NEW YORK (CNN/Money) - Interest rates have been hovering at historic lows and they're bound to ascend sooner or later. But just when is a question stumping even the savviest of Fed watchers, given the U.S. economy's unpredictable route to recovery.

As such, many college grads saddled with student debt assume now is the best time to consolidate their variable-rate federal education loans into one low, fixed-rate.

"It is and it isn't," said Mark Kantrowitz, founder of FinAid.org, a comprehensive resource on student financial aid. "It is from the point of view that rates are the lowest they've ever been."

The beauty of consolidation is that you lock in one fixed rate that is based on an average of your loans' current rates. That way you no longer worry about paying more when interest rates climb, which is an inherent risk of variable-rate education loans such as the Stafford or PLUS.

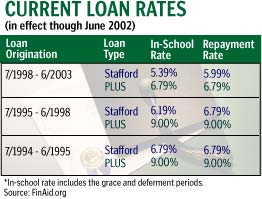

But you might be better off waiting another month or two before deciding to consolidate, since there's a fair chance the Stafford and PLUS loan rates will drop further this year, Kantrowitz said. That's because there's a built-in delay between changes in the Fed funds rate and changes in education loan rates. Interest rates on the Stafford and PLUS are set once a year, in July, based on the last auction of the 91-day Treasury bill in May. (That auction this year falls on May 28, according to Briefing.com.) That means the current rates on those loans have yet to factor in the six Fed rate cuts made since last May.

In fact, said Kalman A. Chany, author of Paying for College Without Going Broke, the best time to decide whether to consolidate is in June. That's when you'll have a one-month window to see whether your loan rates will go up or down by July 1.

If rates are set to go down, you might be better off waiting until July to make your move. If they're set to go up, you might consolidate in June, before the new, higher rates take effect.

Doing the math

Here's how to figure out which way rates will go. The Stafford loan rate, which is given to students, is equal to the May T-bill rate plus 2.3 percent. The PLUS loan rate, which is given to parents, is equal to the May T-bill rate plus 3.1 percent.

| |

CONSOLIDATION MAY MAKE SENSE IF:

CONSOLIDATION MAY MAKE SENSE IF:

| |

| | |

| | |

|

Last May, the 91-day T-bill rate was 3.688 percent. In the most recent auction on May 6, it stood at 1.740 percent. The chances that it will rise nearly two percentage points, or anywhere close to that, by May 28 is fairly low. The T-bill tends to move in anticipation of the Fed, and the Fed is not expected to raise rates in the near term. "It will take at least a year for (education loan rates) to go back up to where they were," Kantrowitz predicted.

Consolidation isn't a free ride

Of course, just because rates are low, doesn't necessarily mean the rate you'll get on a consolidation loan will be lower than what you're currently paying. Remember, variable-rate loans adjust automatically to the most current market rates. A consolidated interest rate is based on a weighted average of the interest rates on your current loans, rounded up to the nearest one eighth of a percent. The rate, which by law may not exceed 8.25 percent, is then fixed for the life of the loan.

Keep in mind, too, that consolidating your student loans doesn't always mean saving money in the long run. Many people consolidate because they want to significantly lower their total monthly payments. One way they can do that is by extending their repayment period. That means paying less per month at the cost of increasing the total interest paid for the money borrowed.

In terms of providing immediate payment relief, however, "loan consolidation can be a really good debt management tool," said Martha Holler, a senior director at Sallie Mae, which owns or manages student loans for more than 7 million borrowers.

But you may save money if you lock in a low interest rate without lengthening your repayment period. That may mean paying more than the required amount each month on your consolidated loan to meet your original deadline. But the good news is that with federal loans, "there is no prepayment penalty," Holler said.

Other considerations

As attractive as interest rates are, however, you must weigh other factors as well. "Look and see if you're foregoing any benefits," Chany said.

For instance, if you make 48 consecutive on-time payments on your original loans you may qualify for a rate discount up to two percentage points. With a Sallie Mae consolidation loan, you'll forego that benefit. So if you're on the cusp of qualifying, it may make sense to stick with the loans you've got.

| |

WHERE TO GO

WHERE TO GO

| |

| | |

| Federal loans may be consolidated through any federally approved private lender such as Sallie Mae or the Student Loan Consolidation Center. Direct Loans from the government may be consolidated through a federally approved private lender or the Department of Education.

|

|

| | |

|

When shopping for a consolidation loan, be sure to ask what benefits are offered. In addition to discounts for timely payments, lenders may offer a rate discount up to a quarter of a point if electronic loan payments are taken directly from your bank account.

For recent grads near the end of what's known as their "grace period" -- a 6-month window after graduation during which they get a 0.6 percent discount on Stafford loans -- it may be a good idea to consolidate now before the grace period runs out. Of course, whether that really is a good idea depends on where all of a borrower's loan rates now stand. While one loan may be at its lowest rate, other loans may not and that could push up the weighted average. You'll have to do the math before consolidating.

The bottom line is, there is no one right answer for everyone when it comes to consolidation. You have to weigh your financial needs with the repayment options available to you. "It's not a one-size fits all," Chany said. "You really have to do your homework."

For help in figuring out whether a loan consolidation makes financial sense for you, use the U.S. Department of Education's Direct Loan Consolidation calculator or Sallie Mae's repayment estimator.

|