|

Allianz-Dresdner deal near

|

|

March 29, 2001: 1:59 p.m. ET

Insurer's $19.5B takeover of bank could come next week, lead to IPO of DKW

|

NEW YORK (CNNfn) - Negotiations between German insurer Allianz and Dresdner Bank are at an advanced stage and a deal could be announced early next week, a person familiar with the situation told CNNfn.com.

The supervisory boards of both companies are meeting this weekend and a deal could be in place by Monday. At the latest, the "friendly" merger should be finished by April 5, when Dresdner is set to formally announce its fiscal 2000 results, the source said.

Allianz, the world's second-largest insurer after France's AXA, and Dresdner, Germany's No. 3 bank, both confirmed Thursday that the firms are in talks. A merger could result in a $19.5 billion stock and cash takeover of Dresdner, press reports said.

"Allianz and Dresdner bank confirm strategic talks concerning the creation of a leading, integrated financial services provider for insurance, investment and banking products," Allianz said in a statement. "Allianz and Dresdner bank confirm strategic talks concerning the creation of a leading, integrated financial services provider for insurance, investment and banking products," Allianz said in a statement.

Dresdner is set to formally reveal its annual results at an April 5 press conference. The conference could be moved up or changed to announce the merger. "It should be out of the way by Thursday," the source said.

Allianz, with a 21.4 percent stake, is Dresdner's biggest shareholders. Both Dresdner and Allianz declined to give further details of the merger.

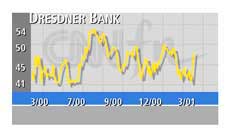

Dresdner shareholders could receive about  53 ($50) a share in cash if a deal is reached, the Wall Street Journal said Thursday, adding that represents a 25 percent premium to Dresdner's closing price of 53 ($50) a share in cash if a deal is reached, the Wall Street Journal said Thursday, adding that represents a 25 percent premium to Dresdner's closing price of  42.21 a share last Friday. 42.21 a share last Friday.

The takeover of Dresdner by Allianz would create a company with a market value of  107 billion at current market prices. 107 billion at current market prices.

"The deal makes sense for Allianz, but that would depend on how much it is willing to pay for Dresdner," Rob Yates, analyst at Fox Pitt Kelton, told CNN. "This is a revenue-driven deal and not driven by a need to cut costs."

Dresdner tries again

Dresdner has bad luck with mergers. Last April, it called off its $28.7 billion merger with Deutsche Bank, citing a disagreement over the future of its investment banking arm, DKB. CommerzBank AG, Germany's fourth-largest bank, then failed in its July attempt to buy Dresdner in a $40 billion-plus takeover when the firms could not agree on how to value the deal.

German insurer Allianz is under pressure to strengthen its distribution network for insurance and investment products amid rising competition in the booming retirement savings field.

The bancassurance model, which has been in existence for the last 10-15 years, has worked well for Belgian financial institution Fortis and Britain's Lloyds TSB, but there have been casualties, such as Dutch group ING, which still is trying to build its network, Yates said.

"The problem occurs in the execution," Yates explained. "You're trying to bring together two different cultures."

Under the terms of the transaction, Allianz may sell its 14 percent stake in HypoVereinsbank, Germany's second-largest bank, to reinsurer Munich Re, which in turn would sell its stake in Dresdner, believed to be around 3 percent, to Allianz, press reports said.

Good for DKW

While Dresdner failed with Deutsche Bank and Commerzbank, it did succeed in its much smaller $1.4 billion bid to buy New York merger and acquisition adviser Wasserstein Perella & Co.

Dresdner spent  550 million last year to make sure its highly paid investment bankers did not jump ship while it was in various failed merger talks. 550 million last year to make sure its highly paid investment bankers did not jump ship while it was in various failed merger talks.

A merger with Allianz is regarded as good news for the investment banking arm, Dresdner Kleinwort Wasserstein (DKW). DKW likely will become more autonomous due to the merger, which could lead to a spin-off or an IPO of the investment bank in a few years. The sale of DKW most likely would take place in Europe, the source said. A merger with Allianz is regarded as good news for the investment banking arm, Dresdner Kleinwort Wasserstein (DKW). DKW likely will become more autonomous due to the merger, which could lead to a spin-off or an IPO of the investment bank in a few years. The sale of DKW most likely would take place in Europe, the source said.

The Allianz takeover also could also lead to a sale of the investment bank, with former Wasserstein partners selling their now Dresdner shares to Allianz, the WSJ said.

"Allianz has no need to keep DKW in the long term," Yates said. "There could be plenty of buyers in Europe, but it needs to keep DKW intact."

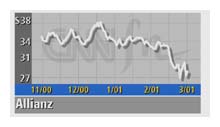

Shares of Allianz (AZ: Research, Estimates) gained 76 cents to $28.20 Thursday afternoon on the New York Stock Exchange.

|

|

|

|

|

|

|