|

Brokers' earnings fall

|

|

March 21, 2001: 9:58 a.m. ET

Morgan Stanley, Lehman, edge forecasts; Bear Stearns, A.G. Edwards miss target

|

NEW YORK (CNNfn) - The bear market took a bite out of some leading brokers' earnings as Morgan Stanley Dean Witter & Co., Lehman Brothers Holdings Inc., Bear Stearns Cos. and A.G. Edwards Inc. all reported sharply lower profits for the latest quarter Wednesday.

Bear Stearns and Edwards fell short of Wall Street forecasts, while Morgan Stanley and Lehman edged past average estimates. Edwards was reporting fiscal fourth-quarter results while the other three released first-quarter results.

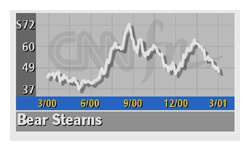

Bear Stearns earned $166.0 million, or $1.10 a diluted share, before the impact of an accounting change. That's 18 cents below the estimates of analysts surveyed by earnings tracker First Call, and down 40 percent from the $278.2 million, or $1.89 a share, it earned a year earlier. Bear Stearns earned $166.0 million, or $1.10 a diluted share, before the impact of an accounting change. That's 18 cents below the estimates of analysts surveyed by earnings tracker First Call, and down 40 percent from the $278.2 million, or $1.89 a share, it earned a year earlier.

St. Louis-based Edwards saw profits fall to $45.9 million, or 57 cents a diluted share. That missed the 64-cent EPS forecast from First Call and was well off the $100.8 million, or $1.11 a share, it earned in the year-earlier period.

Morgan Stanley earnings in its first quarter fell 30 percent to $1.08 billion, or 94 cents a diluted share, from $1.54 billion, or $1.34 a share, a year earlier. But analysts surveyed by earnings tracker First Call expected only 93 cents in the latest period.

Lehman said its first-quarter net income fell to $387 million, or $1.39 a diluted share, for the period ended Feb. 28, from $541 million, or $1.84 a share, a year earlier. Wall Street analysts had forecast $1.37 a share.

Morgan Stanley (MWD: Research, Estimates) shares fell 30 cents to $56.20 early Wednesday while Lehman's (LEH: Research, Estimates) stock fell 68 cents to $65.22. Shares of Bear Stearns (BSC: Research, Estimates) lost 57 cents to $46.18 and AG Edwards (AGE: Research, Estimates) slipped 44 cents to $35.

Click here for a look at financial stocks

The reports come a day after Goldman Sachs reported first quarter earnings well above Wall Street expectations, due mainly to increasing revenue from financial advising. However, results were lower than a year ago as the company suffered losses from underwriting and its investments in the technology and telecommunications sectors.

|

|

|

|

|

|

|