NEW YORK (CNN/Money) - Compaq shareholders have approved Hewlett-Packard's buyout offer by a margin of nine-to-one, the company said Wednesday.

It generally was expected that the deal would breeze through the vote by Compaq shareholders because of the premium HP has agreed to pay for the company and the fact that it was unopposed. At last count, the deal was valued at roughly $21 billion, compared with Compaq's recent market capitalization of about $18.3 billion.

On the HP side, the deal was the subject of a bitter proxy fight spearheaded by dissident HP board member Walter Hewlett.

Acknowledging that it was by a narrow margin, HP claimed victory on Tuesday following the voting deadline for its shareholders. Even so, Hewlett refused to concede, and an official tally will not be returned for weeks.

| |

|

Compaq CEO Michael Capellas talks about the shareholders' approval on the Hewlett-Packard merger.

|

|

In a press conference Wednesday, Compaq Chairman and CEO Michael Capellas also exuded confidence that the merger was effectively a done deal, and the two companies are now preparing to move forward with the process of integrating their vast operations.

"We had anticipated that the launch would be in early April, and that still is our best guess. At this point, we're going to continue to mush forward with our planning," Capellas said.

In all, Capellas said Compaq spent a little more than $50 million during a six-month campaign of selling the merger to shareholders. He also denied that the company had been entertaining offers from other suitors, saying that the HP deal represented more of a merger of equals than an outright buyout of the company.

"There was no time that the 'company' was up for sale," he said. "This was a fit issue, so there is no other combination."

As for Walter Hewlett's potential role in the combined company, Capellas said he would leave that to the executives of HP to decide.

"That really is a decision for HP to make," he said. "But I will give Walter the tribute of having the strength of conviction."

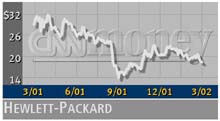

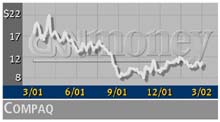

Since the two companies announced their intention to merge in early September, shares of Compaq have shed 12.4 percent of their value, while HP's shares have fallen 21.6 percent.

At the same time, shares of IBM -- which would remain the world's largest supplier of computer hardware and technology services by only a narrow margin in the event the HP-Compaq deal does go through -- rose 5.5 percent.

Should the union take place, HP and Compaq executives claim it will yield annual cost-savings -- including roughly 15,000 job cuts -- of $2.5 billion. They also contend that the combined company's earnings would improve by about 12 percent.

For their part, Hewlett and his allies have argued, among other things, that by buying Compaq, HP would increase its exposure to less profitable areas such as PCs and low-end servers while jeopardizing its strong position in the printing and imaging business.

|