|

Winning run hits a bump

|

|

November 20, 2001: 3:33 p.m. ET

Nascar is fastest-growing U.S. sport, but economy is putting a brake on gains.

A twice-weekly column by Staff Writer Chris Isidore

|

NEW YORK (CNN/Money) - Quick, name the nation's second-most-watched sport, which may lose teams before next season due to economic problems that persist despite the sport seeing record revenue.

No, the answer isn't baseball. It's Nascar, the auto racing circuit which has seen significant growth in both fan interest and the cost of competing.

The sport has seen the number of broadcasts and viewership soar in the first year of a new television contract that will bring in a reported $2.8 billion and put an unprecedented number of its races on Fox over the next eight years and on NBC over the next six years.

The sport now trails only football in average television ratings, producing ratings that baseball and basketball can only dream of achieving throughout their seasons, even though it doesn't get comparable play in the nation's sports media on most days.

Average ratings for the second half of the season on NBC are not yet available, but the Fox broadcasts from the first half of the season stood at 6.1, more than twice the average 2.6 rating on baseball's "Game of the Week" broadcasts on Fox.

|

|

|

Melling Racing's car No. 92 won't be back next year if it can't find a sponsor to replace Kodiak chewing tobacco. | |

But almost two-thirds of the television money goes to the track owners, such as International Speedway Corp. (ISCA: Research, Estimates) and Speedway Motorsports Inc. (TRK: Research, Estimates). Only 25 percent of the money reaches the racing teams.

The overall slowing of U.S. advertising spending, even before the Sept. 11 attack, is leaving owners of a number of racing teams scrambling to find the sponsors they need to cover costs and compete next season.

At least one team that lost McDonald's Corp. (MCD: Research, Estimates) as a sponsor quit racing before the end of the season. Some others who have lost sponsors for 2002 are not certain if they'll be able to return.

"Earlier this season there were 44 full-time teams who showed up at every race," said Lake Speed Jr., spokesman for Melling Racing, which is looking for a sponsor to replace Kodiak chewing tobacco. "Now there's 42, and many of us don't have sponsors for next year."

While the sport still has its roots, and its greatest interest, in the Southeast, it is drawing respectable numbers in non-traditional markets, like New York, where it attracted an average 2.6 rating on Fox this year.

But a longer season (the season concludes under cool New England skies in Loudon, N.H., this Sunday) and new tracks in places like Chicago and Kansas City, Kans., have increased the operating costs for the teams. So has the staffing needed to meet the increased level of competition.

"In 1997 we may have had around 15-to-20 employees, and probably eight guys at track," said Speed. "Now it takes 12 guys at the track and 25-to-30 total employees. You used to build a car and keep it for a few years unless it got wrecked. Now after you race it twice, you're totally tearing it apart to make it better."

Because of these costs teams that could compete for $3 million-to-$4 million for a season in 1997 need at least twice that amount this year, Lake and other team officials said.

| |

|

|

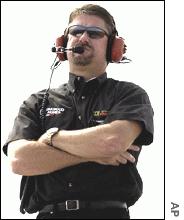

Andy Petree is one of the Nascar team owners scrambling to find a new sponsor to cover the increased costs of racing. | |

"What we're looking for is $8 million to run our team," said Andy Petree, who may have to drop one of the two teams he ran this year due to losing Oakwood Homes Corp. (OH: Research, Estimates), a maker of mobile homes, as a sponsor. "I guess the higher the numbers get, the bigger the company it takes to crack that nut. I think it's likely we'll find one, but it's a lot later than we'd like it to be (without a '02 sponsor lined up). The downturn in the economy is not in our favor."

Nascar Senior Vice President George Pyne said the sport is aware of the problems of rising costs, and it is instituting some new rules to level the playing field and allow lower-revenue teams a better chance to compete. But he said that the scramble for sponsorships is not a sign of economic crisis.

"I don't want to diminish the issue, but you see sponsor turnover as an issue in both good and bad times," he said. "But we want to make sure there's an economic model that makes sense for the teams."

The track owners say it's not just the team owners feeling the pinch of the current economic slowdown. International Speedway Corp., which added two tracks this year, won't add any capacity at its tracks next season, and is seeing its own sponsorship dollars and corporate sales slacken with the economy, said Wes Harris, the company's director of investor relations.

Click here to read CNNSI's auto racing coverage

"Even before we got to Sept. 11, we knew next year would be a tougher year," said Harris.

Still, Petree and some other owners would like to see track owners spread the wealth around a little bit more than they do, although he's not optimistic.

"Unlike other sports, the team owners don't have much say," he said.

Click here to send mail to Chris Isidore

|

|

|

|

|

|

|