|

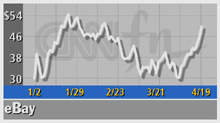

eBay ahead in 1Q

|

|

April 19, 2001: 5:36 p.m. ET

Online auctioneer sees sales jump as registered users and auctions increase

|

NEW YORK (CNNfn) - Online auctioneer eBay Inc. reported first-quarter earnings Thursday that came in two cents ahead of estimates on sales that increased 80 percent from a year earlier, despite a broad economic slowdown that hurt profits at other retailers.

The San Jose, Calif.-based company, which also operates the discount Half.com Web site, also "remains confident" in its near-term strategy, despite the broad economic slowdown, anticipating net revenue during the next two quarters $10 million-to-$15 million higher than previously foreseen. Analysts are forecasting second quarter revenue of $157.7 million and third quarter revenue of $166.7 million, according to earnings tracker First Call.

EBay also said it expects a slower growth rate in future quarters compared with the first quarter, but that it is "generally comfortable" with consensus forecasts of 8 cents a share in the second quarter and 9 cents a share in the third quarter, according to First Call.

Excluding unusual items for the quarter ended March 31, eBay reported consolidated net income of $30.6 million, or 11 cents a share, compared with consolidated net income of $4.4 million, or 2 cents a share a year earlier. Analysts on average were expecting 8 cents a share, according to earnings tracker First Call. Excluding unusual items for the quarter ended March 31, eBay reported consolidated net income of $30.6 million, or 11 cents a share, compared with consolidated net income of $4.4 million, or 2 cents a share a year earlier. Analysts on average were expecting 8 cents a share, according to earnings tracker First Call.

Including one-time charges, eBay's net income was $21.1 million, or 8 cents a share for the quarter.

First quarter revenue soared 80 percent to $154.1 million from $85.9 million a year ago. That's ahead of forecasts for $149.1 million, according to First Call.

Shares of eBay (EBAY: Research, Estimates) ended the regular trading day up $4.24 at $49.99. In after-hours trade, the stock reached $52.

"EBay's momentum continues to accelerate," CEO Meg Whitman said in a statement. "Across all important metrics, we had a great quarter."

During a conference call with analysts following the release of earnings after the bell Thursday, eBay Chief Financial Officer Rajiv Dutta said the company saw strong sales across all businesses and that the business model remained sound.

"We have seen strong buyer demand across all the businesses," Dutta said. "In addition, even though eBay's revenue are primarily transaction generated, we expect to see gross margins above 80 percent for the rest of the year."

Gross margins represent the amount of profit made on each sale after factoring in the cost of bringing that item to sale.

Internet analyst Henry Blodget of Merrill Lynch said in a research note Thursday that eBay appears to be benefiting from the inventory glut that has prompted the rest of the technology industry to scale back production. He noted that a check of eBay's Web site Thursday morning revealed 2,306 items from bellwether Cisco (CSCO: Research, Estimates) up for auction.

In the first quarter, eBay reported net online revenue increased to $147.4 million from $77.4 million a year ago. Off-line revenue decreased to $6.7 million from $8.5 million in the year-earlier period.

eBay users conducted $2 billion worth of transactions in the quarter compared with $1.2 billion a year earlier as it added more than 7.2 million users in the quarter for a total of 29.7 million registered users.

The company hosted 89 million auctions, 66 percent more than in the year ago quarter.

But the big question facing eBay is whether the company can sustain its current momentum for the next few quarters, since the first quarter is usually its strongest and the summer season its slowest.

Blodget said questions remain as to how long eBay can sustain sales based on the current inventory glut combined with the full impact of an auction price increase from earlier in the quarter.

"We remain enthusiastic about eBay's business model and market leadership position," Blodget said in the note.

Click here to view other retail stocks

Separately, eBay announced that its Half.com Web site had expanded into several new categories of second-hand and overstocked items, such as consumer electronics, computer equipment, sporting goods and trading cards.

In February, the company acknowledged it had begun monitoring its Web site for possibly copyright infringement in order to curb illegal sales of copyrighted material such as movies, books and CDs.

The move was a major policy shift for eBay, which previously refused to monitor auction items for fear of being held liable for fraud or infringement.

The company had come under increasing pressure from the Business Software Alliance, the software industry's anti-piracy trade group, as well as from individual software makers such as Microsoft Corp. (MSFT: Research, Estimates).

During the quarter, eBay also struck a partnership with Microsoft in which the two companies plan to enable buyers and sellers to interact on a number of Microsoft's Web properties, including some of its worldwide MSN Network sites.

|

|

|

|

|

|

|