|

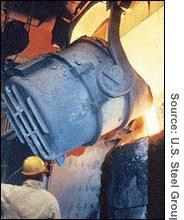

U.S. Steel eyes mergers

|

|

December 10, 2001: 12:57 p.m. ET

Company says deal for National Steel wouldn't block one for Bethlehem.

By Staff Writer Chris Isidore

|

NEW YORK (CNN/Money) - U.S. Steel Group, the nation's largest steelmaker, is in talks to buy rival steelmaker National Steel Corp., adding to the talk of consolidation in the beleaguered U.S. industry.

The announcement Sunday of the U.S. Steel (X: down $0.27 to $18.00, Research, Estimates) talks with National follows the disclosure last week by No. 3 steelmaker Bethlehem Steel Corp. (BS: up $0.09 to $0.80, Research, Estimates), which is operating under bankruptcy court protection, that it had held talks about a merger with U.S. Steel.

A U.S. Steel spokesman Monday would neither confirm nor deny that it had held talks with Bethlehem, but said that even if there is a deal with National Steel it would not preclude a deal for another steelmaker such as Bethlehem.

"We're talking about consolidation. How many companies will be involved, I don't know," U.S. Steel spokesman John Armstrong said. "We're in talks with more than one integrated steel company. Our talks with National are just further down the pike."

A spokeswoman for Bethlehem said it also doesn't believe it would be left out of a deal just because U.S. Steel has identified only National Steel at this point.

|

|

|

U.S. Steel is looking at combining with one or more other steelmakers if it can gain some relief from imports and retiree health-care costs. | |

"We're looking at a consolidation with U.S. Steel as leader, with four or five different steel companies involved," Bethlehem spokeswoman Bette Kovach said. Wheeling Pittsburgh Steel Corp., the nation's No. 9 integrated steelmaker and a unit of WHX Corp. (WHX: up $0.04 to $1.50, Research, Estimates) that also is operating under bankruptcy court protection, also is involved in those talks.

The merger talks come as LTV, the nation's No. 4 steelmaker, completed a shutdown in operations while it attempted to find a buyer for its three steel mills. National Steel (NS: up $0.39 to $1.96, Research, Estimates), which is 53 percent owned by Japan's NKK Corp., is the No. 5 steelmaker behind LTV.

On Friday the U.S. International Trade Commission recommended a series of tariffs of up to 20 percent on steel imports because of damage to the U.S. industry from lower-priced imports that the steel industry contends are being dumped here in violation of U.S. trade laws. That tariff recommendation now goes to President Bush for consideration, but he showed more willingness than his predecessors to consider such action when he asked the USITC to look at the issue in June.

U.S. Steel said such tariffs are only part of the help the industry needs for consolidation talks to be successful. It also wants assistance from the federal government to pay hundreds of millions of dollars a year in retiree health-care costs, as well as new labor agreements with the United Steelworkers union, which represents hourly workers at all the integrated steelmakers involved in talks.

Increased efficiency has left all the firms with far more retirees than active employees, and their labor contracts require them to pay for a significant share of their health-care costs.

Health care for about 94,000 retirees at U.S. Steel cost the company about $166 million last year, according to its annual report. Bethlehem said health-care costs for 130,000 retirees, family members and surviving spouses costs it about $100 million a year. Industry wide, the cost is about $965 million a year, according to the United Steelworkers, which is joining with management to push for federal help for those costs.

The USW has been in talks with LTV creditors about a new labor agreement that could get the federal loan guarantees needed by a potential buyer to reopen its steel mills. And it said it is willing to discuss new labor contracts with the others as long as consolidation leads to preserving jobs and domestic steel capacity. U.S. steelmakers now can produce only about 80 percent of the nation's steel needs.

"There may be too many steel companies but there are not too many steel workers, and any restructuring must preserve the jobs of the workers who have made sacrifice after sacrifice in order to keep the industry alive in the face of a flood of unfairly dumped foreign steel imports," USW President Leo Gerard said last week.

But the integrated steelmakers face a challenge not only from imports but also from nonunion operators of so-called "mini-mills," which make steel by melting steel scrap. The largest minimill operator, Nucor Corp. (NUE: down $0.40 to $52.27, Research, Estimates), is now the nation's No. 2 steelmaker. And while Nucor joined with the integrated steelmakers to support tariffs, it is opposed to any federal assistance for their retiree health-care costs.

Click here for a look at metals stocks

"It's basically a subsidy," Nucor Chief Financial Officer Terry Lisenby said. "We don't think the government should be in the business of picking the winners and losers. The market should do that."

The Bush administration is under pressure to support federal assistance, though, due to the number of jobs involved at a time of rising unemployment as well as the large number of retirees who could be hurt if they lose their health-care coverage. Many of the employees and retirees are from such vital political battleground states as Pennsylvania, Ohio and Illinois.

LTV, with plants in Cleveland, East Chicago, Ind., and Hennepin, Ill., already had about 1,300 hourly employees on layoff before its shutdown started Friday, and it will begin laying off most of the rest of its 4,200 hourly and 2,000 salaried employees this week.

National Steel, which already had idled a blast furnace outside Detroit and a steel pellet plant in Minnesota, has about 8,400 employees as well as 22,000 retirees. Bethlehem has about 13,000 employee and 74,000 retirees.

The merger talks come as U.S. Steel Group is preparing to be spun-off from USX Corp., which consists of both the steel operation and Marathon Oil (MRO: down $0.47 to $27.59, Research, Estimates), both of which have their own tracking stock. That spinoff still is on track, USX spokesman William Keslar said, although it awaits final approval of the Internal Revenue Service that it will be a tax-free transaction.

The prospectus for the new U.S. Steel Corp. stock says the company should take debt of about $1.7 billion with it after the spinoff. The U.S. Steel group has a market capitalization of about $1.6 billion today, compared with about $8.5 billion for Marathon.

|

|

|

|

|

|

|