|

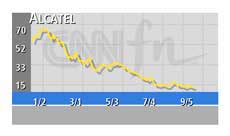

Alcatel may make loss

|

|

September 5, 2001: 7:28 a.m. ET

Telecom equipment makers plunge on doubts of market, profit recovery

|

LONDON (CNNfn) - Telecom equipment maker Alcatel warned it may not deliver an operating profit in 2001, sending shares of rival hardware suppliers tumbling.

Serge Tchuruk, Alcatel Chief Executive, on Wednesday said the group would aim for an operating profit this year, but reaching that target would be a challenge in current market conditions.

"As far as operating income goes, we hope to report a positive result this year, but the market is not helping us. It's a challenge," Tchuruk told an investor conference hosted by HSBC. "As far as operating income goes, we hope to report a positive result this year, but the market is not helping us. It's a challenge," Tchuruk told an investor conference hosted by HSBC.

His comments came a day after Sweden's Ericsson, the world's biggest supplier of wireless phone infrastructure, warned it saw no clear recovery in the telecom market in the next year.

Shares of Alcatel (PCGE), Europe's fourth-largest phone equipment maker, plunged 10.6 percent to  15.15. The stock earlier touched 15.15. The stock earlier touched  15.05, its lowest level since October 1998. 15.05, its lowest level since October 1998.

Ericsson fell 9.8 percent to  40.70 in Stockholm, extending the previous day's double-digit loss. The Swedish company wasn't helped by Goldman Sachs, which issued a new forecast for the company's 2002 result, predicting a loss of 0.02 crowns per share, compared with a previous forecast of a profit of 0.56 crowns per share. 40.70 in Stockholm, extending the previous day's double-digit loss. The Swedish company wasn't helped by Goldman Sachs, which issued a new forecast for the company's 2002 result, predicting a loss of 0.02 crowns per share, compared with a previous forecast of a profit of 0.56 crowns per share.

'Black September'

"Ericsson management stated that 2002 is likely to see only flat to moderate growth in mobile systems, with visibility remaining opaque," Goldman said. "This forecast suggests that our 'Black September' scenario is coming to fruition."

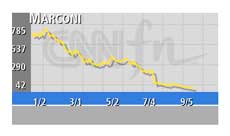

In London, shares of debt-laden British rival Marconi (MONI) plunged 17.5 percent to 43.75 pence amid concerns it may not be able to reduce its debts.

The company on Tuesday ousted both its chairman and chief executive, issued its second profit warning in two months and announced a further 2,000 job losses, taking the total losses this year to 10,000. The company on Tuesday ousted both its chairman and chief executive, issued its second profit warning in two months and announced a further 2,000 job losses, taking the total losses this year to 10,000.

Goldman Sachs also took a swipe at Finland's Nokia, the world's biggest mobile phone supplier, cutting the Finnish company's price target to  25. Nokia slumped 5.9 percent to 25. Nokia slumped 5.9 percent to  16.24 in Helsinki. 16.24 in Helsinki.

"We are concerned that the company will be affected by a significant slowdown in the European market suggested by Ericsson. We are therefore reducing Nokia Networks' growth rates to five percent (from 20 percent), and margins from 12 percent to 10 percent," the bank said in a research note.

Goldman reduced its earnings per share forecast for 2002 to  0.74 from 0.74 from  0.78. 0.78.

|

|

|

|

|

|

|