|

Bulls returning to Wall St.

|

|

May 6, 2001: 7:00 a.m. ET

Analysts see good prospects for market that has gained amid bad news

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - These are strange times on Wall Street, where stocks keep grinding higher even as news on the U.S. economy worsens.

Consider the numbers. Last week, the number of Americans who applied for jobless benefits rose to a five-year high while the unemployment rate jumped to its worst levels since 1998. Manufacturing remains in a deep slump. And Corporate America just wound up its worst quarter for profits in a decade.

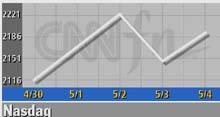

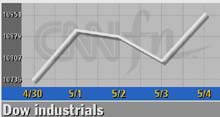

But you wouldn't know it from the stock market. On Friday, the Nasdaq composite index finished nearly 34 percent above its early April low. The Dow Jones industrial average stands more than 17 percent above its last bottom, reached in late March.

And the gains may not be over. Plenty of strategists remain upbeat about a market that historically rises long before the economy recovers. And the gains may not be over. Plenty of strategists remain upbeat about a market that historically rises long before the economy recovers.

"The market generally bottoms three or four months before the economy does," said Lenny Weiss, head of Weiss Wealth Management, with more than $100 million under management.

Despite the stream of bad news, Weiss likes the prospects for stocks this year. Like others, he expects the economic weakness to force the Federal Reserve to push interest rates lower, which generally helps equities. And speaking of history, Weiss mentions a fact that bulls increasingly cite. The Standard & Poor's 500 index, which fell last year, has almost never fallen for two straight years. It has done so only once since 1940, in 1973 and 1974.

"The time clock may be favoring the bulls now," Weiss said.

It certainly has been. Last week, following a strong April, all the major indexes finished higher during the first week of May. The Nasdaq gained more than 110 points, or 5.5 percent, over the last five trading sessions while the Dow rose more than 140 points, or 1.3 percent. The S&P 500 advanced 13 points, or 1.03 percent.

That's all in a week when reports showed jobless claims surged to 421,000 and unemployment rose to 4.5 percent in April. Companies including Newell Rubbermaid (NWL: Research, Estimates), Vitesse Semiconductor (VTSS: Research, Estimates) and Unilever (UL: Research, Estimates) were among the latest to pare their payrolls.

But if the market seems counter-intuitive over the short term, Tracy Eichler, investment strategist at UBS PaineWebber, said is shouldn't be over the long haul. But if the market seems counter-intuitive over the short term, Tracy Eichler, investment strategist at UBS PaineWebber, said is shouldn't be over the long haul.

She forecasts that corporate profits, which generally fell during the first three months of the year, will pick up during the last three months of the year. And Eichler sees the Federal Reserve's target interest rate, which currently stands at 4.5 percent, falling a full percentage point by late summer.

"Twelve months from now, we think (stocks) we will be higher," said Eichler. "We still think this market is undervalued."

Cisco Systems (CSCO: Research, Estimates), down 73 percent from its 52-week high, has certainly lost value. But so have its earnings. The computer networking company, after the close of trading Tuesday, is expected to post profits of 2 cents a share for its fiscal third quarter, well below the 14 cents earned in the year-ago period.

Special Report: Pink slip blues

Cisco has twice lowered its profit outlook for the last quarter as business spending on its equipment has slowed dramatically.

But some investors in Cisco, which has fallen as low $13 this year, clearly believe the company's worst problems may be over as the economy improves. And Cisco could be a bellwether for techs.

"I'm still looking for solid signs of recovery by the third and fourth quarter," John Forelli, senior vice president at Independence Investment, said of the markets.

Forelli expects short-term choppiness. Still, with the Federal Reserve expected to keep cutting interest rates, he likes the prospects for the stock market six months ahead. Central bank policy makers meet May 15.

Several clues about the state of the economy could be revealed in the days ahead.

April's producer price index comes Friday, the same day that retail sales are released. According to economists surveyed by Briefing.com, prices at the wholesale level are forecasts to have gained 0.3 percent following a 0.1 percent decline in March.

Economists expect that retail sales rose 0.5 percent in April, following a 0.2 percent decline in March. Economists expect that retail sales rose 0.5 percent in April, following a 0.2 percent decline in March.

"The real issue is consumer spending," said Sung Won Sohn, chief economic officer at Wells Fargo Bank, "Retail sales will be receiving a lot of attention."

Data on the economy have been uneven. The nation's gross domestic product showed surprising strength during the first three months of the year, rising at an annual rate of 2 percent. But the job market continues to weaken. The stock market remains somewhere in the middle, with the S&P 500 17 percent below last year's high but 15 percent above this year's low.

The questions for investors is: Has the stock market, which rose strongly in April but is down sharply over the last year, fallen enough to reflect the slowdown in the economy and profits? Many analysts believe it may have.

To turn the economy around, the Federal Reserve cut interest rates four times this year. The effect of those moves, by making it cheaper to borrow money, often takes months to be felt.

Ned Riley, chief investment strategist at State Street Global Advisors, likes the market in the months ahead, though he does not expect straight-up gains. Among other things, he expects increased pressure on Washington to cut taxes, which, though not an immediate stimulant, could spur spending over time.

"The market is starting to forget about the next couple of quarters and look to the end of the year," said Riley.

And Riley says he's heartened that the gains of the last five weeks have been met with skepticism which, though seemingly counter-intuitive, is often a sign that gains can continue.

But for those struggling to make sense of the market's gains amid all the bad economic and corporate news, counter-intuitive logic may be the best tool out there.

|

|

|

|

|

|

|