|

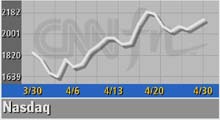

Nasdaq gains 2%

|

|

April 30, 2001: 4:33 p.m. ET

Composite gains 15% for the month as investors bet economy, earnings improving

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - The Nasdaq composite index advanced Monday, posting double-digit gains for the month, as investors bet that the economy is starting to show strength, which could bode well for earnings growth led by the technology sector.

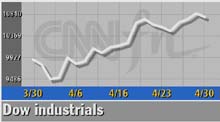

But the Dow Jones industrial average slumped as selling momentum increased in its financial and consumer cyclical issues, offsetting gains from its technology components.

"The Nasdaq is holding up well which is encouraging," said Peter Coolidge, senior trader with Brean Murray & Co. "People don't want to get caught with underexposure if the economy has started to turn and the Nasdaq is where you get more bang for your buck."

Still, the major U.S. indexes all gained for the month of April. The Nasdaq rose 15 percent, the Dow gained 8.6 percent, and the S&P 500 advanced 7.6 percent.

For the day, the Nasdaq rose 40.80 points, or around 2 percent, to 2,116.48. But the Dow Jones industrial average fell 75.08 points to 10,734.97, and the Standard & Poor's 500 shed 3.56 to 1,249.49.

Market breadth was positive. Winners outpaced losers on the Nasdaq 2,442 to 1,474 as more than 1.97 billion shares were traded. On the New York Stock Exchange, advancers beat decliners 1,710 to 1,351 as more than 1.22 billion shares changed hands. Market breadth was positive. Winners outpaced losers on the Nasdaq 2,442 to 1,474 as more than 1.97 billion shares were traded. On the New York Stock Exchange, advancers beat decliners 1,710 to 1,351 as more than 1.22 billion shares changed hands.

The latest economic figures on personal income and consumer spending boosted investor optimism and brought buyers to the table, analysts said. The data came one session after a report showed the nation's gross domestic product (GDP) grew at a surprisingly strong rate in the first quarter.

"They're (investors) getting more confident in the economy yet I still say this is more of a psychological bottom put into effect," said Barry Hyman, chief investment strategist with Ehrenkrantz King Nussbaum. "There's a good reason to believe that some profit-taking is in order ahead of the NAPM (National Association of Purchasing Mangers) numbers."

The manufacturing sector has been particularly hard hit by the slowing economy and Tuesday will bring a leading indicator about the state of that sector.

The NAPM's index of manufacturing activity is due after the market opens, with economists surveyed by Briefing.com forecasting a reading of 43.3 for April. While that's modestly higher from the 43.1 reading in March, anything below 50 points to contraction in the manufacturing sector.

In other markets, Treasury securities fell. The dollar rose against the euro but faltered versus the yen.

Techs rise but financials sag

The recent economic reports, coupled with a string of interest rate cuts by the Federal Reserve, have helped prompt some cautious buying in the tech sector which is expected to lead the markets higher. And the focus is clearly on economic news as the reporting of March quarter corporate results winds down.

That was enough to inspire buying in tech leaders such as Cisco Systems (CSCO: up $1.38 to $16.98, Research, Estimates), Intel (INTC: up $0.73 to $30.91, Research, Estimates), and Microsoft (MSFT: up $0.63 to $67.75, Research, Estimates).

"It's no longer what techs can do to help the economy, it's what can the economy do to help out techs," Nick Angiletta, head of retail sales trading with Salomon Smith Barney, told CNNfn's The Money Gang.

John Forelli, portfolio manager with Independence Investment Advisors, cautioned that investors should tread carefully for the next few quarters until further evidence shows that things, both on the economic and earnings front, have indeed turned around.

"Things aren't as bad as people would have thought, but there are still things to worry about. We're still going to need a couple of quarters before we have a lot of confidence that this recovery is actually happening," he said. "There are still too many questions to say we're off to the races."

And that uncertainty led to selling of financial stocks like American Express and J.P. Morgan Chase on the Dow. Other cyclicals fading in afternoon trading included DuPont (DD: down $1.03 to $45.19, Research, Estimates), General Electric (GE: down $1.42 to $48.53, Research, Estimates), and Honeywell (HON: down $1.07 to $48.88, Research, Estimates).

"I think we still need to see more before I'm convinced we turned the corner," said Brean Murray's Coolidge. "This earnings season was pretty bad so I still don't see Corporate America coming out and beating the drums."

Digesting the data

The economy has taken center stage for investors -- and they have found plenty to bank on.

The Commerce Department said U.S. consumer spending and personal income rose in March, indicating the world's largest economy is sluggish but finding some footing.

Spending jumped 0.3 percent after rising a revised 0.2 percent in February, while personal income grew 0.5 percent after rising a revised 0.5 percent in February, the Commerce Department said. The savings rate hit a negative 0.8 percent, slightly better than February's revised rate of negative 1.0 percent.

Last Friday, the Commerce Department reported that the GDP, the broadest measure of the economy, grew at a 2 percent annual rate in the first quarter, far ahead of analysts' expectations for 0.9 percent growth, according to Briefing.com. That's also up from 1 percent in the fourth quarter.

The Federal Reserve managed to surprise the markets twice in four months with two inter-meeting interest rate cuts, adding to the two cuts made at its regular meetings of the Federal Open Market Committee. This has boosted some consumer and investor confidence, but analysts said more is needed. The FOMC, the Fed's monetary-policy making body, meets May 15 and most market participants said another rate cut is needed.

Corporate results still on tap

While many of the top-tier firms already have posted quarterly results, there still are a slew of companies reporting. But analysts said that most investors already have digested and discounted bad-case scenarios.

"There's no conviction over earnings," said Ned Riley, chief investment strategist with State Street Global Advisors. "You're going to get this vacillation back and forth as we're in this bottoming process and it's going to take some time."

Phillips Petroleum (P: down $0.40 to $59.60, Research, Estimates) became the latest major oil company to report significantly better first-quarter earnings as it edged past Wall Street forecasts.

| |

EARNINGS NEWS EARNINGS NEWS

|

|

| |

|

Click below for a comprehensive look at corporate results and tallies

Earnings Roundup

|

|

|

Tyson Foods (TSN: down $0.09 to $13.77, Research, Estimates), the nation's biggest poultry processor, reported a loss for the latest quarter due to charges related to its terminated acquisition of IBP, bad weather and other factors. But earnings before the special items were 4 cents a share, topping the lowered analysts' forecast of 1 cent.

Expedia (EXPE: up $2.46 to $26.01, Research, Estimates), the online travel service, is due to report after the bell. The Microsoft (MSFT: up $0.63 to $67.75, Research, Estimates) offshoot is expected to post earnings of 4 cents a share, compared with a 40-cent-a-share loss a year earlier.

Discount retailer Dollar General (DG: down $7.38 to $16.50, Research, Estimates) warned that it expects to restate three years of financial results due to accounting irregularities.

Computer Associates (CA: down $3.06 to $32.19, Research, Estimates) disputed a Computer Associates (CA: down $3.06 to $32.19, Research, Estimates) disputed a

New York Times article Sunday that made broad charges against the software maker's accounting practices. According to the report, former employees and independent industry analysts said the company has used accounting tricks to systematically overstate its revenue and profit.

But Sanjay Kumar, Computer Associates' CEO, said the new business model, which reports both sales and order commitments for Computer Associates products, was done to give investors and analysts a better picture of the company's outlook -- not to give a picture of growth that isn't there.

Pier 1 Imports (PIR: down $3.41 to $11.10, Research, Estimates) warned it will miss first-quarter expectations when it reports its fiscal first-quarter results. The retailer now expects to earn between 12 cents and 16 cents a share. Analysts polled by First Call expected profit of 18 cents. Pier 1 cites customer preference for sale items and lower priced merchandise as the reasons for the revised numbers.

|

|

|

|

|

|

|