|

Weekly win for Nasdaq

|

|

March 23, 2001: 4:38 p.m. ET

Betting the worst was over in select techs, rally lifts Nasdaq and Dow

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - Strength in U.S. technology stocks helped the Nasdaq composite index break a seven-week losing streak Friday as traders bet an extended sell-off had taken these issues down to reasonable levels.

The tech-heavy Nasdaq has been down more than 20 percent -- the conventional definition of a bear market -- since early September.

The Nasdaq composite index rose 30.98 to 1,928.68 and is up 2 percent this week. The Nasdaq hasn't recorded a gain on the week since the week ended Jan. 26, when it carved out a 0.3 percent rise. The index is still nearly 62 percent down from its high of 5,048, reached on March 10, 2000  . .

The buying comes one day after blue-chip issues dove into bear market territory and then rebounded out of it.

"I think yesterday (Thursday) was as close to a capitulation as I've seen, where all stocks were dumped out and the momentum carried the market lower and lower all day in the areas that had held up the best," said Joe Battipaglia, chief investment strategist with Gruntal & Co. "Meanwhile, the Nasdaq, which has been crucified, showed great resilience all day."

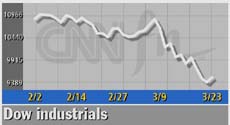

While the S&P 500 and the Dow industrials fell on the week, both indexes carved out significant gains on the day, with financial stocks boosting the Dow.

The Dow Jones industrial average gained 115.30 to 9,504.78, ending the week down 3.2 percent, while the S&P 500 advanced 22.25 to 1,139.83, off 0.9 percent on the week. The Dow is down 18.9 percent from its Jan. 14, 2000 high of 11,722, while the S&P is off 25 percent from its March 23, 2000 high of 1,527.

Uncertainty about corporate profitability in a slow economy was still underpinning the strength and bringing out sellers in some industrial issues -- the same sentiment that sent the Dow plunging Thursday. Uncertainty about corporate profitability in a slow economy was still underpinning the strength and bringing out sellers in some industrial issues -- the same sentiment that sent the Dow plunging Thursday.

But analysts remained optimistic that the day's action signaled some turnaround.

"When the Dow was doing its swan song yesterday (Thursday), the money was staying in the market and rotating into tech," said Art Hogan, chief market analyst with Jefferies & Co. "That's the first time that's happened this year and that's good news -- folks are changing their minds about the sectors but they're staying in the market."

Analysts said most of the buying and volatility was a combination of short covering, rotating assets and no one wanting to hold large positions ahead of the weekend.

A short position is having an excess of sales over purchases. So short covering would bring out buyers looking to cover the sales.

"This is emotion moving the market, it's not just fundamentals moving the market," said Mark Donohoe, institutional equity sales trader with U.S. Bancorp Piper Jaffray. "It's Friday, and you've seen the wild swings over the past couple days."

Analysts were still treading lightly on the significance of the gains. They say volume, although above normal, must be much greater to signal any real turnaround.

Market breadth was positive. Winners beat losers on the Nasdaq 2,485 to 1,219 as more than 2.27 billion shares were traded. On the New York Stock Exchange advancers topped decliners 1,982 to 1,043 as more than 1.36 billion shares changed hands.

In other markets, Treasury securities edged lower. The dollar fell against the euro and yen after posting strong gains this week.

Techs glow on Wall Street

One day after the bears drove the Dow sharply lower amid concern about corporate profitability for "old economy" issues, tech stocks started to look more attractive.

But analysts caution that the rebound in tech issues is not reason enough to break out the champagne.

Gruntal's Battipaglia said the churning was a sign of the markets finding some footing, but that it would still take some time for investor confidence to return.

"That doesn't happen overnight -- it's a process," he said. "As economic data shows restoration of growth and the stock market continues its recovery and the Fed keeps cutting interest rates, these confidence statistics will keep mounting."

Intel (INTC: Research, Estimates) advanced 13 cents to $28.81 after Craig Barrett, chief executive of the top U.S. chipmaker, said late Thursday that his firm's outlook for next three months was not bright. Intel (INTC: Research, Estimates) advanced 13 cents to $28.81 after Craig Barrett, chief executive of the top U.S. chipmaker, said late Thursday that his firm's outlook for next three months was not bright.

The broader tech market gained strength. Microsoft (MSFT: Research, Estimates) rose $2.56 to $56.56, IBM (IBM: Research, Estimates) surged $4.58 to $93.68, and Dell Computer (DELL: Research, Estimates) advanced $1.19 to $27.44.

But some tech issues faltered. Cisco Systems (CSCO: Research, Estimates) shed $1 to $18.75 and JDS Uniphase (JDSU: Research, Estimates) fell $2.25 to $23.19.

Interest rate-sensitive financial stocks on the Dow gave the blue chip index strength. American Express (AXP: Research, Estimates) gained $2.10 to $36.80 and J.P. Morgan (JPM: Research, Estimates) rose $2.80 to $41.71.

Industrial and cyclical issues were mixed on the Dow, as concerns that these companies may suffer some deceleration of revenue growth in a slowing economy generated some caution.

Procter & Gamble (PG: Research, Estimates) fell $2.55 to $60.20 while General Electric (GE: Research, Estimates) gained $2.29 to $39.99.

And the day's second-most active stock, Immunex (IMNX: Research, Estimates) tumbled $7.38 to $11.50 after it said it is withdrawing its Enbrel drug from trials as a treatment for chronic heart failure because of indications it cannot be effective.

|

|

|

|

|

|

|