|

Nike, Titleist wage ball battle

|

|

April 4, 2001: 7:50 p.m. ET

With Woods and Duval, Nike making inroads into Titleist's golf dominance

By Staff Writer Mark McLaughlin

|

NEW YORK (CNNfn) - Masters organizers have always kept corporate advertising to a minimum at the first of professional golf's four major tournaments. This means fewer commercial breaks for TV viewers. Inside the ropes, however, the players are virtually walking billboards for golf companies.

Special Report: The Masters, Golf & Business

Sneaker companies for years have vied for the endorsement of NBA stars, and now the major golf equipment makers are getting into the act, waging bidding wars to sign up top professionals. In exchange for a fat fee that can range from a couple thousand dollars to multimillions per year, players don company logos on their caps, shirts, gloves and golf bags.

Nike, which counts Tiger Woods as its leading pitchman, scored a coup earlier this year by luring former No. 1 player David Duval away from rival Acushnet, which makes Titleist balls and clubs and Foot-Joy shoes and gloves. Titleist, which has built its reputation as the leading maker of golf balls used by professionals, has sued Duval for breach of contract but, regardless of the outcome, the game is on. Nike, which counts Tiger Woods as its leading pitchman, scored a coup earlier this year by luring former No. 1 player David Duval away from rival Acushnet, which makes Titleist balls and clubs and Foot-Joy shoes and gloves. Titleist, which has built its reputation as the leading maker of golf balls used by professionals, has sued Duval for breach of contract but, regardless of the outcome, the game is on.

Woods and Duval have "head-to-toe" contracts with Nike, meaning the golf ball and everything they wear is made by the company. Duval is even testing a prototype set of Nike irons, designed by Dallas-based Impact Technologies which Nike acquired earlier this year to break into the club business.

Other golfers have separate endorsement deals for a specific brand of golf ball, club and apparel. In addition, non-golf companies such as Citigroup (C: Research, Estimates), which sponsors Hal Sutton, and Sun Microsystems (SUNW: Research, Estimates), backing Jesper Parnevik, paste their logos on players' shirts or caps.

Click here for Masters coverage from CNNSI.com

By signing well-known pros to use their products, golf companies are betting that recreational players will follow suit and boost sales. The "Tiger effect" seems to be working for Nike, which has seen its share of the retail golf ball market grow from nothing to between 6 and 10 percent in a year, according to market researcher Golf Datatech.

"Equipment sales have a great correlation to [Woods]; I think that's why Nike opened up its corporate wallet," said Hilliard Lyons analyst Jeffrey Thomison.

Woods' latest five-year contract with Nike (NKE: Research, Estimates) is worth $100 million, while Duval in March signed a four-year pact worth about $28 million, according to GolfWeek. In order to keep marquee player Davis Love III in the fold, Titleist last year extended its contract with Love through 2010.

At the Masters, five of the top 10 golfers in the world (Love, Phil Mickelson, Ernie Els, Vijay Singh and Darren Clarke) will be teeing off with a Titleist golf ball, two with Nike (Woods and Duval) and one each with Callaway (Colin Montgomerie) and Strata (Sutton). At the Masters, five of the top 10 golfers in the world (Love, Phil Mickelson, Ernie Els, Vijay Singh and Darren Clarke) will be teeing off with a Titleist golf ball, two with Nike (Woods and Duval) and one each with Callaway (Colin Montgomerie) and Strata (Sutton).

At a recent PGA Tour event -- The Players Championship -- nearly 53 percent of the field played Titleist, 17 percent used Nike, six percent Callaway and five percent Strata, according to the Darrell Survey Co.

While Nike is targeting the biggest names in pro golf, Titleist sees strength in numbers.

"It's not about a single player, it's about having the significant majority of players using our products," said George Sine, vice president of golf marketing for Titleist. "It's imperative we have plurality usage to establish credibility with the end user consumer."

So does all this on-course brand building work?

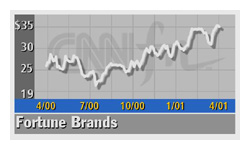

"The ones that are successful with it think it's good," says Barrington Research analyst Alexander Paris Sr. who follows Titleist's parent company Fortune Brands (FO: Research, Estimates). "These people are shooting at very frequent golfers; if there is a new club or ball out there they will try it."

Click here to check on golf stocks

The success of pros using Titleist's new Pro V1 ball in late 2000 created such demand at the retail level that the company started shipping the product a quarter ahead of schedule, Paris said. But beyond that core group of golfers who will buy anything to improve their game, the performance of players using specific brands has less impact on retail purchases, he said.

Golf equipment is expected to be Nike's fastest-growing segment going forward, but with projected annual sales of $100 million, the golf ball division would represent just 1 percent of overall Nike sales of more than $9 billion. Acushnet accounts for about 20 percent of sales for Fortune Brands with roughly $300 million coming from the sale of Titleist golf balls, according to Paris. Golf equipment is expected to be Nike's fastest-growing segment going forward, but with projected annual sales of $100 million, the golf ball division would represent just 1 percent of overall Nike sales of more than $9 billion. Acushnet accounts for about 20 percent of sales for Fortune Brands with roughly $300 million coming from the sale of Titleist golf balls, according to Paris.

Nevertheless, winning does make a difference. The Nike Golf Web site saw its busiest day ever on the Monday following Woods' victory at the U.S. Open. "Golf balls and endorsements go hand and hand, when they perform you get various blips in perception and sales," said Mike Kelly, director of marketing for Nike Golf.

Analysts expect Nike's ball sales to grow faster than Titleist's in the near-term future, but don't expect the swoosh will cut much into Titleist's commanding lead in market share. As of January, Titleist/Acushnet sold 38 percent of all balls in on and off-course golf shops while Acushnet and Spalding (maker of Strata and Top Flite balls) together accounted for 62 percent of that market, according to Golf Datatech.

"Is it accurate to say, 'If Tiger wins, do Nike ball sales go up this week?"' said Golf Datatech's Tom Stine. "You can't say that but the awareness that builds has an effect."

|

|

|

|

|

|

|