|

Boeing drops super-jumbo

|

|

March 29, 2001: 6:01 p.m. ET

Company will develop near-supersonic jet as opposed to a larger 747

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - Aircraft maker Boeing Co. is dropping plans for a larger version of the 747 jumbo jet, conceding that segment of the market to competitor Airbus Industrie, and instead will seek to develop a commercial jet that will fly just under the speed of sound.

The company previously had announced it was looking at a larger version of its established 747 as a response to the 555-seat, double-deck A380 jets that Airbus is starting to offer. But Boeing has found no buyers for its 747X, as the proposed larger, longer-range version of its plane is called, while Airbus has orders for 66 of the A380s.

|

|

VIDEO

|

|

Alan Mulally, CEO of Boeing's Commercial Airplanes unit chats with CNNfn's Fred Katayama. Alan Mulally, CEO of Boeing's Commercial Airplanes unit chats with CNNfn's Fred Katayama. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Alan Mulally, CEO of Boeing's Commercial Airplanes unit, tried to put a positive spin on the retreat, saying the company may come back to a super-jumbo jet at some point in the future, and that the current 747-400, which holds as many as 568 passengers in some configurations, gives it enough presence in the jumbo aircraft segment of the market.

"In our conversations, we have received clear direction from our customers that, with continued improvements, the 747-400 family will satisfy the majority of their large airplane needs," he said. He said Boeing also will slow development on a longer-range version of its 767-400ER jet.

Mulally also said the plans for a swept-wing aircraft that holds far fewer passengers but can fly at 95 percent of the speed of sound would much better fill the needs of the airline industry in the future. Current commercial aircraft other than the supersonic Concorde, which has been grounded, fly at about 80-to-85 percent of the speed of sound.

Plane to be more fuel efficient

The new plane is expected to be able to shave about an hour off travel times of traditional jets for every 3,000 miles it flies, about the distance of a cross-continental flight in the United States.

The aircraft is also expected to be able to travel at least 9,000 miles, longer than any commercial aircraft today. Its capacity is still unknown, with a Boeing spokesman saying it could be anywhere between 100 and 300 passengers, depending upon seating configuration.

It will be a widebody, two-aisle jet, as opposed to the much smaller single-aisle Concorde, and by staying below the speed of sound, it should be able to operate with fuel efficiency similar to most of today's more advanced commercial jets rather than the fuel-guzzling Concorde. It will be a widebody, two-aisle jet, as opposed to the much smaller single-aisle Concorde, and by staying below the speed of sound, it should be able to operate with fuel efficiency similar to most of today's more advanced commercial jets rather than the fuel-guzzling Concorde.

"Once any airplane goes over the speed of sound, it goes into a very different fuel regime," said Boeing spokesman Craig Martin. "The operating costs become absurd. You would not pay a huge premium to fly this airplane."

Boeing did not give any development costs for the new, still unnamed jet. Martin said it could be available to start flying passengers in 2007, give or take a year. Mulally said the initial response from airlines has been positive.

"When we combine higher speed, longer range, the comfort of flight at higher altitudes, and the environmental benefits of quieter landings and takeoffs, we have an airplane that will open a new chapter in commercial aviation," Mulally said. "We are changing our new product development efforts to focus more strongly on this airplane that has caused such excitement among our customers."

Analyst believes retreat is the right call

Chris Mecray, an aerospace analyst for Deutsche Banc Alex. Brown, said that he believes this was the correct decision for Boeing, even it if there is a downside.

"I think it's a recognition of modest defeat in the wide-body space," he said "They will lose market share. But perhaps it's the right thing to do for shareholders."

Mecray said Boeing had never been committed to the super-jumbo market and started looking at a 747X only in response to Airbus' efforts, despite its top officials questioning the market for the plane. Mecray said that's one of the reasons Boeing found no buyers for its super-jumbo.

Click here for a look at aerospace stocks

"Airbus invested $1 billion in its plane. It's a real program," Mecray said. "Boeing never offered a real program. Airlines saw through it."

But Mecray said that it's still to soon to say that the A380 will be a success.

"We won't know for another 10 years. That's nature of aircraft programs," he said. "Without Boeing competing, the chances are a lot better it's going to be profitable. But will it be a runaway success? We don't know."

Officials at Airbus wouldn't comment on the Boeing's plans for the new faster jet, but said they weren't surprised Boeing was exiting the super-jumbo market.

"The customers we've been talking to say they want a new airplane, not an update of a 30-year old jet," said Mark Luginbill, a spokesman in Airbus' U.S. headquarters. "I think it (Boeing's statement) vindicates our market research and development."

Airbus is set to deliver its first passenger A380 to Singapore Airlines in March, 2006, and its first freight version of the aircraft to FedEx Corp. (FDX: Research, Estimates) in 2008. Its list price is $239 million-to-$263 million per plane.

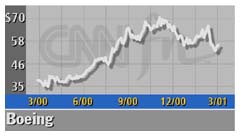

Shares of Boeing (BA: Research, Estimates), a component of the Dow Jones industrial average, closed up 95 cents to $55.95 following the late afternoon announcement at a Seattle press conference. European Aeronautic Defense and Space Co., which owns an 80 percent stake in Airbus, closed up  0.38 to 0.38 to  20.44 in Paris trading. 20.44 in Paris trading.

|

|

|

|

|

|

|