|

IBP sues Tyson over merger

|

|

March 30, 2001: 6:46 p.m. ET

Nation's biggest meatpacker sues Tyson to force $3.2 billion takeover

|

NEW YORK (CNNfn) - IBP Inc. filed a lawsuit Friday to force Tyson Foods to honor its $3.2 billion takeover agreement.

Dakota Dunes, S.D.-based IBP (IBP: Research, Estimates) claimed Tyson was unjustified when its pulled its plans for the takeover, the company said in a suit filed in Delaware Chancery court. IBP says Tyson officials were routinely notified of potential charges at Tyson unit DFG Foods, both before and after the merger agreement was signed.

Tyson called off its proposed merger with IBP late Thursday, citing misleading financial information.

"We can only speculate that this is a classic case of 'buyer's remorse,' because there is clearly no basis for Tyson's claim that it was fraudulently induced and does not have to proceed with this transaction," said IBP Chairman Robert Peterson in a statement.

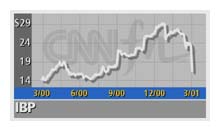

New of the cancellation caused IBP shares to plummet, falling $6.39, or 28.04 percent, to $16.40. Tyson rose by $1.97 to $13.47.

IBP said earlier this month that it expected Tyson to consummate the $3.2 billion merger since federal regulators had finished their investigation into the nation's biggest meatpacker. IBP said earlier this month that it expected Tyson to consummate the $3.2 billion merger since federal regulators had finished their investigation into the nation's biggest meatpacker.

The SEC investigation led to IBP taking a one-time, pre-tax charge of $60.4 million related to its acquisition of DFG, a Chicago-based hors d'oeuvres and appetizer maker it bought in 1998. The charge turned out to be much lower than the $108 million previously estimated.

On Thursday, Springdale, Ark.-based Tyson (TSN: Research, Estimates), the largest U.S. chicken producer, ended the $3.2 merger and sent a letter to IBP stating it relied on misleading information in determining to enter into a merger. IBP restated its financial statements at the request of the Securities and Exchange Commission.

"Consequently, whether intended or not, we believe Tyson Foods Inc. was inappropriately induced to enter into the Merger Agreement," Tyson said in its letter Thursday. "Further, we believe IBP cannot perform under the Merger Agreement."

IBP claimed Friday that Tyson was told before the merger agreement that it could take an additional write down of $30 million-to-$35 million and that the actual write-down could be even greater.

|

|

|

|

|

|

|