|

Daimler back in black

|

|

July 20, 2001: 1:06 p.m. ET

Carmaker beats forecasts as Chrysler unit narrows loss in 2Q

|

NEW YORK (CNNfn) - DaimlerChrysler, the world's third-largest automaker, returned to profitability in the second-quarter with better-than-expected results despite continued losses at its U.S. Chrysler unit.

The Stuttgart, Germany-based company said Friday second-quarter earnings excluding one-time items plunged 70 percent to  535 million, or $470 million, from 535 million, or $470 million, from  1.75 billion, or $1.5 billion, in the year-earlier period. 1.75 billion, or $1.5 billion, in the year-earlier period.

|

|

|

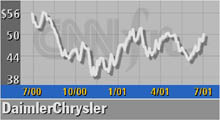

Share price reflects trading of DaimlerChrysler's U.S. shares. | |

Earnings per share fell to  0.53, or 45 cents, for the three months ended June 30, from 0.53, or 45 cents, for the three months ended June 30, from  1.74, or $1.47 a share, a year earlier. Analysts surveyed by U.S. earnings tracker First Call had forecast EPS of 30 cents for the latest quarter. 1.74, or $1.47 a share, a year earlier. Analysts surveyed by U.S. earnings tracker First Call had forecast EPS of 30 cents for the latest quarter.

Shares of DaimlerChrysler (DCX: up $1.08 to $50.26, Research, Estimates) were up in both New York and Frankfurt Friday.

Including special items, net income for the German-American automaker came to  700 million, or $620 million. 700 million, or $620 million.

The North American Chrysler Group reported an operating loss of $125 million, a sharp drop from operating profit of $986 million a year earlier but a considerable improvement from the $1.2 billion loss in the first quarter, even excluding a $3 billion restructuring charge it took in the period.

While Chrysler did not return to profitability in the most recent period, the company's other units – Mercedes-Benz and commercial vehicles, as well as a service segment, all were profitable, allowing the overall profits to return. Mercedes-Benz was the only unit to improve profitability from a year earlier.

The Mercedes unit managed to increase sales by 6 percent to 328,800 vehicles. Revenue rose 10 percent to  12.5 billion and operating profit, excluding one-time items, also rose 10 percent to 12.5 billion and operating profit, excluding one-time items, also rose 10 percent to  830 million. 830 million.

Sales of its C-Class series sedans, sports coupes and station wagons rose 61 percent. Western European sales rose 11 percent but U.S. sales dipped 5 percent, underlining the U.S. economic slowdown.

Progress seen on Chrysler turnaround

DaimlerChrysler took a massive $3 billion one-time charge in the first quarter to reorganize its money-losing Chrysler unit, including a layoff of 26,000 employees worldwide. To date, more than 11,000 workers have lost their job as part of the company's plans.

Company executives and analysts said that while Chrysler still is losing money, they are pleased to see the progress being made.

"Chrysler's turnaround plan is working, thanks to an American market that has performed better than expected, heavy incentives to attract customers, interest rate cuts and the removal of suppliers who could not cut costs," Philip Rosengarten, an analyst at auto consultant DRI-WEFA, told CNN.

Rosengarten said their model for the U.S. light vehicle market had showed sales of about 15 million to 16.5 million for the year. "We are now raising our 2001 expectations to the top end of forecasts, to 16.5 million," he added. Still, "The second half will be the real test," Rosengarten added.

DaimlerChrysler CEO Juergen Schrempp, who faced calls to resign after his expansionist plans came unhinged last year, said Chrysler was on track with its previously announced plans to break even in 2002

Sales of Chrysler vehicles fell 4 percent to 820,982 in the April-June period, "primarily as a result of softer demand in the U.S. market," the company said. Revenue declined 1 percent to $15.5 billion.

Click here for a look at auto stocks

"Overall, we continue to expect lower demand in the U.S. automotive market and a high level of industry-wide consumer incentives this year," DaimlerChrysler said, adding "we expect that Chrysler Group's sales and revenues in the year 2001 will be below the figures achieved last year."

The company expects the Chrysler unit to post an operating loss, excluding one-time items, of between  2.2 billion and 2.2 billion and  2.6 billion for the year. 2.6 billion for the year.

But DaimlerChrysler reiterated its forecast that the overall company should see an operating profit of between  1.2 billion and 1.2 billion and  1.7 billion for 2001. 1.7 billion for 2001.

|

|

|

|

|

|

DaimlerChrysler

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|