NEW YORK (CNN/Money) -

Computer memory chip maker Micron Technology Inc. Thursday logged a wider fiscal second-quarter loss than most analysts had expected.

After the close of trading, Micron said it lost $30 million, or 5 cents per share, during the quarter ended Feb. 28. That compares with a net loss of $4 million, or a penny per share, during the same period last year, and it was a penny more than the 4 cents per share analysts generally had expected the company to lose in the most recent quarter, according to a survey conducted by First Call.

At $645.9 million, Micron's second-quarter revenue was 41 percent below the $1.1 billion posted during the year-ago quarter and 52 percent above the $423.9 million it logged in the fiscal first quarter.

Earnings estimates for Micron's (MU: Research, Estimates) second quarter ran from a loss of 12 cents per share to a profit of 6 cents per share.

Micron is a top supplier of dynamic random access memory, or DRAM, chips, which are among the most abundant components sold in the electronics industry. Pricing in the DRAM business is extremely volatile, sometimes wildly fluctuating within short periods of time, which typically makes for a wide range of analyst estimates.

During the most recent quarter, Micron Chief Financial Officer Wilbur Stover said average selling prices of Micron's DRAM products had risen 70 percent over the prior quarter.

Micron executives in a teleconference Thursday said most of the improvement in their end markets has so far been in the consumer market. However, Mike Sadler, vice president of sales and marketing, said he has been "seeing multiple signs of life in the commercial market" as well, especially in the market for memory chips used in servers.

The company did not provide specific financial targets for the current quarter. By First Call's count, analysts most recently had forecast a profit of 6 cents per share in the current quarter on revenue of roughly $950.3 million.

Executives also declined to comment on the status of its merger discussions with Korean memory chip-maker Hynix, which have been ongoing for several months.

Micron ended its fiscal second-quarter with $1.5 billion in cash and liquid investments, compared with $1.7 billion in the prior quarter.

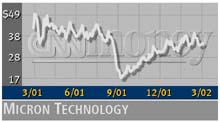

Shares of Micron $2.01, or 6.2 percent, to $34.51 on the New York Stock Exchange prior to the earnings news. They fell to $33.01 in extended-hours trade.

|