|

Confidence on Wall St.

|

|

March 27, 2001: 5:03 p.m. ET

Buoyancy in consumer sentiment lifts the entire market

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Dow Jones industrial average rallied for a third session Tuesday as Wall Street drew strength from Main Street, where the confidence of consumers surged in March after five monthly declines.

That jump in consumer confidence, reported by a private research group, surprised economists who expected another dip. It also staunched for a moment the flow of troubling economic news that has helped hammer stocks this year.

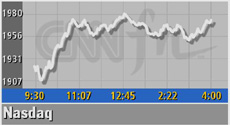

The buying spread to technology stocks, with the Nasdaq composite index rising for the third time in four sessions.

Still, Wall Street's advance amid months of declines did nothing to stop questions about whether the market's worst days are really over. Thomas Galvin, chief investment officer at Credit Suisse First Boston, believes they are. Still, Wall Street's advance amid months of declines did nothing to stop questions about whether the market's worst days are really over. Thomas Galvin, chief investment officer at Credit Suisse First Boston, believes they are.

"We've really run the gamut of bad news and I think people have grown tired of it," Galvin told CNNfn's The Money Gang.

Since peaking last year, the market has staged many mini-rallies only to fall lower still. Several negatives emerged Tuesday. Profit warnings from two chipmakers, Vitesse Semiconductor and TranSwitch, sent those stocks sharply lower. And the government said orders for durable goods fell for a second month in February.

"There's no question that this market has to learn how to walk before it can run again," Galvin said.

On Tuesday, it ran. The Dow Jones industrial average rose 260.01 points, or 2.7 percent, to 9,947.54. The Dow's third day of triple-digit gains, its first such advance in five months, put the blue chips more than 500 points above their lowest close of the year, reached Thursday.

The Nasdaq jumped 53.77, or 2.8 percent, to 1,972.26 while the S&P 500 rose 29.48, or 2.4 percent, to 1,182.17. The Nasdaq jumped 53.77, or 2.8 percent, to 1,972.26 while the S&P 500 rose 29.48, or 2.4 percent, to 1,182.17.

More stocks rose than fell. Advancing issues on the New York Stock Exchange topped declining ones 1,943 to 1,117 as 1.3 billion shares traded. Nasdaq winners beat losers 2,204 to 1,562 as 1.9 billion shares changed hands.

In other markets, the dollar fell against the yen but rose versus the euro.

Confidence builder

The Conference Board said its Consumer Confidence Index surged to 117.0 in March from a revised 109.2 in February. That surprised economists who expected that falling stock markets and rising corporate layoffs would continue to sap the confidence of consumers, whose spending counts for about two-thirds of the economy.

The report signaled to some that the economy may recover sooner than expected. But Steven Wood, economist at FinancialOxygen.com, said it's too soon to determine the data's significance on the direction of interest rates.

"Neither consumer confidence nor equity markets are, by themselves, reasons for altering monetary policy," he said.

The Federal Reserve cut interest rates three times this year to keep the economy from falling into a recession. Some investors wanted a weak confidence figure, believing it could force the Fed to cut interest rates before its next meeting, May 15. The bond market, which has gained on hopes for lower interest rates, sold off on the news. The Federal Reserve cut interest rates three times this year to keep the economy from falling into a recession. Some investors wanted a weak confidence figure, believing it could force the Fed to cut interest rates before its next meeting, May 15. The bond market, which has gained on hopes for lower interest rates, sold off on the news.

No clues on monetary policy came from Fed Chairman Alan Greenspan, who in a speech Tuesday talked about economic forecasting.

The day's advances were broad; 26 of the 30 Dow stocks rose. Among them, Procter & Gamble (PG: Research, Estimates) gained $1.71 to $62.13, while Exxon Mobil (XOM: Research, Estimates) added $2.39 to $80.64 and IBM (IBM: Research, Estimates) advanced $4.10 to $99.50.

Nasdaq gainers included Dell Computer (DELL: Research, Estimates), which rose $1.25 to $26.94, and Oracle (ORCL: Research, Estimates), which gained 96 cents to $16.65.

The day's gains came even as another round of companies said they were having trouble unloading their wares. Vitesse Semiconductor (VTSS: Research, Estimates) fell $4.88 to $29.06 after the chipmaker cut its fiscal second-quarter revenue and earnings forecasts. And TranSwitch (TXCC: Research, Estimates) lost $3.75 to $15.13. The semiconductor maker warned that first-quarter profit and sales would come up short of forecasts.

The Dow's biggest loser, Johnson & Johnson (JNJ: Research, Estimates), dropped $2.13 to $83.25 after agreeing to buy drugmaker Alza for about $10.5 billion in stock. Alza (AZA: Research, Estimates), which rallied Monday on reports of the deal, rose 25 cents to $39.

The day's advance comes during a tough time for making money in U.S. stocks. The Nasdaq composite is down nearly 61 percent since peaking last year, while the S&P 500 is more than 22 percent from its record high. The day's advance comes during a tough time for making money in U.S. stocks. The Nasdaq composite is down nearly 61 percent since peaking last year, while the S&P 500 is more than 22 percent from its record high.

A late rally Thursday saved the Dow from the 20 percent peak-trough decline considered a bear market. But the blue-chip index is down 7.8 percent this year.

A tough period for the market could come in the weeks ahead. Profit warnings are expected to rise as companies close their books on the quarter ending Friday. Actual results could also pose problems. Earnings for the first quarter are expected to fall 7.2 percent, according to First Call, marking the worst period for earnings in a decade.

But for a day anyway, optimism edged out caution – if barely.

"The positive consumer confidence could have been a negative," said Brian Belski, market strategist at U.S. Bancorp Piper Jaffray, who said the bullish reception signals that the market could finally be stabilizing.

|

|

|

|

|

|

|