NEW YORK (CNN/Money) -

Handheld computer maker Palm Inc. Thursday reported a fiscal third-quarter loss that was narrower than Wall Street had expected, on sales that fell 38 percent from the same period a year ago.

And executives of Palm reaffirmed their revenue targets for the current quarter prompting a sharp rise in its shares during extended hours trade.

After the closing bell, Palm said its loss, excluding the impact of one-time gains and charges, was $14 million, or 2 cents per share. That compares with a profit of $9.3 million, or 2 cents per share, during the same quarter a year earlier but is 2 cents less than the 4 cents per share analysts generally had expected the company to lose during the quarter, according to a survey conducted by First Call.

At $292.7 million, Palm's third-quarter revenue smartly beat the Street's consensus estimate of $253.6 million but fell 38 percent from the $470.8 million it reported for the comparable period last year.

"We're pleased to report our third consecutive quarter of improved financial results, despite the traditional post-holiday seasonal slowdown," said Eric Benhamou, Palm's chairman and CEO.

"Tangible progress across virtually every aspect of our income statement and balance sheet gives us increased confidence in our ability to execute and to return to profitability," Benhamou added.

Benhamou took over as CEO after Carl Yankowski abruptly resigned in early November. The company is currently seeking a permanent replacement.

Moving forward, Palm executives said they expect revenue in the fiscal fourth-quarter ending in May to be in a range between $290 million and $300 million, which matches the company's previous forecast as well as Wall Street's most recent consensus revenue estimate.

"Behind this revenue range is an expectation that our unit sell-through will be slightly higher than it was last year, on its way back to the double-digit growth," said Judy Bruner, Palm's chief financial officer.

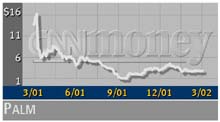

After rising 19 cents to close at $3.17 on Nasdaq ahead of the earnings release, shares of Palm spiked another 9.5 percent to $3.47 in extended-hours trade Thursday evening.

During the most recent quarter, Palm (PALM: up $0.19 to $3.17, Research, Estimates) released several new products, including the i705 integrated wireless handheld for mobile professionals; the m130, a low-end device with a color screen; and the m515, which replaced the m505 on the high end of the company's handheld product line.

The company, which is facing an increasingly competitive threat from Microsoft and recently split its operating system business off from its hardware business, is expected to make its next major product shift near the end of the year.

That's when the company is expected to begin selling hardware based on more powerful microprocessors and introduce its newest operating system software, called Palm OS 5.

During the third quarter, Palm said it shipped 1.3 million devices, bringing the total number it has shipped since it first entered the market in 1996 to 17.2 million.

|