|

Palm beats, warns

|

|

March 27, 2001: 6:21 p.m. ET

Handheld-computer leader edges estimates, foresees 4Q loss

|

NEW YORK (CNNfn) - Palm Inc., the leading supplier of handheld computers, reported a fiscal third-quarter profit Tuesday that narrowly beat expectations but said it expects to post a loss in the current quarter, where the Street had expected a modest profit.

The Santa Clara, Calif.-based company said it earned $9.3 million, or 2 cents per share, during the quarter ended March 2, excluding extraordinary charges. That was a penny more than analysts surveyed by First Call had expected the company to report and slightly less than the $15.8 million, or 3 cents per share, it earned in the same quarter a year earlier.

At $470.8 million, Palm's sales for the quarter rose 73 percent from the $273.3 million it reported in the year-ago quarter, but fell shy of the $475 analysts had expected, according to the First Call survey.

Executives at Palm said the slowing economy has resulted in lower orders and said demand in the current quarter had fallen well below their previous expectations.

"We believe that the market demand is approximately flat on a year-over-year basis," Judy Bruner, Palm's chief financial officer, told analysts during a teleconference Tuesday.

In last year's fiscal fourth quarter, Palm logged total revenue of $350 million. However, because of lower selling prices and the risks involved with the roll-out of the company's new handheld products, Brunner said revenue in this year's fourth quarter is likely to fall to between $300 million and $315 million.

Earlier this month, Palm introduced its latest handheld computers, the Palm m500 and the Palm m505, which sport new features such as color screens and expansion slots that allow for connections to a other electronic devices. They are expected to begin shipping in volume in the second half of the fiscal fourth quarter.

As a result of the deteriorating demand and the expenses related to the new product introductions, Brunner said Palm will post a fiscal fourth-quarter operating loss of roughly 8 cents per share, excluding charges related to restructuring moves it plans to make during the quarter. Analysts had recently expected the company to log a fourth-quarter profit of 4 cents per share on sales of about $572.6 million.

Brunner said the company's gross margin in the fiscal fourth quarter will fall to a range of 25 percent-to-26 percent, compared with 36 percent in the most recent quarter.

In response to the economic slowdown and the weaker results, Palm said it is taking a number of steps to reduce costs, including reducing its work force by about 250.

The company also is postponing construction of its new corporate headquarters in San Jose, Calif., which had been scheduled to begin this month. Palm also said it is re-evaluating its real estate needs and strategy with the goal of reducing or eliminating cash requirements associated with real estate.

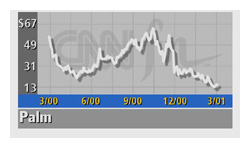

After finishing at $15.50 on Nasdaq ahead of the earnings news, which was  released after the close of trading, shares of Palm (PALM: Research, Estimates) plunged $5.38 to $10.12 in after-hours trade. released after the close of trading, shares of Palm (PALM: Research, Estimates) plunged $5.38 to $10.12 in after-hours trade.

Palm is the No. 1 supplier of handheld computers, a position it has held since it first introduced the popular Palm Pilots in 1996. However, the company has faced an increasingly competitive threat from other vendors of devices that run on the Palm operating system, such as Handspring and Sony, as well as the recently introduced PocketPC, computers powered by Microsoft's newest version of its handheld computing operating system.

During the quarter, Palm said it shipped 2.1 million handheld computers during the third quarter, 112 percent over the same period a year ago. This brings the total number of handheld devices shipped by Palm to date to nearly 13 million.

The company's total fourth-quarter product revenue, that which it derived from the sale of the Palm computing devices and peripherals, was $45.1 million, which was down 11 percent from the prior quarter but up 69 percent from the same quarter last year, according to Brunner.

In addition to product sales, Palm derives revenue from licensing its operating system software to competitors such as Handspring. Brunner said licensing revenue for the fourth quarter totaled $8.6 million, up 28 percent from the previous quarter and 191 percent annually.

The remaining $11.2 million in fourth-quarter revenue came from Internet content and access services, which reflects a 28 percent rise from the prior quarter and a 250 percent increase from the same period last year, Brunner said.

|

|

|

|

|

|

|