation technology from Lucent Technologies (LU: Research, Estimates), another troubled telecom equipment maker.

Click here to view other technology stocks

In February, Corning said it was thinking about eliminating jobs and employing other cost-control measures in hopes of maintaining its fiscal 2001 earnings targets after its largest customer, Nortel Networks (NT: Research, Estimates), warned it would post a first-quarter loss and would trim 10,000 jobs.

Shares in companies that make equipment to connect and speed up phone service carriers' networks have been hit hard as carriers, realizing they over-expanded their networks, significantly cut back on spending to re-evaluate their strategies.

However, Corning's stock was moving higher in the wake of the earnings warning. Its shares were up $1.67, or 7.2 percent, in afternoon trade on the New York Stock Exchange.

Analysts who track Corning and the fiber-optic industry said the estimate reduction had been widely anticipated.

"I think many market participants had been expecting an announcement along these lines," said Larry Harris, and analysts at Josephthal & Co., noting a similar warning of weakening earnings from JDS Uniphase (JDSU: Research, Estimates), the No. 1 supplier of optical networking components.

James P. Parmelee, an analysts who covers Corning at Credit Suisse First Boston, also said the company's reduced estimates should have been expected, considering its dependence on Nortel, which he said represents about 60 percent of its photonics sales.

"The pre-announcement is not surprising given the slowing industry demand for basic infrastructure, Corning's exposure to the U.S. optical fiber market and continued lack of near-term visibility in optical component modules as a substantial inventory correction continues," Parmelee said in a note to clients Monday.

-- Reuters contributed to this report.

|

|

|

|

|

|

|