|

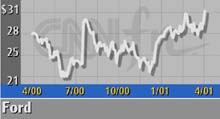

Ford tops 1Q forecasts

|

|

April 19, 2001: 12:24 p.m. ET

No. 2 automaker's profit falls 40%; parts maker Delphi loss slightly below target

|

NEW YORK (CNNfn) - Ford Motor Co. topped Wall Street forecasts for the first quarter Thursday, although the automaker's profit fell more than 40 percent from a year earlier.

The world's second-largest automaker after General Motors Corp. (GM: Research, Estimates) earned $1.1 billion, or 60 cents a diluted share, excluding special items. Analysts surveyed by research firm First Call forecast the company to earn 54 cents a share.

A year earlier, Ford (F: down $0.38 to $30.33, Research, Estimates) earned $1.9 billion, or 90 cents a share on the same basis, when vehicles were selling at a record pace. A year earlier, Ford (F: down $0.38 to $30.33, Research, Estimates) earned $1.9 billion, or 90 cents a share on the same basis, when vehicles were selling at a record pace.

North American auto profits plunged to $754 million from $1.7 billion a year earlier. But European operations posted an $88 million profit after a narrow loss a year ago. The company lost money in South America and the rest of the world, although the loss in South America narrowed.

The Ford report follows a similar earnings statement Wednesday from GM, which had an even larger drop in profits but easily beat forecasts for the period.

|

|

VIDEO

|

|

Henry Wallace, Ford's CFO chats with CNNfn about second quarter and gives his outlook for the rest of the year. Henry Wallace, Ford's CFO chats with CNNfn about second quarter and gives his outlook for the rest of the year. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Meanwhile, Henry Wallace, Ford's chief financial officer, told analysts he is comfortable with a First Call consensus forecast of 81 cents a share for the second quarter. Ford earned $1.18 a share in last year's second quarter on a comparable basis.

"Given what I see right now, I think we're all comfortable with this estimate, that we can meet that," Wallace said. He gave no guidance on full-year results.

David Healy, analyst with Burnham Securities, said he wouldn't be surprised to see those forecasts edge up, given Ford's profit in a difficult first quarter. His own EPS forecast for Ford's second quarter is near $1.00.

"My best guess is they're being kind of cautious [with the 81 cent guidance]," he said. "They cut production well below the level of dealer sales to deal with inventories. They won't have to bite the bullet again.

"They're also in launch with some important products, such as the new Explorer, that didn't make much contribution to first-quarter results as they ramped up production," Healy said. "It's too early to tell on market reception, but it looks pretty good so far. They're not having to put any incentives on it, although there are incentives on plenty of other vehicles."

John Casesa of Merrill Lynch said with the economy slowing, Ford has relied on incentives to entice consumers to buy. (210KB WAV)(210KB AIFF)

Healy said that Ford edged past goals and built 72,000 of the new Explorers, but sold only 12,000 of them in their first appearance at dealers' showrooms at the very end of the quarter.

Click here for a look at auto stocks

Overall, Ford's dollar sales slipped 1 percent to $42.4 billion while the number of vehicles sold fell 6 percent to 1.8 million.

The results exclude an accounting change as well as earnings from Visteon Corp., the parts arm Ford spun off last year. Visteon is due to report results Friday.

Delphi loss edges lowered forecasts

Delphi Automotive Systems Corp. (DPH: up $0.51 to $14.84, Research, Estimates), GM's former auto parts division and the world's largest auto parts supplier, reported a loss slightly below forecasts Thursday.

Dephi lost $25 million, or 4 cents a share, in the quarter excluding special charges, compared with earnings of $322 million, or 57 cents a share, on the same basis a year earlier.

Analysts surveyed by First Call lowered their forecasts to a 5 cent a share loss for the period after the company said its results would range between break-even and a 9 cent a share loss in the period. The consensus forecast had been for a profit of 17 cents a share before the warning, which was accompanied by announcement that the company would cut 11,500 jobs and close or sell 9 plants worldwide.

Including charges related to that restructuring, the company reported a net loss of $429 million, or 77 cents a share, in the period. Delphi earned $290 million, or 51 cents a share, a year earlier.

The company repeated guidance that it expects to earn between $160 million and $200 million in the second quarter, which equals EPS of 29 to 36 cents. First Call had forecast earnings of 37 cents in the second quarter before it gave that guidance March 29, and analysts later lowered their forecasts to 28 cents.

Sales fell to $6.5 billion in the first quarter from $7.8 billion a year earlier. The company said expects second-quarter revenue of $6.8 billion to $6.9 billion.

|

|

|

|

|

|

|