NEW YORK (CNN/Money) -

U.S. stocks fell Wednesday after worries about weakening consumer and business spending dimmed some of the economic-recovery hopes that have lifted shares in recent weeks.

The Dow Jones industrial average snapped a three-session win streak while the Nasdaq composite index fell for a third straight day. Blame some of that on Intel, which fell 5 percent after repeating vows to cut its capital budget and suffering a brokerage downgrade.

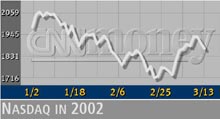

The Nasdaq index lost 35.08 points, or 1.9 percent, to 1,862.04, widening its year-to-date loss to 4.5 percent. The Dow industrials skidded 130.50, or 1.2 percent, to 10,501.85, narrowing its 2002 gain to 4.8 percent. Up 0.5 percent on the year, the Standard & Poor's 500 index declined 11.49, or 1 percent, to 1,154.09.

A string of stronger-than-expected economic reports came to an end when the government said retail sales rose just 0.3 percent in February. Economists expected a 0.9 percent advance.

Intel (INTC: down $1.65 to $31.34, Research, Estimates), in a government filing, reconfirmed a capital spending cut this year, while J.P. Morgan lowered the chipmaker's profit targets.

"There's no near-term catalyst to buy it," said Chris Chaney, who covers Intel for A.G. Edwards and has a "hold" rating on the stock. "The market for PCs is still pretty weak."

Elsewhere, Comverse Technology and Cree, a chipmaker, forecast weaker-than-expected results, joining Nokia and Lucent Technologies, whose warnings rattled stocks Tuesday.

But with the recent advance, some market watchers said they expected a pullback regardless of the economic and corporate news.

"The markets really are little overdone to the upside," Linda Jay, trader at LaBranche & Co, told CNNfn's Market Call.

More stocks fell than rose. On the New York Stock Exchange, decliners topped advancers 3-to-2 as 1.3 billion shares traded. Nasdaq losers beat winners 3-to-2 as 1.6 billion shares changed hands.

In other markets, the dollar rose against the yen and was little changed versus the euro. Treasury securities gained.

Disappointments

The February retail sales numbers countered a string of surprisingly strong economic data on jobs, manufacturing and home sales that have sent stocks higher for much of March.

|

|

| Traders at the NYSE |

But Tony Crescenzi, analyst at Miller Tabak, said the three-month annualized rate of retail sales has been a strong 8.4 percent. "Don't be fooled by this report," he told clients. "The economy remains on an upward track."

Intel, the Dow's biggest loser, said it still expects 2002 capital spending to fall to $5.5 billion from $7.3 billion in 2001, according to Reuters, which cited its annual report. J.P. Morgan cut earnings and sales estimates for Intel's second quarter and full year, saying it expects the chipmaker to keep lowering prices to shore up demand.

Losses spread to Intel's suppliers such as Applied Materials (AMAT: down $1.17 to $49.49, Research, Estimates) and its customers including Dell Computer. (DELL: down $1.16 to $26.84, Research, Estimates)

With demand weakening, communications systems developer Comverse Technology (CMVT: down $2.71 to $13.14, Research, Estimates) cut its financial guidance for the next two quarters. Cree (CREE: down $2.09 to $14.16, Research, Estimates), a chipmaker, took down sales and profit forecasts for its third fiscal quarter.

Losses continued for Lucent Technologies (LU: down $0.73 to $4.92, Research, Estimates), the maker of communications gear, which joined mobile phone maker Nokia (NOK: down $0.20 to $21.89, Research, Estimates) in cutting sales targets Tuesday.

Goldman Sachs said its survey of information technology managers found that a "significant" rebound in spending is unlikely in the second half of this year.

Federal Reserve Chairman Alan Greenspan, speaking by satellite to a bankers group in Honolulu, also referred to the business spending drought that has hamstrung the economy.

"On balance, the recovery in spending on business fixed investment is likely to be only gradual; in particular, its growth will doubtless be less frenetic than in 1999 and early 2000," Greenspan said.

The Fed chairman gave a balanced view on the economy, pointing to signs of improvement while calling the pace and strength of recovery uncertain

More profit and sales warnings are expected as companies wrap up their March quarters in the weeks ahead.

"We'll probably see some profit taking going into next month," Peter Canelo, an independent investment strategist, told CNNfn'sBefore Hours.

Supermarket chain operator Albertson's (ABS: up $0.29 to $31.69, Research, Estimates) said its fourth-quarter net income rose 32 percent, topping forecasts. Foot Locker (Z: down $0.86 to $16.49, Research, Estimates), the sporting goods retailer formerly known as Venator Group, said its fourth-quarter profit rose to 28 cents a share, matching forecasts.

Only one Dow stock, Merck (MRK: up $0.88 to $64.37, Research, Estimates), saw meaningful gains. In an unusual development for a Dow issue, Prudential Financial initiated coverage of International Paper (IP: down $1.31 to $43.32, Research, Estimates) by advising investors to sell its shares.

Stocks have been diverging in recent days, with the Nasdaq struggling and the Dow Tuesday finished at its highest level in nearly nine months.

With blue chip gains, David Briggs, head of equity trading at Federated Investors, wasn't surprised by Wednesday's losses.

"We were looking for a little pullback because you don't often see a 9 percent gain over two weeks," Briggs told CNNfn's Street Sweep.

|