|

Red Hat breaks even

|

|

March 22, 2001: 6:20 p.m. ET

Linux software specialist sees sales more than double in 4Q

|

NEW YORK (CNNfn) - Red Hat Inc., a leading distributor of the Linux operating system, said Thursday it broke even during its fiscal fourth-quarter, compared with the Street's expectation that the company would post a loss of a penny per share.

After the close of trading, Red Hat said its loss for the quarter ended Feb. 28 was $600,000, which it said means it broke even on a per-share basis.

Analysts polled by First Call, a research firm that tracks corporate earnings, had expected Red Hat to post an operating loss of a penny per share during the quarter. During the same quarter a year earlier, Red Hat reported an operating loss of $5.6 million, or 4 cents per share.

At $27 million, Red Hat's fourth-quarter revenue rose 106 percent from the $13.1 million it reported in the year-ago quarter and was slightly ahead of the $26.7 million analysts had expected, according to the First Call survey.

For the full fiscal year, Red Hat said its total revenue was $84 million, doubling the $42 million in sales it logged during the prior year. The company's net loss for the fiscal year was $5.9 million, or 3 cents per share, compared with a loss of $19 million, or 19 cents per share, the year earlier.

Red Hat (RHAT: Research, Estimates) is one of a growing number companies that specialize in software and solutions based on the Linux operating system. Linux is an "open-source" operating system, which means that it is in the public domain and open to modifications by independent developers. Red Hat (RHAT: Research, Estimates) is one of a growing number companies that specialize in software and solutions based on the Linux operating system. Linux is an "open-source" operating system, which means that it is in the public domain and open to modifications by independent developers.

Executives at Red Hat in Research Triangle Park, N.C., attributed the company's improved results in large part to customer wins at some major corporations.

During the quarter, the company inked software and services deals with companies including Nortel, Germany's Deutsche Telekom, LSI Logic and General Electric, among others, executives said.

"Red Hat expanded its sources of revenue by introducing strategic solutions to our global customers, which contributed to our strong operating results," Matthew Szulik, Red Hat's president and chief executive, said in a statement. "Our management team has continued to accomplish the operational and financial goals stated a year ago."

Looking ahead to the current quarter, Red Hat executives said they are aiming for revenue that is flat with the current quarter but said they expect to turn a small profit. For the full fiscal year, the company said it expects to log an operating profit of about $17.4 million, or 10 cents per share. The Street had most recently expected an annual profit of 4 cents per share, according to First Call's survey.

The Linux products and services offered by Red Hat and other companies, such as VA Linux (LNUX: Research, Estimates) and Caldera Systems (CALD: Research, Estimates), have emerged as rivals to Microsoft's ubiquitous Windows operating system and have been gaining strength in the server market, especially among dot.coms.

Although it is offered for free, most corporate users opt to pay for the Linux operating system and its attendant support and services through distributors such as Red Hat, which derives the bulk of its revenue from support and services.

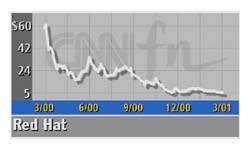

Shares of Red Hat rose ended the regular session unchanged at $5.22 ahead of the earnings report. They rose 28 cents to $5.50 in after-hours trade. The company's shares have fallen more than 93 percent from a 12-month high of $79.56.

|

|

|

|

|

|

|