|

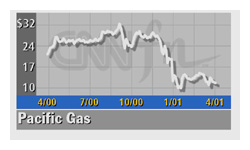

PG&E seeks bankruptcy

|

|

April 6, 2001: 3:02 p.m. ET

California's utility says bankruptcy won't affect service, no layoffs planned

|

NEW YORK (CNNfn) - Pacific Gas & Electric Co., California's largest utility, filed Friday for bankruptcy protection from creditors because of unreimbursed power costs that are now running at more than $300 million a month.

The company, a unit of PG&E Corp. (PCG: Research, Estimates), filed for Chapter 11 bankruptcy protection in Northern California despite months of efforts by state officials to bail out the cash-starved company.

Bankruptcy will not have any affect on services offered by Pacific Gas & Electric Co. which has 13 million customers. The utility does not expect any layoffs and also vowed to pay all its debts, executives on a conference call said.

"We are committed to running the utility," said Gordon Smith, PG&E Co. president and CEO. ""This is a very viable financial entity save for the huge unrecovered wholesale costs."

In Chapter 11, a company is protected from creditors as it tries to reorganize. In Chapter 11, a company is protected from creditors as it tries to reorganize.

PG&E (PCG: down $4.18 to $7.20, Research, Estimates) the parent of Pacific Gas & Electric Co., provides power and natural gas to central and northern California. Nether parent firm, PG&E, nor any of its other units were included or are affected by the filing. PG&E Co.'s decision contributed to an overall slump in the energy sector Friday.

PG&E Co., which has about $9 billion in debt, notified the Governor last summer of the impending crisis, executives said. It has been hit, along with other California utilities, by soaring wholesale power costs and the state's 1996 deregulation law.

Energy deregulation has caused blackouts throughout the state of California. Soaring utility rates have been the subject of much debate in California as the wholesale prices of electricity have skyrocketed, jumping from an average of $30 per megawatt hour last year to $330 in January.

California was the first state to deregulate its electricity market in 1996. The move was supposed to lower the bills of consumers by preventing most utilities from passing rising costs on to their customers until at least March 2002.

Under deregulation, the state's investor-owned utilities sold most of their power generating plants. Now they must buy back that power at market prices.

On Thursday, California Governor Gray Davis proposed his own plan for rescuing Pacific G&E and Southern California Edison. Davis proposed an average 26.5 percent rate increase for some customers of Pacific G&E, SoCal Edison and San Diego Gas & Electric Co., the state's third-larges t investor-owned utility.

SoCal says bankruptcy not preferable

PG&E Co.'s bankruptcy decision was not met with approval by rival SoCal Edison, which has not filed for court protection.

"We at Southern California Edison continue to believe that working out a comprehensive solution to our current crisis is a preferable course to take," said SoCal Edison CEO John Bryson in a statement.

Analysts now believe that the PG&E Co. bankruptcy filing may prompt SoCal Edison, owned by Rosemead, Calif.-based Edison International (EIX: down $4.39 to $8.25, Research, Estimates), to follow a similar route.

"We are clearly surprised by this action coming after a call with the Governor's Advisers last night that seemed promising toward a solution to this ongoing crisis," said Merrill Lynch analyst Steven Fleishman. "However, PG&E was not convinced that these negotiations would ultimately succeed."

Executives on the PG&E Co. call declined to detail stumbling blocks involved in the negotiations. However, they did admit that the utility's huge debt played a part in the decision to file for bankruptcy protection. Negotiations between PG&E Co. and the Governor have stalled with no face-to-face meetings in the past month and Chapter 11 will force parties involved in the process to reach some sort of consensus.

"The political regulatory process has been able to negotiate but not close the deal," executives said. "A federal bankruptcy court is a better way to get a deal closed."

-- from staff and wire reports

|

|

|

|

|

|

|