|

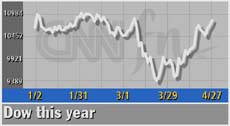

Dow ahead for year

|

|

April 27, 2001: 5:12 p.m. ET

Blue chips go positive for year, Nasdaq rises, amid economic optimism

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Dow Jones industrial average wiped out its losses for the year Friday after a report showing surprising strength in the U.S. economy lifted hopes that corporate profits will recover sooner than expected

The nation's gross domestic product grew at a surprisingly strong 2 percent annual rate in the first three months of the year, the government said. That news helped brighten the business outlook, overshadowing, for a day, a string of dismal news about rising layoffs and weakening consumer confidence. The Nasdaq composite index and S&P 500 also advanced.

"The factors are coming into place that point to an eventual rebound," Mickey Levy, chief economist at Bank of America, told CNNfn's The Money Gang.

Even as another round of companies -- including Corning, Amgen and Starbucks -- warned that quarterly financial results would fall short, the GDP report signaled that the Federal Reserve's four interest rate cuts this year are taking hold. Even as another round of companies -- including Corning, Amgen and Starbucks -- warned that quarterly financial results would fall short, the GDP report signaled that the Federal Reserve's four interest rate cuts this year are taking hold.

"These GDP numbers helped us out a lot," Linda Jay, NYSE trader for LaBranche and Co. told CNNfn's Market Call.

The Dow industrials rose 117.70 points, or 1.1 percent, to 10,810.05. In a rise that began late last month, Friday's advance put the blue-chip index more than 22 points above the 10,787.99 mark where it began the year.

The Nasdaq composite index rose 40.80, or 2 percent, to 2,075.68 while the S&P 500 added 18.53 to 1,253.05.

For the week, the Dow rose 2.2 percent while the S&P 500, still down 5 percent on the year, gained 0.8 percent. But tech stocks are still in trouble. The Nasdaq fell 4 percent on the week, bringing its losses to 16 percent for the year.

More stocks rose than fell. Advancing issues on the New York Stock Exchange topped declining ones 1,994 to 1,023 as more than 1 billion shares changed hands. On the Nasdaq, gainers stocks led declining ones 2,396 to 1,420 on volume of nearly 1.8 billion. More stocks rose than fell. Advancing issues on the New York Stock Exchange topped declining ones 1,994 to 1,023 as more than 1 billion shares changed hands. On the Nasdaq, gainers stocks led declining ones 2,396 to 1,420 on volume of nearly 1.8 billion.

In other markets, the dollar rose against the euro and yen. Treasury securities declined.

Solid GDP

The gain in gross domestic product surprised economists who expected growth of about half the 2 percent rate. Countering a string of weak economic data, the GDP figures point to an economy that, while not surging, is slowly expanding.

"Today's report in and of itself will play a positive role in helping to alter attitudes about the economic outlook," said Tony Crescenzi, bond analyst at Miller Tabak & Co.

Although the figures do not reflect what happened after March, many economists said the report's strength shouldn't prevent the Federal Reserve from lowering borrowing costs next month. Still, the GDP's strength caused some to lower their expectations for the size of the Fed's next rate cut.

"I think it's now looking more like (a quarter percentage point)" Richard Cripps, chief investment strategist at Legg Mason, told CNNfn's Market Call. "I think it's now looking more like (a quarter percentage point)" Richard Cripps, chief investment strategist at Legg Mason, told CNNfn's Market Call.

Stocks rose broadly following the report with 24 of the Dow's 30 components finishing higher. The gainers included IBM (IBM: up $2.46 to $116.20, Research, Estimates) 3M (MMM: up $1.15 to $118.98, Research, Estimates) Wal-Mart (WMT: up $1.59 to $52.83, Research, Estimates) and American Express (AXP: up $1.84 to $43.74, Research, Estimates).

Investors also moved into tech stocks that have fallen sharply in recent days, including JDS Uniphase (JDSU: up $1.05 to $19.26, Research, Estimates) Juniper Networks (JNPR: up $3.22 to $55.02, Research, Estimates) and Sun Microsystems (SUNW: up $1.60 to $17.38, Research, Estimates)

But bad news from the nation's corporations continued. Corning, (GLW: down $0.25 to $20.75, Research, Estimates) which makes fiber-optic equipment, warned that the slowdown in spending by telecommunications service providers will cause it to miss profit targets this year.

Similarly, Starbucks (SBUX: down $2.52 to $37.16, Research, Estimates) warned that revenue and per store sales growth would be slow for the rest of 2001.

Rounding out the high-profile warnings, Amgen (AMGN: up $3.99 to $59.88, Research, Estimates) lowered its profit growth targets for the year.

This week marks the end of the busiest period for corporations reporting first-quarter results. While many companies have beaten lowered forecasts, last quarter is still expected to be the worst three months for profits in a decade

But not all reports were disappointing. VeriSign, (VRSN: up $5.69 to $51.91, Research, Estimates) which makes Internet security software, said it earned 23 cents per share in the first quarter, nearly double expectations.

In a separate economic indicator, the University of Michigan's consumer sentiment index fell to 88.4 in April from 91.5 in March, although the final figure for the month was above the preliminary reading of 87.8. The intra-month improvement could reflect the timing of the survey, which was taken after the Fed made a surprise rate cut between meetings last week. Stocks rallied on the news.

Jobs report next Friday

A more important economic gauge comes next week with employment data for April. And the news isn't expected to be good. The unemployment rate is expected to rise, reflecting growing corporate layoffs.

Unilever, the world's biggest maker of food and soap, became the latest major company to trim payrolls, saying Friday it will axe 8,000 jobs.

The major stocks indexes, which have gained in April, are still well below their highs. The Nasdaq composite index, up 24 percent from its low, is down nearly 59 percent from last year's record high of 5,048. The S&P 500, off 18 percent from its peak, is up 13.6 percent from its trough. Blue chips have held up better. The Dow, up 15.7 percent from its low, is just 7.8 percent below its high.

Still, analysts are divided over whether the recent advance is sustainable or just a short-lived rally amid a bear market. But John Davidson, chief investment officer at Circle Trust, says it may be riskier to wait for the answer.

"If you wait until the volatility's gone, you're going to be buying at higher prices," Davidson told CNNfn's Before Hours.

|

|

|

|

|

|

|