|

Nokia finances again

|

|

April 3, 2001: 1:12 p.m. ET

Orange gets $3.1 billion in loans from Nokia, Ericsson, Alcatel for equipment

By CNN's Tara Duffy

|

LONDON (CNN) - Orange secured  3.5 billion ($3.1 billion) in loans from Nokia, Alcatel, and Ericsson as part of high-speed mobile network gear contracts. 3.5 billion ($3.1 billion) in loans from Nokia, Alcatel, and Ericsson as part of high-speed mobile network gear contracts.

Orange, Europe's second-largest mobile phone operator after Vodafone, said on Tuesday the loans were to finance three-year deals to buy third-generation network equipment totaling  2.3 billion from the three companies. 2.3 billion from the three companies.

The deals reflects mobile phone operators' increasing reluctance to bear the burden of heavy debts for rolling out the third-generation network services that will allow them to offer cellular Internet and video services.

Mobile phone operators have amassed huge debts after spending some  128 billion on third-generation licenses by some analysts' estimates. France Telecom, Orange's parent, alone had debts of 128 billion on third-generation licenses by some analysts' estimates. France Telecom, Orange's parent, alone had debts of  61 billion as of December 31. Securities firm Bear Stearns puts the total cost of building the networks at about 61 billion as of December 31. Securities firm Bear Stearns puts the total cost of building the networks at about  300 billion. 300 billion.

Under the deals, the three suppliers would be penalized if new networks are not ready in time or if deliveries of third-generation mobile phone handsets are delayed.

"They are very satisfactory, very competitive commercial terms," John Allwood, Orange's vice president, United Kingdom, told a conference call. "It means that if we can get it from the vendors, it leaves our lines of credit available for elsewhere."

Nokia, the world's biggest handset maker, agreed to supply Orange with  2 billion ($1.8 billion) in financing for 2 billion ($1.8 billion) in financing for  1.5 billion of its products. The agreement is the second in as many days in which Nokia provides financing to operators as part and parcel of selling them its products. 1.5 billion of its products. The agreement is the second in as many days in which Nokia provides financing to operators as part and parcel of selling them its products.

Nokia will provide the equipment for the networks to France Telecom's mobile phone unit Orange in the United Kingdom, and will be the leading supplier for its Itineris arm in France and MobilCom in Germany.

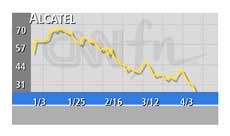

Shares of Finland-based Nokia ended down 7.3 percent Shares of Finland-based Nokia ended down 7.3 percent  25.25 in Helsinki afternoon trade. Shares in Alcatel (PCGE), which is selling 25.25 in Helsinki afternoon trade. Shares in Alcatel (PCGE), which is selling  315 million of equipment to Orange for the French market, dropped 9.4 percent to 315 million of equipment to Orange for the French market, dropped 9.4 percent to  30.59 in Paris. 30.59 in Paris.

Nokia's cross-border rival Ericsson, the world's largest network equipment maker, fell 7.3 percent to 51.00 Swedish crowns. Stockholm, Sweden-based Ericsson will jointly supply MobilCom with Nokia.

Analysts said they were wary of equipment makers offering financing to win business.

"Nobody is comfortable with vendor financing deals," Sofia Ghachem, analyst at UBS Warburg in London, told CNN.

"But strategically, this is a very important deal for Nokia to win and given the strength of their balance sheet, has an appropriate risk profile," she added.�

Nokia on Monday said it would provide $652 million in financing to Hong Kong ports-to-telecom conglomerate Hutchison Whampoa to cover the cost of rolling out third-generation network equipment. Hutchison awarded contracts totaling over $720 million to Nokia and Japan's NEC to supply network equipment for its mobile phone venture in the United Kingdom.

Nokia says bulk of financing over

Nokia said it had announced the bulk of vendor finance deals for new-generation networks.

"If there is a need in certain strategic cases, we might do vendor financing," Nokia spokeswoman Arja Souminen told CNN. "Our vendor finance policy is extremely conservative, we only expect to finance on certain deals," she added.

Nokia had  1.2 billion of vendor financing on its books at the end of 2000, she said. 1.2 billion of vendor financing on its books at the end of 2000, she said.

Nokia called the financing "bridge," indicating it expected to pass the short-term loan off to banks when the market warms up to funding third generation investments.

"We can understand that there is some pessimism in the market and we expect that to turn when the technology is up and running," Nokia's Souminen said. Nokia and cellular operators expect launches of the technology next year.

Ed Protheroe, fund manager on Aberdeen Asset Manger's global equity desk, told CNN he thought the market overreacted. Ed Protheroe, fund manager on Aberdeen Asset Manger's global equity desk, told CNN he thought the market overreacted.

"I really don't think it's any great thing to be worried about. Especially since they (Nokia) have specifically said they're not expecting to see significant further deals on the financing side."

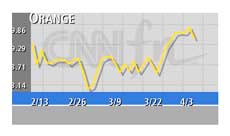

Orange shares fell 3 percent to  9.56 while France Telecom (PFTE) dropped 5.2 percent to 9.56 while France Telecom (PFTE) dropped 5.2 percent to  65.75. 65.75.

-- from staff and wire reports

|

|

|

|

|

|

|