|

Not a ticket to profits

|

|

February 14, 2002: 10:21 a.m. ET

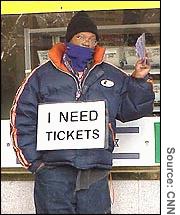

Many 2002 Winter Olympic tickets are sold on street for face value or less.

By Staff Writer Chris Isidore

|

SALT LAKE CITY, Utah (CNN/Money) - Jay Barton spent about $12,000 a year ago for tickets to this month's Winter Olympics, but the Salt Lake City resident figured he'd be able to sell most of the tickets he bought at a profit and cover the cost of going to the events he really wanted to see.

It hasn't worked out that way.

Many of the tickets he's sold, such as the $885 tickets for the opening ceremony, were sold at a loss, while other tickets were sold for only face value. He sold two of the opening ceremony tickets for $600 each, and had to sell his figure skating final tickets that he wanted to use himself at face value in order to make that sale. His four $885 tickets for closing ceremonies have yet to be sold.

"It's a frustrating ordeal," said Barton, a diamond dealer who spends several hours a day on street corners trying to sell tickets. "I'll probably come out ahead, but it's cost me a lot of work."

|

|

|

Street-corner Olympic ticket sales in Salt Lake City are often at or below face value. | |

He's made a nice profit by selling the $425 tickets to the upcoming gold medal game of men's hockey at $1,200 each, but that too was one of the events he wanted to attend himself.

A lot of the profit he's ended up making comes not on the tickets to a dozen events that he bought from the Salt Lake Organizing Committee a year ago, but on tickets he bought on the street for a fraction of face value within the last week, and was able to sell quickly.

"I picked up 9 ski jumping tickets for $10 a piece, and sold them for $25. They have a $45 face value," he said.

Unlike some states, Utah does not have any laws limiting the resale of tickets, and the market in Olympic tickets has been very active. The corner of Main Street and 200 South in Salt Lake resembles a sub-freezing Middle East street bazaar, with people from all over the world both buying and selling tickets, often at face value, or less.

"Many of the people are selling tickets they got for nothing, or just trying to get something back for tickets they can't use," said Richard Fletcher, a Manchester, England, resident who has come to Salt Lake for the games and estimates he's spending 12 to 14 hours a day on the corner buying and selling tickets. "Most people are reasonable in what they want for the tickets."

| |

|

|

Ticket brokers depend on established sources of tickets, such as sponsors and national teams. | |

But the high demand events, such as figure skating and ice hockey, are often going for $100 or more over face value. Barton said that the pairs figure skating competition Monday night saw tickets going for $500 for a $210 ticket even after the event started.

Many of the most-sought tickets are being sold by established ticket brokers, who have opened up offices in Salt Lake during the game, and who have established sources of supplies, such as some of the national teams or Olympic sponsors and others who have blocks of tickets for sale.

Doug Knittle, president of Beverly Hills, Calif.-based ticket broker Razorgator.com, opened a Salt Lake City office with 14 employees about two months ago. He said his business hasn't been hurt by the street corner sales at or below face value because he said most of those aren't prime events or prime seats.

"Generally what they're buying is leftover tickets, it's bottom of the barrel stuff," said Knittle. "When somebody comes in and can buy the two or three things they want, they're going to do that rather than go to a bunch of different guys on the street."

Knittle said that with the recession, corporate spending for tickets is down a bit, but that consumer demand is keeping prices about where he thought they would be.

"Like the economy itself, it's the consumers' buying that's supporting things," he said. "Because the corporate buyers didn't take all the premium events, we're able to offer them (consumers) the top tickets. It's not like we have an endless supply. In 1994, (the figure skating competition between) Nancy Kerrigan and Tonya Harding went just to the corporate buyers."

Knittle said his company makes most of its money on the events where there are a lot of tickets available, rather than those which have the highest prices, especially since his cost for tickets to the key events is also higher.

"We might only sell 100 gold medal hockey tickets for $1,350, while I'll sell 1,000 tickets to the moguls skiing for anywhere from $150 to $250," he said.

He says the amount of mark-up is more art than science.

"It's feel. We don't run it into a calculator," he said. "This is our ninth Olympics."

|

|

|

|

|

|

|