|

Reuters eyes Bridge

|

|

April 9, 2001: 2:06 p.m. ET

U.K. news provider in discussions to buy rival; bids due by April 11

|

NEW YORK (CNNfn) - Global news provider Reuters Group PLC is in talks to acquire rival Bridge Information Systems, a person familiar with the situation told CNNfn.com Monday.

Bridge is talking with a number of parties as the April 11 deadline for bids nears. Reuters has expressed interest in buying parts of Bridge or the entire company. A consortium of banks also is in discussions to buy the troubled news provider, the source said.

Both Bridge and Reuters declined to comment. However, Reuters admitted that only 15 percent of its global revenue, excluding its Instinet brokerage, come from North America.

The purchase of Bridge would help expand Reuters' equities coverage, which lags Bridge in terms of U.S. users. Reuters' flagship domestic service, Reuters Plus, has only about 60,000 domestic users while Bridge has about 100,000. Globally, Reuters is much stronger with 558,000 professional users in 50,600 locations, a spokesman said. The purchase of Bridge would help expand Reuters' equities coverage, which lags Bridge in terms of U.S. users. Reuters' flagship domestic service, Reuters Plus, has only about 60,000 domestic users while Bridge has about 100,000. Globally, Reuters is much stronger with 558,000 professional users in 50,600 locations, a spokesman said.

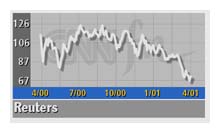

London-based Reuters (RTRSY: up $3.52 to $74.65, Research, Estimates) competes with Bloomberg LP and Dow Jones as well as Bridge in providing financial news information.

In February, privately held Bridge filed for bankruptcy protection in St. Louis under Chapter 11 of the U.S. Bankruptcy Code. So far, the only offer on the table comes from SunGard Data Systems.

In March, Wayne, Pa.-based SunGard (SDS: up $0.50 to $48.55, Research, Estimates) agreed to buy parts of Bridge, including the Bridge Trading brokerage unit, the Internet services unit eBridge, and BridgeNews-LiveWire service for $165 million. The offer, which does not include Bridge News wire service, has not "endeared" SunGard to Bridge executives, the source said.

The consortium of banks includes majority shareholder Welsh Carson Anderson & Stowe as well Deutsche Bank and UBS Warburg. The consortium's bid is for all of Bridge, the source said.

Offers to buy Bridge must be submitted by Wednesday to U.S. Bankruptcy Court Judge David McDonald.

|

|

|

|

|

|

|