|

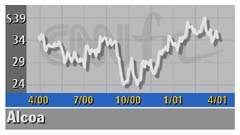

Alcoa beats 1Q targets

|

|

April 5, 2001: 11:19 a.m. ET

Dow component reports record profit despite energy costs, weaker demand

|

NEW YORK (CNNfn) - Alcoa Inc., the world's biggest aluminum producer, overcame weakening demand and higher energy prices to report a record first-quarter profit Thursday that edged past analysts' forecasts.

The company -- the first component of the Dow Jones industrial average to report January-March quarter results -- posted net income of $404 million, or 46 cents a share. Though net income was up from $347 million a year earlier, EPS fell from 47 cents due to an increased number of shares outstanding.

The First Call consensus of analysts was 43 cents, although it was 44 cents as recently as Wednesday. The First Call consensus of analysts was 43 cents, although it was 44 cents as recently as Wednesday.

Shares outstanding increased due to its stock purchase of Reynolds Metals Co., which had been the world's No. 3 aluminum producer. That deal closed May 3, 2000, making comparisons with the year-earlier period difficult.

Alcoa said it is pleased with results, especially in light of increased energy costs and decreased demand for its products. The company said its results reflect curtailed production at various locations and the sale of several small non-core businesses. Those actions added about 2 cents a share to earnings per share in the period.

The company's earnings were supported by payments by the Bonneville Power Administration to stop production at several Alcoa plants in the Pacific Northwest due to a shortage of electricity on the West Coast.

Click here for a look at metals stocks

One analyst also said the company's outlook is encouraging, given the weak demand and pricing for aluminum at the moment.

"Things look fairly positive for them. When the market does get a rebound, the rebound for aluminum could be very sharp," said Craig Woker, an aluminum analyst with Morningstar Inc.

Woker said he was not surprised that earnings were toward the upper end of analysts' expectations, because investors had taken into account the difficulties of the aluminum industry.

Revenue totaled $6.2 billion, also topping estimates of $5.9 billion, though down from $6.6 billion in the fourth quarter of 2000 and $6.3 billion in the preceding quarter, the first two full periods after the Reynolds purchase. Revenue totaled $4.5 billion in the year-ago quarter.

The addition of Reynolds helped Alcoa (AA: up $1.02 to $36.57, Research, Estimates) increase shipments 16 percent from a year earlier to 1.3 million metric tons. But Alcoa said demand fell in a number of sectors, including vehicles and construction, and aluminum prices dropped 5 percent from year-earlier levels.

-- Reuters contributed to this story

|

|

|

|

|

|

|