|

Time for energy stocks

|

|

September 4, 2001: 10:02 a.m. ET

There are ways for investors to profit from the crude crunch

By Jon Birger

|

NEW YORK (MONEY) - What ever happened to the energy crisis? That is a question a lot of frustrated energy-stock investors are asking these days. With oil and natural gas prices in retreat and Barron's spooking Wall Street with warnings of "the coming energy glut," this once hot sector has gone into deep freeze. The Standard & Poor's energy index is more than 10 percent off its 52-week high. Leaders such as ExxonMobil and Royal Dutch are down and oilfield services giant Schlumberger -- a stock MONEY plugged in April -- has been among the hardest hit, slumping 40 percent.

Momentum investors are running for the exits, leaving the rest of us to ponder whether this is a massive buying opportunity or the end of energy stocks' 2 1/2-year run. We are convinced that the sector is a buy.

|

|

|

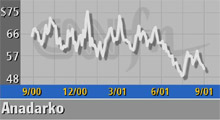

Anadarko is one of four energy stocks that are a great value. | |

Not only are today's "lower" oil and gas prices still quite high by historical standards, but the stocks in the sector are incredibly cheap. The S&P energy index has a price-to-earnings ratio of only 15 -- 38 percent below the index's five-year average. "It's 1999 all over again," says David Kiefer, manager of the Prudential Utility and Equity funds. "The stocks are practically screaming at you to buy."

Right now that message isn't getting through, and it's easy to understand why. Rolling blackouts in California no longer lead the evening news, and anyone who's pulled into a service station lately knows how much gasoline prices have come down. Between May and August, the average price of a gallon of regular unleaded fell 31 cents to $1.40 a gallon. Natural gas -- a favorite play for speculators trying to make a buck off California's woes -- has experienced the most precipitous price declines. No wonder everyone thinks the energy crisis is over.

In fact, supplies of oil and natural gas have barely budged this year, despite the best efforts of Big Oil to ramp up production. So why have energy prices fallen?

The answer is slumping demand, not additional supply. Energy-intensive industries such as chemical and metal manufacturing have scaled back production this year in response to the economic slowdown. According to A.G. Edwards oil analyst Greg McMichael, energy consumption by U.S. industry fell 20 percent in the first half of 2001 before recovering slightly in July and August. McMichael thinks that by early next year, demand will have rebounded to 96 percent of 2000 levels. "We still have an energy crisis," he says. "It's just masked right now."

| |

|

|

| |

|

We believe that the Federal Reserve's aggressive interest-rate cuts will lead to an economic recovery in 2002.

|

|

|

Energy is a cyclical business, which means any bet on energy stocks is in part a bet on the economy. We believe that the Federal Reserve's aggressive interest-rate cuts will lead to an economic recovery in 2002, but we've hedged a bit with our energy picks. The four stocks we're recommending may not get quite the lift from a revved-up economy as pricier names like Schlumberger or Enron. But they're great values nonetheless, and their low P/Es should help cushion the blow if our economic optimism proves misplaced.

Anadarko Petroleum

The world's largest independent exploration and production company, Anadarko (APC: up $1.03 to $52.78, Research, Estimates) has increased earnings per share at a 209 percent annual clip since 1996, and it's one of the only major oil companies anticipating double-digit production increases for years to come. No wonder CEO Robert Allison Jr. thinks his company is getting a raw deal from Wall Street. "We're trading at a lower multiple than at any point in our history," he laments.

Allison blames momentum investors for triggering a sell-off in Anadarko shares. Down 21 percent from its high, the stock now trades at 11 times 2001 earnings, a huge discount to Anadarko's five-year average P/E of 48. Of course, every CEO will tell you that his stock is too low, but Allison has put his money where his mouth is with a $1 billion stock buyback plan announced in July. Add to the mix impressive results from new wells in Algeria, and Anadarko is a stock we think could quickly move from $60 to $75 -- and still be underpriced.

Chevron

Over the past five years, Chevron has increased its earnings at an annualized rate of 19 percent vs. 12 percent for ExxonMobil. Chevron (CHV: up $0.59 to $91.34, Research, Estimates) also has a higher dividend yield than Exxon, 2.8 percent vs. 2.2 percent, yet its current P/E of 12 is five points lower than Exxon's. Exxon is a great company, but we cannot think of any good reason why Chevron should be that much cheaper. Neither can Goldman Sachs oil analyst Arjun Murti, which is why Chevron is his top Big Oil stock pick. "We think the valuation gap ought to close to 2.5 P/E points and could ultimately go back to parity," says Murti.

The catalyst for a higher Chevron P/E (and thus a higher stock price) could be its pending $38 billion acquisition of Texaco. Murti believes Exxon's current premium stems from its larger representation in the S&P 500 index -- 2.69 percent vs. Chevron's 0.56 percent. "As the S&P 500 was rising at a 20 percent clip during the latter part of the 1990s, many active portfolio managers felt pressure to own the bellwether index names," Murti says. Once the Texaco deal closes, Chevron's S&P 500 weighting should increase to 0.93 percent, significantly enhancing demand for the stock.

The Texaco merger will help in more obvious ways as well. "There's a story there of cost savings that some of the other majors just don't have," says Michael Hoover, manager of the Excelsior Energy & Natural Resources fund. Chevron is predicting $1.2 billion a year in merger-related cost savings, and Hoover suspects that figure is low.

Unocal

We recommended Unocal in our October 2000 issue, calling the company's patent on clean-burning gasoline the legal equivalent of a gusher. Since then, the controversial patent has been upheld by the U.S. Supreme Court -- a decision that could force refiners to pay Unocal $100 million or more a year in royalties -- and Unocal (UCL: up $0.30 to $35.60, Research, Estimates) stock is up a solid 5 percent vs. an 18 percent loss for the S&P 500 over the same period. The legal wrangling continues -- the Federal Trade Commission is now investigating the patent's legitimacy -- but we think Unocal stock has a lot more upside.

A driller like Anadarko, Unocal has fallen out of favor recently as a result of a string of dry holes, primarily in the Gulf of Mexico. The company did announce a major gulf find in July, but the news failed to boost its stock. At $37 a share, Unocal boasts a 2.2 percent dividend yield and a P/E ratio of 11, well below its five-year average multiple of 35. Putnam New Value's David King sees little downside from here. Either the company gets its act together or it becomes a candidate for a takeover. "Shareholders benefit either way," says King. "I view it as a low-risk situation."

Valero Energy

A leading oil refiner, Valero is another beaten-up stock whose prospects could be enhanced by a recent acquisition. Goldman Sachs' Murti expects Valero's purchase of rival Ultramar Diamond Shamrock to add $2 in earnings per share within two years. With Valero (VLO: up $0.50 to $42.00, Research, Estimates) currently trading at a mere 4.7 times 2001 earnings, Murti argues that Valero has a 72 percent upside in an average economic climate and virtually no downside even in a "doom and gloom" scenario. The stock took a 35 percent hit early in the summer, when falling gasoline prices eroded refining margins (the difference between what refiners pay for crude and the price they get for gasoline). Periodic collapses in refining margins are a fact of life, yet investors reacted as if the sky were falling.

Murti believes Valero, now $36 a share, could climb to $57 within 12 months. We think it could happen even sooner. John Perry, an analyst with oil-industry investment bank John S. Herold, points out that rival refiner Tosco will be dropped from the S&P 500 when its acquisition by Phillips Petroleum becomes official. "Valero," says Perry, "will become the nation's largest independent refiner, and that makes it the logical candidate to replace Tosco in the S&P."

* Disclaimer

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|