|

No gain in contraction pain

|

|

November 6, 2001: 1:20 p.m. ET

Economics says dropping weakest baseball teams won't help game.

A twice weekly column by Staff Writer Chris Isidore

|

NEW YORK (CNNmoney) - Baseball owners voted Tuesday to eliminate two of the 30 franchises before the start of next year, a move Commissioner Bud Selig said was made necessary by the poor economic outlook of numerous teams.

But the raw numbers suggest that contraction will hurt baseball's bottom line -- not help it.

Contraction doesn't make any more economic sense for baseball than $6 hot dogs do for its fans or million-dollar-a-year backup catchers do for its teams.

The basic reason for this is baseball teams, with few exceptions, don't compete with one another for all revenue. People are not going to spend more at Yankee Stadium or even at Kauffman Stadium in Kansas City because weak sister teams in Montreal or elsewhere have been disbanded.

Baseball does share about 20 percent of its local revenue and all its national revenue. An analysis of 1999 statistics released by the league, the most recent available, shows that dropping Montreal and Minnesota, the two smallest revenue teams, and dividing the remaining revenue pie 28 ways instead of 30 ways, will only increase each team's split of revenue sharing by about $2 million, or roughly the cost of the average salary of a single player.

| |

|

|

Getting rid of empty seats in Montreal will do little to help baseball's remaining teams. | |

Instead of getting rid of the teams, the ownership would be better off moving the lowest-revenue franchises to larger, growing markets, such as Sacramento, Calif. and Las Vegas. Those two new locations would only have to raise modest annual local revenue of about $30 or $40 million a year to have each team better off than they would be through contraction. Basically everyone is better off with 30 pieces of a larger pie than 28 pieces of a smaller pie.

And getting rid of two teams will not be cheap - it will cost at least $250 million, or about $9 million per team remaining in the league, to buy out the two ownership groups, minor league team owners and the like. That means contraction is a money loser for each remaining franchise for at least the next few years. Moving the weak teams to better markets has little, if any, cost for the league.

A former baseball executive speaking on a not-for-attribution basis told me that the league has that amount of money squirreled away within its central fund, and that the payout to the exiting owners could be over a number of years, rather than requiring upfront payment from cash-starved small market teams.

But the struggling franchises would be better off if that share of the money was returned to them, or reinvested in the game in some other manner, rather than given to owners who are exiting the game.

Picking a loser tougher than it seems

Selig refused to identify the two teams that supposedly will be eliminated by the beginning of next year, saying that a final decision has not been made, and that negotiations with the franchises and with the Major League Baseball Players union need to take place before there is an announcement.

He said that the talks will entail how to eliminate the two teams, and disperse the players to the other teams -- not if to eliminate them. But some see this entire contraction vote as a negotiating ploy to put the union on the defensive at the start of a new round of labor negotiations.

While Selig wouldn't confirm any franchise that would be eliminated, Montreal seems certain to lose. The team drew a franchise record low 619,541 tickets last season, giving it a per-game average below many minor league teams.

But baseball's every-day schedule necessitates that an even number of teams be dropped, and it is a difficult question as to which team would join the thinly-supported Montreal Expos in being voted off the island.

Part of that is because it's tough to tell the difference between a weak market and a badly-run team going through a temporary slump.

If the question of contraction had been raised a dozen years ago, then three of the teams on the top of everyone's contraction list would have been Seattle, Cleveland and Atlanta, teams that today are among the league's most successful in terms of both on-field talent and revenue.

Today the Florida Marlins are cited as a potential target of contraction, but South Florida is a large market with a strong Latino population base that is more inclined to follow baseball than fans in most metropolitan areas.

|

|

|

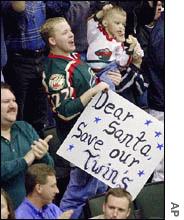

Fans in Minnesota turned out to see their Twins in the just completed season, but some are worried if they'll get a chance to return next year. | |

While their attendance is near the bottom today, when the Marlins won the National League wild card on their way to a World Series victory in 1997, the team had the fifth-largest attendance in the league, even playing in a football stadium never designed for baseball. The team has a strong young pitching staff and may be competitive again soon.

Minnesota is near the bottom of most rankings of revenue and total payroll. But the team actually was in first place much of last year, hurting the arguments that it can't compete. And while the owner says the team has seen mounting losses, a 78 percent increase in attendance in 2001 due to the team's success coupled with low payroll brings those claims of losses into doubt.

Tampa Bay, created through expansion only four years ago, has been an on-field and off-field disaster almost from its first pitch. But a long-term lease at its stadium may make it difficult for baseball to pull out of that market altogether.

One plan discussed would have Walt Disney Co. (DIS: Research, Estimates) sell its ownership of the Anaheim Angels back to the league, with a successful smaller market team, such as the Oakland Athletics, moving into its market. And former Commissioner Fay Vincent told me last week that the mounting debts made the Arizona Diamondbacks a candidate for contraction.

"If you're broke and banks own the team, it's easier to negotiate their departure," he said.

But even the tone-deaf baseball leadership must know how badly it would hurt fan support for the game to disband the defending champions who had just dethroned baseball's richest team, the New York Yankees. And the Arizona chief financial officer told me the team was back on solid economic ground, even with its debt load and continued losses, before it received the bump in revenue from getting to and winning the World Series.

Non-economic motives are behind contraction vote

But the economic and logistical problems of contraction were apparently not enough to kill the idea, assuming the vote is a genuine move to contraction and not a bluff.

The threat of closing teams could be used to scare government officials in some markets into building new stadiums to keep the same thing from happening to their team. It also keeps strong markets available for any existing team looking to move. Selig said that while relocation would not be a way to halt this contraction, it is an option that will be considered in the future.

Large-market owners being asked to share a greater percentage of their revenue with small-market owners might be more willing to agree to that if there are fewer small-market teams. And some owners obviously feel they can gain some negotiating leverage with the players if they threaten to get rid of the 50 jobs included on two teams' rosters.

Click here for a look at CNNSI's baseball coverage

Still, there are downsides to each of the political reasons for contraction, such as the threat of lawsuits from public officials seeking to keep teams, the damage that would be done to the game from a harsh labor battle on the heels of a successful season. Selig tried to soften the labor environment somewhat by announcing there would be no lockout by owners with the expiration of the collective bargaining agreement Wednesday, but the union can't see this announcement as anything but an opening attack in these talks.

Hopefully, economic common sense will still stop the owners from heading down this risky road of contraction for these potential political gains.

But given many of the decisions by baseball owners in the past as to what constitutes their best interest, hoping for common sense is like pulling for the Boston Red Sox to win the World Series - you can always hope, but it's best not to get your hopes too high.

Click here to send mail to Chris Isidore

|

|

|

|

|

|

|