|

Help for the house poor

|

|

April 2, 2001: 8:21 a.m. ET

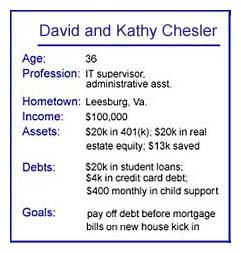

Virginia couple needs to trim their debt before tackling higher mortgage bills

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - The clock is ticking for David and Kathy Chesler.

The Leesburg, Va., newlyweds expect to close on a new single-family home later this fall, once construction is complete, and they're worried the mortgage payments will be too hot to handle if they don't pare down their debt – and fast. Monthly payments on the new $228,000 house will double from the $800 they pay today.

"We don't think we bought too much house, but with our debt it would really be tough to afford those payments," David notes. "Our goal is to pay off as much as we can before we close."

The Cheslers, who both work for WorldCom, expect to profit by $20,000 from the sale of their existing town home. They've got $13,000 in the bank, another $20,000 in their 401(k)s and they're able to sock away an extra $900 each month in their savings account, in spite of doubling up on the minimum payments to their credit card companies.

The Cheslers also, however, have two car payments, $20,000 in student loans, and credit card debt of $4,000. Additionally, David pays $400 a month in child support payments to his former wife.

The couple is trying to decide whether they should reduce their retirement plan contributions to pay off those credit cards or if it's smarter to use their savings. They also hope to learn how best to allocate the proceeds from the sale of their town home – as a downpayment for the new house, to pay off their cars, or apply it to student loans and credit debt.

"Everyone tells us to pay off our credit cards first, which is what we're doing, but we just want to know what money to use to do that," David notes. "Should we reduce or eliminate our 401(k) contributions to pay off the credit cards or should we use our savings to pay them off?"

David, a supervisor on WorldCom's information technology help desk, earns $55,000 a year and contributes 10 percent of his salary to his tax-deferred retirement account, while Kathy, an administrative assistant at the company, earns $45,000. She contributes 5 percent of her salary to a 401(k).

The Cheslers, both 36, have full health insurance coverage through Aetna U.S. Healthcare, in addition to long- and short-term disability coverage and accidental death and dismemberment policies. Additionally, they have both purchased supplemental insurance for cancer treatment coverage through American Family Life Assurance Co. (AFLAC).

"We've been getting advice from everybody to do this and that but we need to know where to use the profits from our house," he said. "Should we hold onto that to put it into a new house, pay off our credit cards and car loans or apply it to my wife's student loan?"

If you'd like to be considered for the Checks & Balances column, in which a team of professional, financial planners develop a roadmap to help you manage your money, send us your submission: checksandbalances@cnnfn.com Include detailed information on your age, occupation, income and assets – and don't forget your phone number, which will be kept confidential. Please note, however, that any financial and personal information you supply may be used in a story on CNNfn.com and affiliated AOL Time Warner sites.

What the planners say:

"David and his wife are at a crossroads in their financial lives," said Chris Dalto, a financial planner with Delessert Financial Services, Inc. in Boston. "The purchase of a new home is a great time for them to evaluate where they stand financially and to develop a plan to meet their financial goals."

As for whether the Chesler's should reduce or eliminate their 401(k) contributions, Dalto said the answer is a resounding no.

"David and his wife need to continue to save aggressively towards retirement," he said. "Currently they have $20,000 in their 401(k)s and are saving approximately $833 per month. If they continue depositing 10 percent of their salary per year into the plan and their salary increases at the inflation rate, their 401(k)s will be valued at $2,230,000 at age 66, assuming a 10 percent return."

That amount will allow them to withdraw approximately $100,000 per year during retirement, assuming they withdraw 4.5 percent of the account value each year, Dalto said.

Click here to review your mutual-fund portfolio with CNNfn.com's Morningstar tools. Click here to go to CNNfn.com's 401 (k) and pension-plan page.

Scott Kahan, a certified financial planner and president of the New York-based Financial Asset Management Corp., agrees with Dalto's assessment.

"They should not reduce the 401(k) contributions to pay off the credit cards," he said. "Being 36, this is a great time to be saving for retirement. Using the 401(k) is probably one of the best vehicles for this."

He adds the Cheslers should keep in mind they are saving an additional $280 in federal taxes for every $1,000 they contribute, since 401(k) contributions are tax-deferred.

Click this link to read the latest Checks & Balances column.

Additionally, Dalto suggests the Cheslers use their current savings to pay off their credit cards.

"Credit card debt tends to charge a high interest rate and is not able to be deducted from taxes," he notes. "David has stated that he and his wife have $13,000 of savings; they should take $4,000 of this and pay off their credit card debt as soon as possible, assuming that their credit card is charging them a higher interest rate than what they are earning in their savings/money market account."

Instead of making double credit card payments each month, he said, the couple should take that money and apply it towards Kathy's student loan.

But Kahan suggests a slightly different approach.

"I would recommend that they maintain their savings for the time being," he said. "With a new home purchase, there may be other needs for this money. As a rule of thumb, they should maintain a balance of three months worth of expenses as an emergency fund."

He said the Cheslers should allocate the $900 they save each month toward paying down their debt.

"Since they are not closing [on their home] for a few months, they may be able to reduce or eliminate the debt before their closing," Kahan said.

And finally, the Cheslers have a number of options with respect to the money they will earn on the sale of their existing town home.

Both planners say it would be wise to pay off their credit card debt but they diverge on the strategy.

Assuming the Chesler's estimates are correct, Dalto said David and Kathy would have $24,000 in cash after selling the house and using their savings to pay off their credit card debt. That money should be used for the purchase of their new home and for their financial cushion.

Since they won't have enough money to put 20 percent down on the new house, the should expect to pay private mortgage insurance, or PMI, which is usually between $100 and $200 more added to the mortgage monthly. As a result, Dalto said, they should decide what amount they are comfortable with to hold in cash, and "put the rest down on the house."

Kahan, on the other hand, said it is just as acceptable to use part of the proceeds from the real estate sale to wipe out their credit cards and car balances.

"It sounds like they may need to do this since they are concerned about the cash flow when they move," Kahan notes.

He adds, however, that if they reduce, but fail to eliminate, their car debt, they are most likely going to shorten the payment period rather than lowering their monthly outflow. A larger mortgage provides a nice tax deduction.

Kahan adds, too, that the Cheslers should be prepared for higher expenses than projected. The process of buying and selling a home inevitably costs more than consumers imagine.

"It is a new home, so major repairs will not be a concern, but ongoing maintenance can be costly," Kahan said. "I would recommend that they keep extra savings available in the first year to see what costs they will have."

Finally, both planners agree the Cheslers are taking on too great a risk in their long-term investments. The couple recently took a 401(k) rollover from a previous company and cashed it in to buy 800 shares of WorldCom stock – about $15,000 worth of stock at its then-trading price.

"I figured it was a good bet since the stock was trading at a 52-week low and I'm in it for the long haul," he said.

That leaves them with just $5,000 in the Van Kampen Emerging Growth equity fund offered through their 401(k) plan.

(Click here to check your mutual funds.)

Kahan said that while WorldCom should be a "fine stock," he said with both of their jobs tied to the company, "they run the risk of having too much hinging on its success."

"A downturn in profits can lead to lower stock values and layoffs," he said. "I would not recommend that they buy additional stock unless it is through a purchase plan at work where they get a discount on the price."

Dalto said he, too, feels the David and Kathy are being "very aggressive," noting that a good rule of thumb is for no individual stock to comprise more than 10 percent to 15 percent of one's portfolio.

WorldCom stock currently makes up 75 percent of their portfolio, which leaves them more exposed to telecommunication sector slowdowns.

(Click here for today's most active telecommunication stocks.)

The Cheslers would be better positioned to ride out any future market storms if they reduced their holding of WorldCom stock and instead boosted their investments in mutual funds.

The Van Kampen Emerging Growth fund, which they already own, experienced a rough ride last year, performing in the bottom 7th percentile of all Large Growth funds, but Dalto said it has performed solidly over its 3-year and 5-year periods.

"It is a good holding, but David and his wife should also consider adding a value fund to help reduce the volatility of the portfolio in years like 2000," he notes.

* Disclaimer

|

|

|

|

|

|

|