|

Wall St. plunge led by Fed

|

|

March 20, 2001: 4:28 p.m. ET

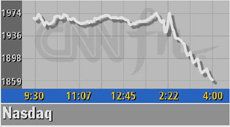

Rate cut disappoints traders, sparks sell-off; Nasdaq at 28-month low

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - U.S. stocks fell sharply Tuesday as investors showed dissatisfaction that the Federal Reserve failed to cut interest rates by more than half a percentage point.

"It's just continued disappointment in the Federal Reserve," said Michael Holland, chairman of Holland & Co. "We have a growing problem in the economy and with companies' profitability and the Federal Reserve is behind it (the curve)."

Analysts expected traders to unwind positions if the rate cut fell in line with widely held expectations, while the key for investors was in the Fed's statement. But the momentum just fed on itself after hopes were dashed that the Fed would be more aggressive.

"The traders wanted 75 basis points (three-quarter percentage point) so they sold on the news," Larry Wachtel, market analyst with Prudential Securities, told CNNfn's The Money Gang. "After the traders sold, investors stepped up to the plate (to sell)." "The traders wanted 75 basis points (three-quarter percentage point) so they sold on the news," Larry Wachtel, market analyst with Prudential Securities, told CNNfn's The Money Gang. "After the traders sold, investors stepped up to the plate (to sell)."

The Nasdaq fell to a 28-month low, plunging 93.74, or more than 4 percent, to 1,857.44 -- its lowest close since Nov. 13, 1998, when it finished at 1,847.99. The index is now 63 percent down from its high of 5,048, reached on March 10, 2000.

And the Dow industrials fell 238.35, or more than 2 percent, to 9,720.76 -- after briefly crossing the 10,000 point earlier in the session. The S&P 500 slid 28.19 to 1,142.62.

Once the Fed news is fully digested, analysts expect investors are likely to start stepping back in with more conviction, either on the buy side or the sell side. Once the Fed news is fully digested, analysts expect investors are likely to start stepping back in with more conviction, either on the buy side or the sell side.

"I don't think you're getting a lot of investors stepping in here," said Seth Martin, equities analyst with IDEAglobal.com. "Over the next couple of days is when people will be making major decisions."

Ahead of the 2:15 p.m. ET announcement, traders nervously bought and sold stocks to hedge their bets, but quickly sold when the news came out.

Market breadth was negative. On the Nasdaq losers beat winners 2,259 to 1,369 as more than 2 billion shares were traded. Decliners beat advancers on the New York Stock Exchange 1,759 to 1,306 as more than 1.22 billion shares changed.

In other markets, Treasury securities edged higher. The dollar slipped against the euro but was little changed versus the yen.

Stocks tumble after rate cut

Traders dictated most of the action with some investor participation in the last hour of trading.

"A lot of this is trader (driven)," agreed Brian Finnerty, head of Nasdaq stock trading at C.E. Unterberg Towbin. "The gyrations are crazy but it's just sort of a typical reaction."

He fully expects investors to start gaining confidence from the Fed action and from the accompanying statement.

"Over time, things are going to settle down. But people are going to realize the Fed has given us 150 basis points of rate cuts in three months," he said. "That's a lot and it's going to start working its way into the economy." "Over time, things are going to settle down. But people are going to realize the Fed has given us 150 basis points of rate cuts in three months," he said. "That's a lot and it's going to start working its way into the economy."

The major indexes have fallen sharply recently and were due to attract some buying, but the Fed does not base its decisions on how the markets are acting, said analysts.

"There was too much hope built up that the Fed was going to cut by more than 50 basis points," said Bill Meehan, chief market analyst with Cantor Fitzgerald. "We had a rally in anticipation of Fed action but we are in a bear market. The hopes and prayers of the bulls was totally on the shoulders of the Fed."

However, there is a relationship between the markets and the economy, the latter being the Fed's primary focus.

"I don't think the Fed looks at the equity market and makes decisions off the equity markets, but the equity markets are absolutely a reflection of wealth and consumer confidence," said Barry Hyman, chief market strategist with Weatherly Securities. "That is what the equity markets mean in relation to other economic scenarios and that is where (the Fed's) interest is."

And in the Fed's accompanying statement, the Board of Governors wrote, "persistent pressures on profit margins are restraining investment spending and, through declines in equity wealth, consumption."

But there was little traction for stocks on the upside. While analysts expected some support ahead of the Fed announcement, it has quickly fizzled out.

"There's not enough fear and there was too much hope," said Cantor Fitzgerald's Meehan.

Goldman gives up gains

Corporate results and warnings put a drag on select technology stocks. Goldman Sachs advanced for most of the session, but the Fed's rate cut prompted broad selling, especially for interest-rate-sensitive financial issues.

Financial services firm Goldman Sachs (GS: Research, Estimates) fell $3.88 to $87.06 after it beat expectations to earn $1.40 a diluted share in the first quarter ended Feb. 23. Analysts expected the company to have earned $1.29 a share compared with $1.76 a share in the year-earlier quarter.

Semiconductor equipment maker KLA-Tencor (KLAC: Research, Estimates) shed $3.38 to $38.38 after it said earnings for its fiscal third quarter will be below prior expectations because of the continued weakness in the economy.

Another warning came from Solectron (SLR: Research, Estimates), the electronics manufacturing services contractor, which said fiscal third-quarter earnings will be about half what was originally expected -- although the company did manage to top estimates for the second quarter ended March 2. Solectron shares slipped $2.47 to $19.02. Philips Electronics (PHG: Research, Estimates) fell 75 cents to $28.40 after it said that first-quarter profit from its semiconductor unit will decline due to weakness in the U.S. market. Another warning came from Solectron (SLR: Research, Estimates), the electronics manufacturing services contractor, which said fiscal third-quarter earnings will be about half what was originally expected -- although the company did manage to top estimates for the second quarter ended March 2. Solectron shares slipped $2.47 to $19.02. Philips Electronics (PHG: Research, Estimates) fell 75 cents to $28.40 after it said that first-quarter profit from its semiconductor unit will decline due to weakness in the U.S. market.

In other corporate news, Microsoft said it is planning an array of new Internet services under the brand name HailStorm, to help consumers manage and share personal information in an attempt to more effectively compete with AOL Time Warner, according to a published report. Microsoft (MSFT: Research, Estimates) shares fell $1.63 to $52.69. In other corporate news, Microsoft said it is planning an array of new Internet services under the brand name HailStorm, to help consumers manage and share personal information in an attempt to more effectively compete with AOL Time Warner, according to a published report. Microsoft (MSFT: Research, Estimates) shares fell $1.63 to $52.69.

|

|

|

|

|

|

|