|

Apple ups 2Q targets

|

|

January 16, 2002: 7:06 p.m. ET

PC maker meets 1Q EPS forecast on slightly weaker-than-expected sales.

|

NEW YORK (CNN/Money) - Personal computer maker Apple Computer Inc. posted fiscal first-quarter results that met Wall Street profit estimates as it said it expects to top earnings and sales forecasts in the current period.

The company earned $38 million, or 11 cents a share, excluding special items, in the period ending Dec. 29. That was in line with the forecasts of analysts surveyed by earnings tracker First Call.

The company lost $195 million, or 58 cents a share, in the year-earlier period.

The company said it expects to again earn 11 cents a share in the fiscal second quarter, which is above the current First Call earnings per share forecast of 9 cents. It is also looking for revenue to rise to $1.5 billion in the period, above the First Call forecast of $1.3 billion. The company earned 11 cents a share on sales of $1.4 billion in the year-ago period.

The new guidance helped lift shares of Apple (AAPL: Research, Estimates) 96 cents to $21.74 in after-hours trading, but that was only following a loss of 92 cents in regular-hours trading ahead of the after-market earnings report.

|

|

|

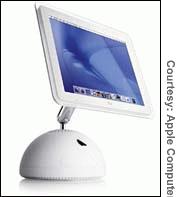

Apple said it expects not to be able to meet demand in the current quarter for its newly unveiled iMac computer. | |

Revenue in the fiscal first quarter rose to $1.38 billion from $1.0 billion a year earlier, but that brought it in just below the First Call forecast for sales of $1.43 billion in the just-completed period. The company said it sold 125,000 of its new iPod MP3 in the first two months since the product's launch.

Company executives said they expect stronger demand than they will be able to meet for the new iMac computer, which was unveiled earlier this month. Costs associated with the ramp-up of the new computer, including increased air shipment costs to try to meet demand, should hurt the company's operating profit in the fiscal second quarter, even as revenue increases.

"It'll take most of the quarter to ramp up production of the iMac, and we're unlikely to be able meet expected demand for the quarter," said Apple Chief Financial Officer Fred Anderson in a call with analysts. "We certainly hope more than half of the iMac sales this quarter will be the new iMacs. How much over half it goes will depend on supply."

The company said it is seeing some drop in purchases of computers during the first quarter due to the slowing of the economy and concern over cuts in education funding. But the company said it is seeing good sales growth at new Apple stores that it opened during the quarter.

The company saw 800,000 customer visits in December to the 27 stores it had opened at the end of the year. Anderson said that a survey of the customers who bought new computers at the stores showed about 40 percent had never bought Apple systems before and that the company believes most of those customers are converting from Windows-based personal computers.

"Overall we're very pleased with how our retail strategy is working," he said. "We believe it is helping us reach out beyond our installed based of customers."

Click here for a look at computer stocks

Anderson said that he couldn't project a specific profit margin target after the company gets through the ramp-up period for the new iMac, but he said he expects it to improve due to the end of some costs, such as air freight shipments.

"While the march quarter will be a quarter of product transition, we remain very optimist about opportunity for product growth in the second half of our fiscal year," he said.

The company saw its $24 million restructuring charge in the first quarter balanced out by a $23 million gain from equity investments in the period.

|

|

|

|

|

|

|